Their roles are opposite in any crisis, like two sides of a see-saw: private debt causes crises, and public debt, to some extent, ends them. But conventional economic theory gets this completely wrong, by ignoring private debt, while seeing government debt as a problem rather than a solution.

The conventional economic argument is firstly, that private debt simply transfers spending power from one private person to another—the debtor has more money to spend when money is borrowed, the creditor has more to spend when debt is repaid. In the aggregate, this cancels out: the borrower’s spending power rises when debt is rising and falls when it is falling, but the lender’s spending power goes in the opposite direction. They claim, therefore, that changes in the level of private debt have very little impact on the economy. As Ben Bernanke put it in his book Essays on the Great Depression, “pure redistributions should have no significant macroeconomic effects” (Bernanke 2000, p. 24).

On the other hand, they see government debt as “crowding out” the private sector, by competing with private borrowers for the available stock of “loanable funds”, and thus driving up the interest rate—the price of borrowed money. Excessive government deficits add to the demand for money, drive up interest rates, and therefore reduce private investment, and hence the rate of economic growth. As Gregory Mankiw puts it in his influential textbook, “government borrowing reduces national saving and crowds out capital accumulation” (Mankiw 2016, pp. 556-57).

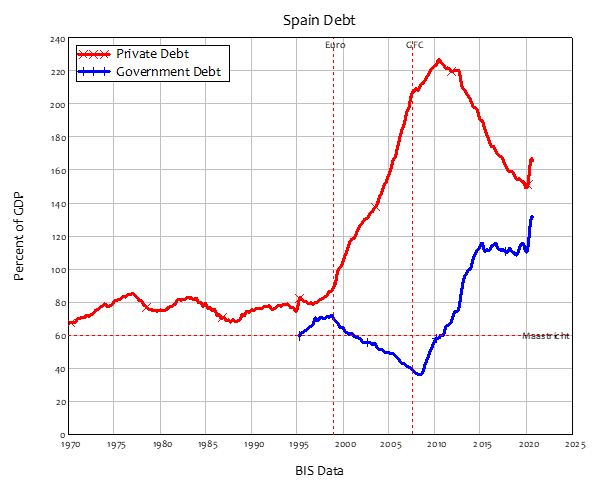

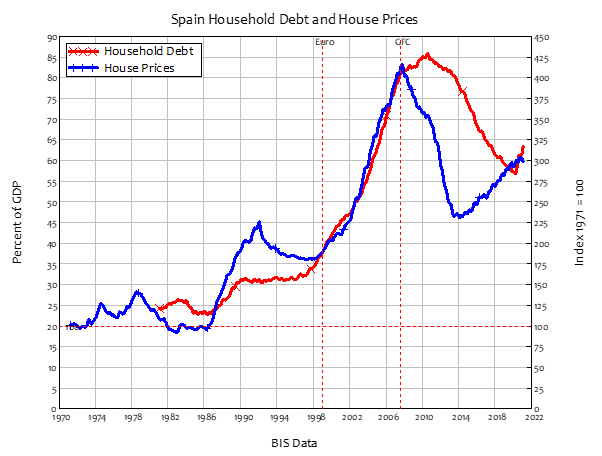

This is why the Maastricht Treaty put limits on government debt and deficits, but completely ignored private debt and credit. Spain shows the impact of this conventional attitude to debt: while government debt halved from 72% to 36% GDP from the introduction of the Euro until just after the Global Financial Crisis in 2007, private debt almost trebled, from 88% of GDP to a peak of 227% of GDP in 2010.

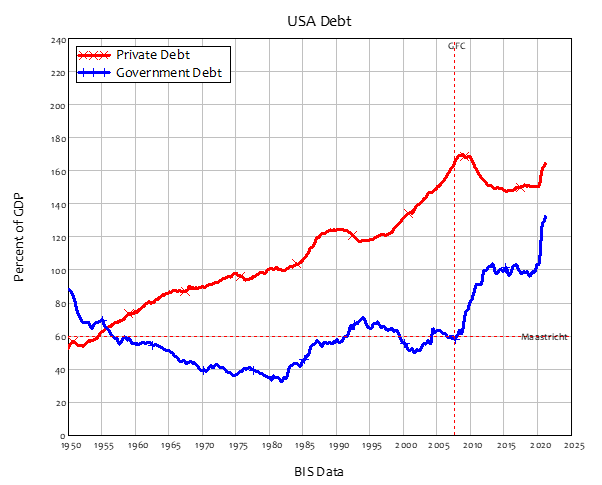

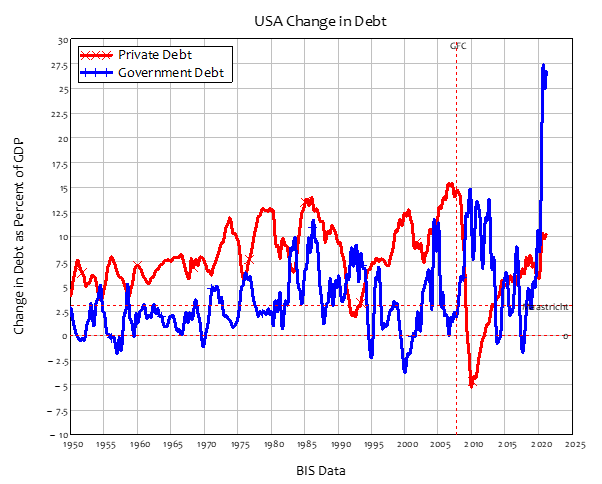

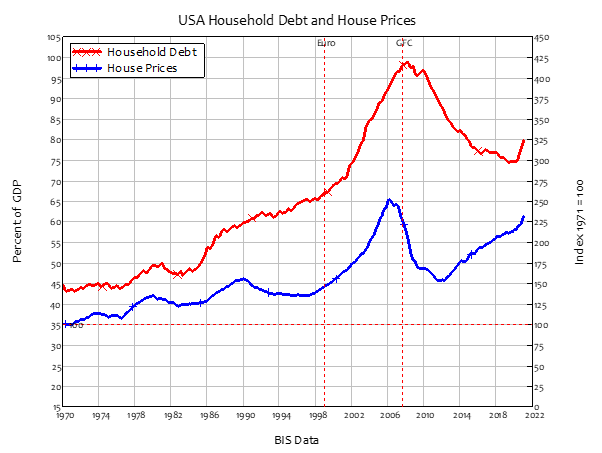

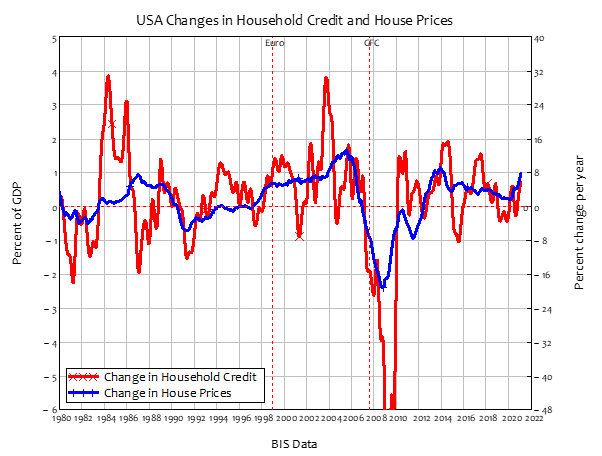

The USA shows a similar pattern—unrestrained growth in private debt until the crisis, government debt growing after it in response to the collapse of demand as credit turned negative.

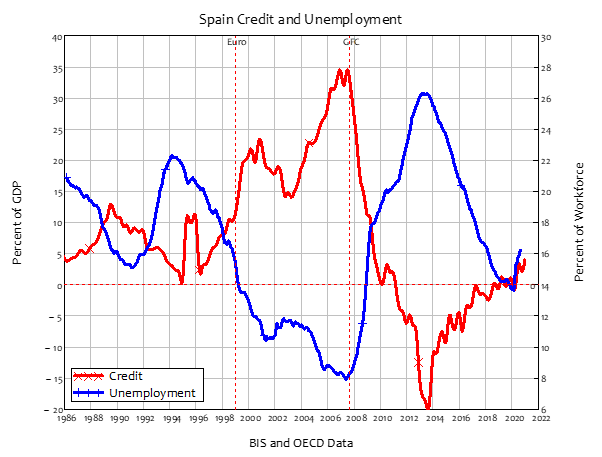

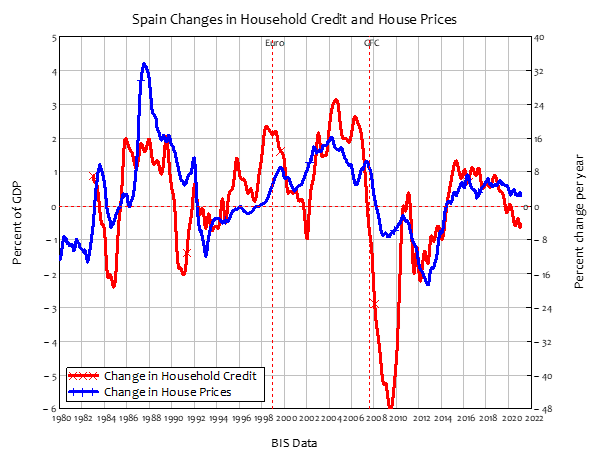

Looking at the annual change in debt, the same picture emerges: while Spain congratulated itself for staying below the Maastricht target of government deficits being below 3% of GDP, credit (the annual change in private debt) rose from zero before the Euro began to as much as 35% of GDP during the boom. It then fell to as low as minus 20% of GDP in 2014.

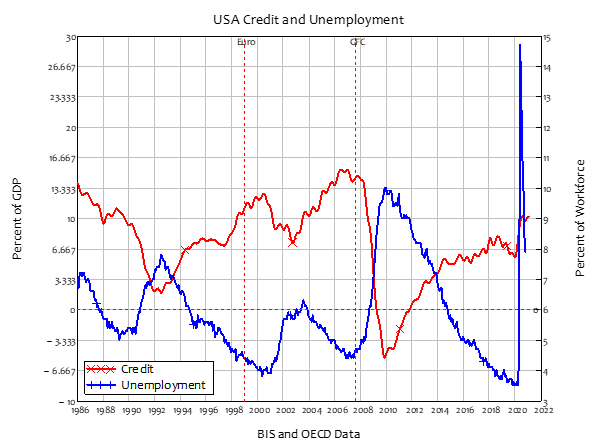

Ditto for America, with credit turning negative during the GFC for the first time since WWII.

If conventional economics were correct, then there shouldn’t have been a crisis at all in 2007—and this is exactly what mainstream economists said at the time. In June 2007, two months before the crisis began, the Chief Economist of the OECD predicted that “sustained growth in OECD economies would be underpinned by strong job creation and falling unemployment” (Cotis 2007 , p. 7).

Since there was a crisis—the worst since the Great Depression before Covid hit—there must be something wrong with conventional economic thought. And there is, because it asserts that the actual details of money don’t matter to macroeconomics—that the macroeconomy can best be understood by ignoring money, and treating the economy as a barter system. To quote a Neoclassical economist on Twitter:

Most people who teach macro do it by leading people through simple models without money …You can even do banks without money [yes!]. And it’s better to start there. Then later, study money as it superimposes itself and complicates things, giving rise to inflation, exchange rates, business cycles.

With this belief, they have never built a framework for analysing how money is actually created. Instead, they developed a “supply and demand” model of lending called “Loanable Funds”, where savers lend more when interest rates are high, and borrowers demand more when interest rates are low, and the market sets both the quantity lent and the interest rate. In this model, banks act as “intermediaries”, taking in deposits from savers and lending them out to borrowers. In their model, if the government enters the market as a borrower, then it adds to the demand for money, thus driving up interest rates and “crowding out” private investment, which lowers the rate of economic growth.

In 2014, the Bank of England categorically declared that this model was wrong: banks do not take in deposits from some customers and lend them out to others, but instead, “Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits” (McLeay et al. 2014, p. 1). This means that private lending doesn’t cancel out, as the mainstream still believes. Instead, rising bank debt creates new money and causes a rising amount of spending, while falling bank debt destroys money and contracts spending. This is obvious in the data: when credit is positive and rising, unemployment falls; when credit is negative and falling, unemployment rises.

America shows the same pattern: rising credit, falling unemployment; falling credit, rising unemployment.

It’s also obvious when you look at the actual way in which money is created: I invented a software program to enable that, called Minsky. It very easily shows that mainstream economics have things backwards: rather than bank loans shuffling existing money between savers and borrowers, bank lending increases the money supply; and rather than government deficits adding to the demand for money, they add to the supply of money.

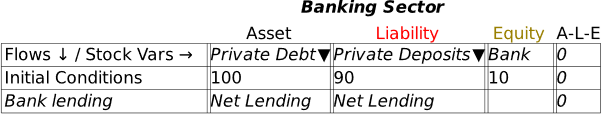

The process of money creation is actually very simple, as the Bank of England pointed out. Most money today is in the form of bank deposits. To create money therefore, you have to do something that adds to bank deposits. Both bank lending and government deficits qualify, but in different ways.

Bank lending increases deposits while repaying debt reduces deposits, so if net lending is positive, bank deposits increase, and hence so does the money supply.

Since people borrow in order to spend, rising private debt stimulates aggregate demand and asset prices, making the economy—and the government—look great to conventional eyes. The economy booms, unemployment falls, and booming tax receipts make the government look like it is responsible by running a surplus. But if the rate of growth of private debt—otherwise known as credit—turns negative, then everything unravels. The economy goes into a recession, unemployment rises, asset prices fall, and government debt increases—and if it didn’t, the recession would be far deeper.

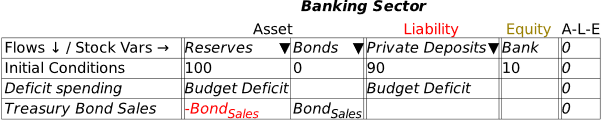

This is because, as well as being wrong about what banks do, the mainstream is also wrong about government deficits and government debt. Rather than deficits meaning that the government has to take money away from the private sector—which is what the mainstream thinks the government does when it sells bonds to cover a deficit—the deficit creates money by increasing the bank deposits of the private sector.

In simple terms, by not studying the accounting involved in government deficits, they have wrongly classified them as increasing the demand for money, when in fact they increase the supply of money. So all the arguments they make have it back the front: deficits crowd in private spending and investment by increasing the supply of money and, if anything, they drive down the interest rate, rather than driving it up.

The bonds that Treasury issues to cover the deficit are also sold in the first instance to the banking sector, and this lets them swap the excess Reserves that the deficit creates with Bonds. Bonds earn interest income, while normally Reserves don’t. So it’s a sensible thing for banks to buy them when Treasury offers them for sale: they get to swap a non-tradeable and non-income earning asset (Reserves) for a tradeable and income-earning asset (Bonds). That’s why bond issues by governments of countries that have their own currencies are always oversubscribed.

Unfortunately, governments belonging to the European Union gave up both these differences when they created the Euro. Draghi’s “whatever it takes”, and the EU ignoring its own silly rules on the maximum levels of government debt and deficits during the crisis, meant that the ECB reduced the severity of the crisis to some degree, but nowhere near as much as did America, which ran huge deficits because it wasn’t subject to the EU’s silly rules.

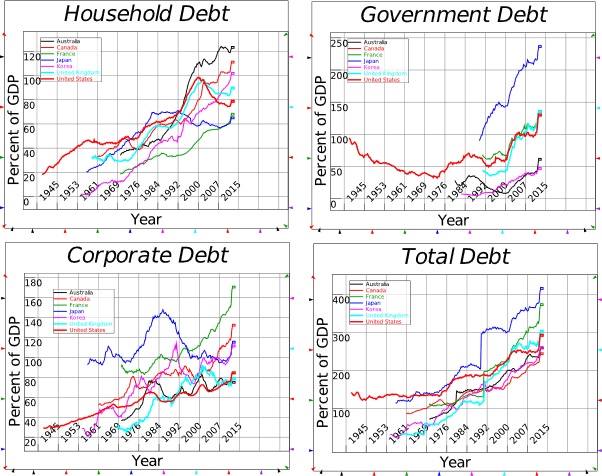

So the short answer to your question is that excessive growth of private debt will cause the next financial crisis, and government debt growth during the crisis will reduce its severity. But the long answer is that private debt is so high now, in virtually all Western countries, that credit—the annual change in debt—is likely to be small, while people will spend the money they currently have slowly because they want to hang onto whatever money they currently have to service their existing debts. The result is what I call “credit stagnation” rather than a crisis.

After the covid crisis, debt seems to be uncontrollable. What is the best way to take control of the current situation?

The first thing to focus on is that it’s the private debt level that is the real problem. Secondly, it’s not the absolute level of debt that is the problem, but the ratio of debt to GDP. So we have to do something that reduces that ratio.

Conventional thought focuses on either reducing debt directly—paying the debt down—or somehow increasing GDP while leaving the level of debt constant. But paying the debt down doesn’t work, because each dollar of debt that is paid off means one less dollar of money circulating in the economy. It’s quite possible that the fall in debt can cause an even larger fall in GDP: as Irving Fisher put it:

the very effort of individuals to lessen their burden of debts increases it, because of the mass effect of the stampede to liquidate in swelling each dollar owed. Then we have the great paradox which, I submit, is the chief secret of most, if not all, great depressions: The more the debtors pay, the more they owe. (Fisher 1933, p. 344)

The other obvious method is to increase GDP—to grow our way out of debt—but excellent historical research by the American philanthropist Richard Vague found that this has only ever worked when the country involved benefits from an export surge—as Saudi Arabia did when the oil price quadrupled in 1980. The only method he found that had worked was writing off the debt: debt cancellations of some description.

My proposal is a twist on an ancient practice: a Modern Debt Jubilee. In ancient societies, regular household debt jubilees freed people who had become debt slaves to go back and work on their own land, and prevented society dividing into one class of creditors and another class of debt slaves. We can’t do the same thing today—simply cancel all household debt—because it would bankrupt the banks. But we can use the power of the government to create money to do a modern version of a Jubilee which doesn’t benefit those who speculated over those who didn’t, which keeps the banks solvent, and which doesn’t increase the money supply—instead, it replaces credit-based money with fiat-based money.

To take the case of the USA, the Treasury would give every adult an equivalent amount of money—say $100,000 in the USA—which had to be used to pay down debt. If the recipients don’t have debt, then they would be required to buy newly issued shares, and the firms that sold them would have to use that new equity to pay down corporate debt. This could reduce private debt by 110% of GDP—bringing it back to the 50-60% of GDP it was in the 1960s, which were regarded as the “Golden Age of Capitalism”.

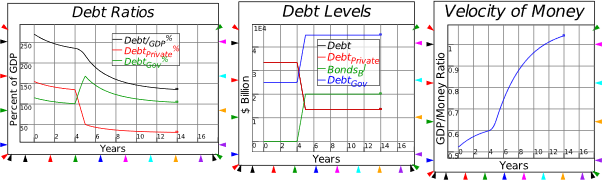

Of course this involves a large increase in government debt of precisely the same scale—110% of GDP. But when I modelled this in Minsky, there was an unexpected side-effect: the level of GDP rose substantially because the velocity of money rose dramatically.

The explanation is simple: because workers are the vast majority of the population—the 99%, so to speak—the Jubilee goes far more to workers than it does to capitalists or bankers. Workers spend their savings much more rapidly than capitalists or bankers do, simply because they have far less money and have to spend what they’ve got more quickly.

The result was that all debt ratios ultimately fell because of the Jubilee—even government debt.

So it looks like it could be done and would work, but I think the political chances of something like this being tried are basically zero.

Is the financial system acting in favor of society’s needs?

Far from it! As Marx once put it, the finance sector is a good servant but a terrible master, and that’s what the Neoliberal obsession with deregulation has actually allowed to happen: finance has become the economy’s master, rather than its servant. We need to return it to its servant role: it should provide the money that firms need for working capital, that households need for large consumption items, and that entrepreneurs need to finance innovation, and that’s it. Instead, what it has been doing ever since the 1970s is financing asset bubbles. These can make some people extremely wealthy—or make homeowners think they are wealthy—but in the end it only enriches the finance sector itself.

The only way to stop this happening is to regulate finance: to limit the power that a banking licence grants to create money to ways of creating money that are beneficial to society, as well as profitable for the banks. Without those controls, banks end up financing asset price bubbles, as we saw vividly in the Spanish housing market. The huge increase in household debt from the introduction of the Euro caused spiralling house prices, only to come crashing down into Spain’s worst recession since the Great Depression afterwards.

It’s of course no surprise that the USA shows a similar pattern:

Behind all housing bubbles is the same story: since supply is inflexible, demand determines price; the source of demand for housing is new mortgage debt; and the change in demand, which is change in new household debt, drives the change in house prices.

I have a number of ideas about how to stop this happening again, such as a rule I call The PILL for “Property Income Limited Leverage”. Rather than being able to effectively lend as much as they like for housing, a bank loan would be limited to some multiple of the income earning potential of the house. If a house would rent for 30,000 Euro, then the most that anyone could borrow to buy it would be 300,000 Euro. This would break the amplifying feedback that currently exists between house prices and household debt: if you and I have the same income and are competing to buy a house today, the winner will be the one that takes out the higher amount of debt. But with the PILL in place, the only way to beat another potential buyer would be to save more money.

Basically, we need to be smarter than the banks, because by letting them become the “Masters of the Universe” in the last 40 years, they have made fools of us.

Bernanke, B. S. (2000). Essays on the Great Depression. Princeton, Princeton University Press.

Cotis, J.-P. (2007). Editorial: Achieving Further Rebalancing. OECD Economic Outlook. OECD. Paris, OECD. 2007/1: 7-10.

Fisher, I. (1933). “The Debt-Deflation Theory of Great Depressions.” Econometrica

1(4): 337-357.

Mankiw, N. G. (2012). Principles of Macroeconomics, 6th edition. Mason, South-Western, Cengage Learning.

McLeay, M., A. Radia and R. Thomas (2014). “Money creation in the modern economy.” Bank of England Quarterly Bulletin

2014 Q1: 14-27.