I discuss a Modern Debt Jubilee On Macro’n’Cheese today, and this is a quick explanation of how it could be done.

Jubilees were common in antiquity. The Lord’s Prayer did not originally say “And forgive us our sins, as we have forgiven those who sin against us”, but “And forgive us our debts, as we also have forgiven our debtors”. But an old-fashioned Jubilee would reward those who gambled with borrowed money, and thus effectively penalise those who did not. It would also effectively bankrupt the banks, since their assets—our debts—would fall, while their liabilities—our deposits—would remain constant.

A Modern Debt Jubilee gets around both problems by:

- Giving everyone, whether they borrowed or not, exactly the same amount of money; and

- Replacing risky private debt as an income earning asset for banks with riskless Jubilee Bonds.

The basic mechanics in a Modern Debt Jubilee are:

-

Every adult gets an identical sum of money;

- Those in debt must pay their debt down by that amount;

- Those that are not in debt—or have less debt than the Jubilee amount—must buy newly-issued shares directly from corporations;

- Corporations must use the revenue from share sales to pay down corporate debt;

-

Jubilee Bonds are sold by Treasury to banks; and

- Interest payments on Jubilee Bonds (partly) compensate for the fall in interest payments on household and corporate debt.

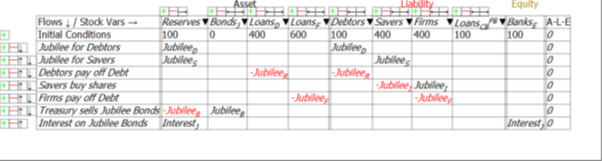

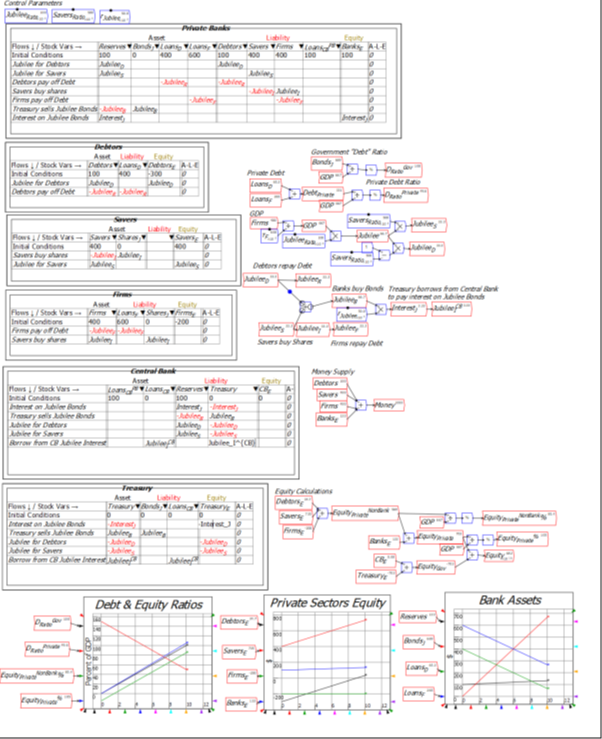

Figure 1: The basic mechanics of a Modern Debt Jubilee

The end-result of a Modern Debt Jubilee is:

- Debtors are not unfairly advantaged over savers (debtors have less debt, while savers get new debt-free assets);

- Private debt, both household and corporate, falls, while equity (share ownership) rises;

- The amount of money does not change a great deal (it changes only by the interest on Jubilee Bonds); and

- Banks remain solvent, because their assets rise as much as their liabilities, and they gain equity from the interest on Jubilee Bonds.

As with a government deficit, the government doesn’t need to borrow the money given to debtors and savers: the Jubilee creates the money, in the same manner that a deficit creates money. It also creates additional Reserves, on the Asset side of the Banking Sector’s ledger. If the Treasury issues “Jubilee Bonds”, then rather than those bonds involving borrowing money from the private sector, they are an asset swap that lets the banks swap non-income-earning reserves for income-earning bonds.

I’ll go into more detail on the hows, whys and wherefores of a Modern Debt Jubilee in a later post.