I am writing a chapter on for a book on economic dynamics right now, and as I was doing so, I cited John Blatt‘s Dynamic Economic Systems, and lamented the fact that this brilliant book was out of print. But you never know, so I decided to check.

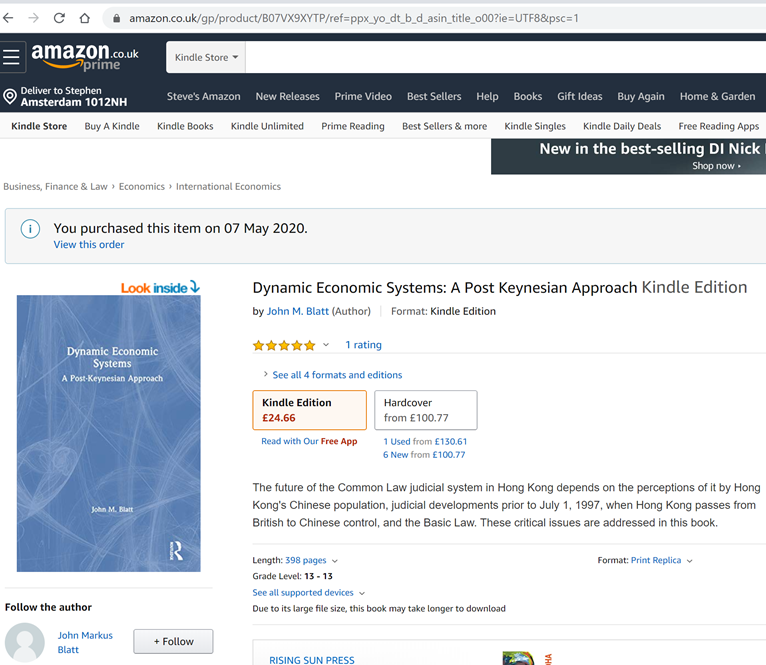

I was delighted to find that this is no longer a fact. On July 29, 2019, Dynamic Economic Systems: A Post Keynesian Approach was republished in Kindle format by Routledge (its Taylor and Francis division): here’s the link to it on their website: https://www.taylorfrancis.com/books/e/9781315496290.

I was a bit dubious when I first saw the link, because the abstract of the book—both on Amazon, and on Taylor & Francis’s website—was “The future of the Common Law judicial system in Hong Kong depends on the perceptions of it by Hong Kong’s Chinese population, judicial developments prior to July 1, 1997, when Hong Kong passes from British to Chinese control, and the Basic Law. These critical issues are addressed in this book.”. Really. But Blatt’s book is SO good that I thought I’d risk wasting the £24.66 and becoming more informed than I needed to be on Hong Kong.

Fortunately, there it was in all its glory, and brilliantly typeset—far better than the scanned version I’ve been relying upon for many years.

I urge my Patrons to buy a copy: I knew a lot of the history of economic thought and the mathematical methods that Blatt covers before I read this book, but Blatt taught me many things I didn’t know, and he gave me insights that I probably would never have acquired on my own. In particular, I had read Goodwin’s “A growth cycle” paper {Goodwin, 1967 #279} before reading Blatt, but really couldn’t make head nor tail of it: Goodwin was not a good writer. Fortunately, Blatt’s explanation of it was so clear, and so encouraging, that I used Goodwin’s model as the basis of my model of Minsky’s Financial Instability Hypothesis {Keen, 1995 #3316}. That model has been the basis of everything I’ve done in economics since. I wouldn’t have managed it without Blatt.

The book is superbly written, and Blatt handles the problem of communicating mathematics to economists—who know far less mathematics than they think they do—very well. Even if you can’t cope with the mathematics, it provides the best overview of the history of economic thought and the development (and retardation!) of economics that I have ever read. I aspire to writing as good a book as this when I finally pen my “magnum opus”.

I quote the first part of the book’s introduction below, to give you a feeling for its content, and Blatt’s extraordinarily clear writing style. Before it, I’ll provide one of my favorite anecdotes, in which Blatt stars: I wasn’t there to witness this event unfortunately, but I heard about it from many colleagues when I was studying both economics and mathematics while working at the University of New South Wales in the late 1980s and early 1990s. The antagonist in this story, Murray Kemp, was also a colleague then, and I have to emphasise, Murray was—and is—a thorough gentleman, and someone I was very glad to call a friend when I was there (he also beat me at tennis every time we played, so he was a top class sporting companion too). Murray suffers in the anecdote, and I can think of many other people whom I’d rather had been on the sharp end of Blatt’s famously sharp tongue than the very decent Murray. But the story is too good not to share, in this context.

Murray Kemp and John Blatt were both Professors at the University of New South Wales, Murray of Economics and John of Mathematics. Murray had been nominated for the “Nobel Prize in Economics” for his work on international trade theory, while Blatt had been nominated for the Nobel Prize in Physics. Neither got the award, but because of this coincidence, Murray regarded John as his one true peer at UNSW, and invited John to attend a seminar of his at the Department of Economics.

After Murray finished delivering his paper, he asked John what he thought of it. Blatt replied, in his heavily Austrian-accented English:

“Zat is ze greatest load of rubbish that I have sat through in my professional career. If this is advanced economics, then there is something seriously wrong with the state of economics, and I intend finding out what it is.”

Some years later, this brilliant book was born. Buy a copy: you won’t regret it.

Introduction A. Purpose and limitations

The bicentenary of The Wealth of Nations has passed, and so has the centenary of the neoclassical revolution in economics. Yet the present state of dynamic economic theory leaves very much to be desired and appears to show little sign of significant improvement in the near future.

From the time of Adam Smith, economic theory has developed in terms of an almost universal concentration of thought and effort on the study of equilibrium states. These may be either states of static equilibrium, or states of proportional and balanced growth. Truly dynamic phenomena, of which the most striking example is the trade cycle, have been pushed to the sidelines of research.

In defense of this concentration on equilibrium and the neglect of true dynamics, there are two arguments:

1. Statics or (what comes to much the same thing) balanced proportional growth is much easier to handle theoretically than true dynamic phenomena. A good understanding of statics is a necessary prerequisite for the study of dynamics. We must learn to walk before we can attempt to run.

2. In any case, while no economic system is ever in strict equilibrium, the deviations from such a state are small and can be treated as comparatively minor perturbations. The equilibrium state is, so to speak, the reference state about which everything turns and toward which the system gravitates. Market prices fluctuate up and down, but there exist “natural prices” about which this fluctuation occurs, and these natural prices can be determined directly, by ignoring the fluctuations altogether and working as if strict equilibrium obtained throughout.

Such arguments did carry a great deal of conviction two hundred years ago, when the basic ideas of the science of economics were being formulated for the first time.

However, it is impossible to ignore the passage of two hundred years. A baby is expected to first crawl, then walk, before running. But what if a grown-up man is still crawling? At present, the state of our dynamic economics is more akin to a crawl than to a walk, to say nothing of a run. Indeed, some may think that capitalism as a social system may disappear before its dynamics are understood by economists.

It is possible, of course, that this deplorable lack of progress is due entirely to the technical difficulty of investigating dynamic systems and that economists, by following up the present lines of research, will eventually, in the long long long run, develop a useful dynamic theory of their subject.

However, another possibility must not be ignored. It is by no means true that all dynamic behavior can be understood best, or even understood at all, by starting from a study of the system in its equilibrium state. Consider the waves and tides of the sea. The equilibrium state is a tideless, waveless, perfectly flat ocean surface. This is no help at all in studying waves and tides. We lose the essence of the phenomenon we are trying to study when we concentrate on the equilibrium state. Exactly the same is true of meteorology, the study of the weather. Everything that matters and is of interest to us happens because the system is not in equilibrium.

In the first example, the equilibrium state is at least stable, in the sense that the system tends to approach equilibrium in the absence of disturbances. But there is no such stability in meteorology. The input of energy from the sun, the rotation of the earth, and various other effects keep the system from getting at all close to equilibrium. Nor, for that matter, would we wish it to approach equilibrium. The true equilibrium state, in the absence of heat input from the sun, is at a temperature where all life comes to a stop! The heat input from the sun is the basic power source for winds, clouds, etc., for everything that makes our weather. The heat input is very steady, but the resulting weather is not steady at all. None of this can be understood by concentrating on a study of equilibrium.

There exist known systems, therefore, in which the important and interesting features of the system are “essentially dynamic,” in the sense that they are not just small perturbations around some equilibrium state, perturbations which can be understood by starting from a study of the equilibrium state and tacking on the dynamics as an afterthought.

If it should be true that a competitive market system is of that kind, then the lack of progress in dynamic economics is no longer surprising. No progress can then be made by continuing along the road that economists have been following for two hundred years. The study of economic equilibrium is then little more than a waste of time and effort.

This is the basic contention of Dynamic Economic Systems. Its main purpose is to present arguments for this contention and to start developing the tools which are needed to make progress in understanding truly dynamic economic systems.

A subsidiary purpose, related to the main one but not identical with it, is to present a critical survey of the more important existing dynamic economic theories-in particular, the theories of balanced proportional growth and the theories of the trade cycle. This survey serves three purposes:

1. It is useful in its own right, as a summary of present views, and it can be used as such by students of economics.

2. It establishes contact between the new approach and the literature.

3. It is necessary to clear the path to further advance, which is currently blocked by beliefs which are very commonly held, but which are not in accordance with the facts.

The third point needs some elaboration. The main enemy of scientific progress is not the things we do not know. Rather, it is the things which we think we know well, but which are actually not so! Progress can be retarded by a lack of facts. But when it comes to bringing progress to an absolute halt, there is nothing as effective as incorrect ideas and misleading concepts. “Everyone knows” that economic models must be stable about equilibrium, or else one gets nonsense. 1 So, models with unstable equilibria are never investigated! Yet, in this as in so much else, what “everyone knows” happens to be simply wrong. Such incorrect ideas must be overturned to clear the path to real progress in dynamic economics.

This is a book on basic economic theory, addressed to students of economics. It is not a book on “mathematical economics,” and even less so a book on mathematical methods in economics. On the contrary, the mathematical level of this book has been kept deliberately to an irreducible, and extremely low, minimum. Chapters are literary, with mathematical appendices. The level of mathematics in the literary sections is the amount of elementary algebra reached rather early in high school; solving two linear equations in two unknowns is the most difficult mathematical operation used. In the mathematical appendices, the level is second year mathematics in universities; the meaning of a matrix, of eigenvalues, and of a matrix inverse are the main requirements. Whenever more advanced mathematics is required-and this is very rarely indeed-the relevant theorems are stated without proof, but with references to suitable textbooks. This very sparing use of mathematics should enable all economics students, and many laymen, to read and understand this book fully. Those who cannot follow the mathematical appendices must take the mathematics for granted, but if they are prepared to do that, they will lose nothing of the main message.

This does not mean that mathematics is unimportant or of little help, when used properly. This unfortunately all too common belief is incorrect. To make real progress in dynamic economics, researchers must know rather more, and somewhat different, mathematics from what is commonly taught to students of economics. But while mathematics is highly desirable, probably essential, to making further progress, the progress that has already been made can be phrased in terms understandable to people without mathematical background. This reliance on nonmathematical diction has not been easy for someone to whom mathematics is not some arcane foreign language, but rather his normal mode of thinking; only time can tell to what extent the effort has been successful.

Another limitation of this work is the restriction to classically competitive conditions in most cases. There is no discussion of monopoly, oligopoly, restrictions on entry, or related matters which are stressed, quite rightly, in the so-called post-Keynesian literature. This omission is not to be interpreted as disagreement with, or lack of sympathy for, the contentions of that school. Rather, the post-Keynesians have been entirely too kind and indulgent toward the neoclassical doctrine. The assumption of equilibrium has indeed been attacked (Robinson 1974, for example), but only in rather general terms. The more prominent part of the postKeynesian critique has been that conventional economic theory bases itself on assumptions (e.g., perfect competition, perfect market clearing, certainty of the future) which are invalid in our time, though some of them (not perfect certainty of the future!) may have been appropriate a century ago. We agree with this criticism, but that is not the point we wish to make in this book.

Rather, even under its own assumptions, conventional theory is incorrect. A competitive economic system with market clearing and certainty of the future does not behave in the way that theory claims it should behave. It is not true that, under these assumptions, the equilibrium state is stable and a natural center of attraction to which the system tends to return of its own accord. Obviously, in any such discussion, questions of oligopoly, imperfect market clearing, etc. are irrelevant. It is for that reason, and only for that reason, that such matters are ignored here.

In this view, the rise of oligopoly toward the end of the nineteenth century was not just an accident or an aberration of the system. Rather, it was a natural and necessary development, to be expected on basic economic grounds. John D. Rockefeller concealed his views on competition and paid lip service to prevailing ideas when it suited him. But he was a genius, who understood the system very well indeed and proved his understanding through phenomenal practical success. Alfred Marshall’s Principles of Economics was written and refined at the same time that Rockefeller established the Standard Oil trust and piloted it to an absolute dominance of the oil industry. There can be little doubt who had the better understanding of the true dynamics of the system.

It follows that the theory of this book should not be applied directly to conditions of monopoly or oligopoly, which are so prevalent in the twentieth century. However, the theory is directly relevant to something equally prevalent, namely the creation of economic myths and fairy tales, to the effect that all our present-day ills, such as unemployment and inflation, are due primarily to the mistaken intervention by the state in the working of what would otherwise be a perfect, self-adjusting system of competitive capitalism. This system was in power in the nineteenth century. It is wellknown that it failed to ensure either common equity (read Charles Dickens on the conditions under which little children were worked to death!) or economic stability: There were “panics” every ten years or so. The theory of this book shows that the failure of stability was not an accident, but rather was, and is, an inherent and inescapable feature of a freely competitive system with perfect market clearing. The usual equilibrium analysis assumes stability from the start, whereas actually the equilibrium is highly unstable in the long run. The economic myths pushed by so many interested parties are not only in contradiction to known history, but also to sound theory.

Blatt, John M.. Dynamic Economic Systems (pp. 4-8). Taylor and Francis. Kindle Edition.