The Italian Edition of The New Economics: A Manifesto (Keen 2021) will be published in November by Meltemi, and I will attend the BookCity book fair in Milan to launch the book on November 18th. I owe a great intellectual debt to many great Italian economists, from Pierro Sraffa (Sraffa 1960, 1926) and Pierangelo Garegnani (Garegnani 1970), to Augusto Graziani (Graziani 1989): without their work, I could never have made the contributions that I have managed to add to sound economics. It is great pleasure to know that I will in part repay that debt by having my book appear in Italian.

Below is the preface that will be published (in Italian, of course) with the book.

There are few countries on the planet that illustrate the weaknesses of mainstream macroeconomic thinking better than Italy. As I explain in this book, amongst its many other weaknesses, mainstream “Neoclassical” economics ignores the role of private debt and credit in the economy, and demonises government debt and deficits, both on utterly fallacious grounds.

Mainstream economics dominates economic policy globally, but the extent to which policies based on it can be enforced varies around the world. Since the Maastricht Treaty effectively codified conventional economic thinking via its rules on government debt and deficits—that government debt should not exceed 60% of GDP, and deficits should be below 3% of GDP—the European Union has been the laboratory in which mainstream economics has been tested, and found wanting.

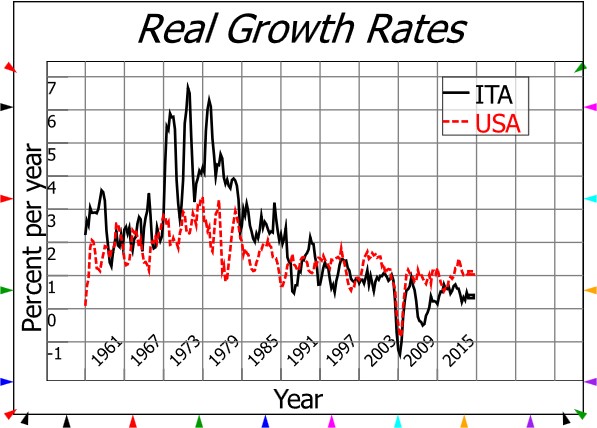

Italy has suffered more than most EU countries from the perverse effects of imposing mainstream economic fantasies on real economies. A country which used to regularly and substantially outperform the USA has now fallen behind it, especially in the aftermath to the abandoning the Lira for the Euro in 1999, and even more so during and after the Global Financial Crisis (GFC) in 2008—see Figure 1.

Figure 1: Real annual economic growth rates for Italy versus the USA

Before Neoclassical econocrats wrestled the reins of power from Italy’s falsely maligned post-WWII “Keynesian” bureaucrats, Italy’s real economic growth was volatile, but almost always substantially higher than the USA’s. Growth in both countries trended down, rather than up, as the Neoclassical orthodoxy displaced Keynesian-style policies, and from the date that the “Growth and Stability Pact” took hold in Europe, things got worse rather than better for Italy. Its diminishing growth rate fell permanently below the USA’s, it suffered more from the GFC than America—despite not having a Subprime Bubble—and the aftermath to the crisis has seen Italy’s growth rate fluctuate around zero. The Growth and Stability Pact has brought stagnation and instability.

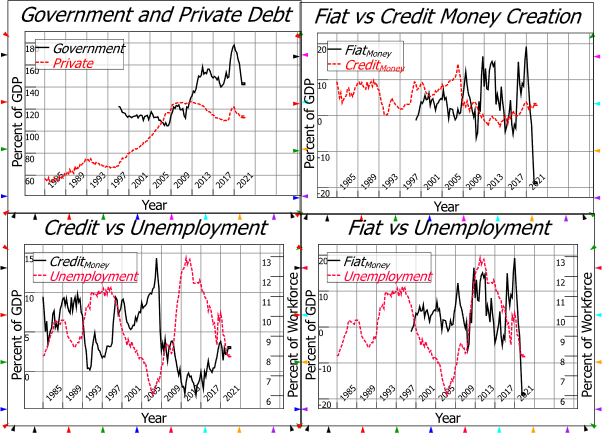

Despite—or rather because of—the EU obsession with reducing the level of government debt, Italy is one of the few countries in the world where government debt substantially exceeds private debt. High private debt is not good for the economy—far from it, as I explain in the second chapter—while high government debt, contrary to Neoclassical economics, is not a major problem for a country which issues its own currency. But to end up with substantially higher government debt, when the objective of the policy was to reduce it—to halve it as a proportion of GDP, in Italy’s case—is a sign of how truly perverse these policies have been in practice.

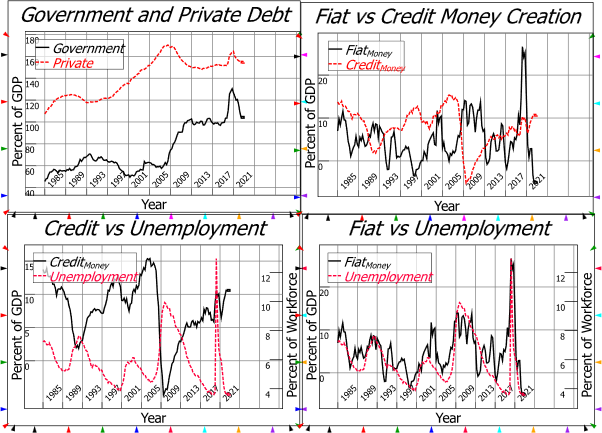

These effects are obvious when you compare the key economic indicators for Italy (Figure 2) that my approach to economics emphasises—the level of private debt and its annual rate of change—to the same data for America (Figure 3).

Figure 2: Key New Economic Indicators for Italy

Much of this perversity emanates from fallacious mainstream theories of money creation. Despite the Bank of England (McLeay, Radia, and Thomas 2014) and the Bundesbank (Deutsche Bundesbank 2017) both declaring that the Neoclassical models of money creation are wrong, mainstream economists continue to ignore the macroeconomic impact of banks creating money by creating loans—as evidenced by the 2022 award of the “Nobel” Prize in Economics to three economists who continue to pretend that banks are “financial intermediaries” linking savers to borrowers (Committee for the Prize in Economic Sciences in Memory of Alfred Nobel 2022). This pretence leads to the conclusion, as stated by Bernanke in 2000, that credit (which he falsely described as a “pure redistribution”) “should have no significant macroeconomic effects” (Bernanke 2000, p. 24).

The data for both Italy and the USA begs to differ. Between 1985 and 2015, the correlation between credit and unemployment was -0.8 in the USA, and -0.73 in Italy. As I explain in the second chapter, this is not mere correlation, but causation: since banks create money when they loan, and no-one borrows for the sheer pleasure of being in debt—we borrow in order to spend—credit is part of aggregate demand and income, and by far the most volatile part. It therefore is the primary determinant of the economy’s booms and busts.

Figure 3: Key New Economic Indicators for the USA

Absent ignorant policy rules like the “Growth and Stability Pact”, Government deficits tend to respond to the level of economic activity, so that rising government spending attenuates the rise in unemployment during a slump. But the enforcement of the Maastricht Treaty rules on Italy are now resulting in a dramatic decline in government money creation, as Figure 2 shows: the current savage decline in government debt will act to increase unemployment, rather than to reduce it.

From Economics to Climate

The above is written as if economic growth is always and everywhere a good thing. Especially as Europe and America swelter during the hottest summer in recorded history, as droughts damage croplands and cripple power plants, and flash floods destroy towns, that is clearly not the case: we have grossly exceeded the capacity of the biosphere to support our industrial civilisation, and our focus should be on equitably reducing the human ecological footprint, rather than adding to it.

Here again, mainstream economics is a positive hindrance to doing what is right. Beginning with a baseless and ignorant attack by William Nordhaus (Nordhaus 1973) on the research behind the Limits to Growth study in 1972 (Meadows, Randers, and Meadows 1972), mainstream economists have trivialised the dangers posed by climate change in what is, without a doubt, the worst research I have ever read (Keen 2020).

The key point of that chapter, that economists have used spurious data and logic to downplay the dangers of global warming, is highlighted in a survey of economists working on climate change that was published after it was written (Howard and Sylvan 2021). This survey asked how much economic damage would be done by global warming of 3°C by 2075, 5°C by 2130, and 7°C by 2220. The median answer was that this would reduce GDP two centuries hence by 20%, from $3,650 trillion (in USD 2019 terms) to $2,730 trillion. In economic growth terms, this is a fall in the annual rate of economic growth of 0.02%, which is one fifth of the accuracy with which economic growth is measured today. In other words, economists believe that global warming will have an imperceptible impact on the performance of the economy.

Scientists, on the other hand, are warning that a temperature increase of 1°C, which we have already exceeded, could be sufficient to trigger “tipping points” that could seriously damage our sedentary civilisation (Armstrong McKay et al. 2022), and that an increase of the order of 5°C implies “beyond catastrophic, including existential threats” (Xu and Ramanathan 2017).

This failing by mainstream economists is far, far worse than their mistakes leading up to the Global Financial Crisis, when they ignored the rise in private debt and predicted, using their flawed macroeconomic models, that the immediate economic future was bright (Cotis 2007). Then they merely led us blindfolded into the greatest economic crisis since the Great Depression. This time, they are leading us into the potential destruction of the capitalist economy, when they see themselves as the main defenders of capitalism.

Now, more than ever, we need a realistic economics that appreciates the ecological constraints under which we must operate on this finite planet. Its first job will not be to manage the economy, but to salvage what we can as the Prometheus that Neoclassical economists have helped unleash ravages our economic and social systems.

Armstrong McKay, David I., Arie Staal, Jesse F. Abrams, Ricarda Winkelmann, Boris Sakschewski, Sina Loriani, Ingo Fetzer, Sarah E. Cornell, Johan Rockström, Timothy M. Lenton, Ecology Spatial, Change Global, and Sciences Environmental. 2022. ‘Exceeding 1.5°C global warming could trigger multiple climate tipping points’, Science (American Association for the Advancement of Science), 377: 1-eabn7950.

Bernanke, Ben S. 2000. Essays on the Great Depression (Princeton University Press: Princeton).

Committee for the Prize in Economic Sciences in Memory of Alfred Nobel, The. 2022. “Financial Intermediation and the Economy.” In. Stockholm: The Royal Swedish Academy of Sciences.

Cotis, Jean-Philippe. 2007. ‘Editorial: Achieving Further Rebalancing.’ in OECD (ed.), OECD Economic Outlook (OECD: Paris).

Deutsche Bundesbank. 2017. ‘The role of banks, non- banks and the central bank in the money creation process’, Deutsche Bundesbank Monthly Report, April 2017: 13-33.

Garegnani, Pierangelo. 1970. ‘Heterogeneous Capital, the Production Function and the Theory of Distribution’, Review of Economic Studies, 37: 407-36.

Graziani, Augusto. 1989. ‘The Theory of the Monetary Circuit’, Thames Papers in Political Economy, Spring: 1-26.

Howard, P. H., and D. Sylvan. 2021. ” Gauging economic consensus on climate change.” In Technical report. Institute for Policy Integrity, New York University School of Law,.

Keen, Steve. 2020. ‘The appallingly bad neoclassical economics of climate change’, Globalizations: 1-29.

———. 2021. The New Economics: A Manifesto (Polity Press: Cambridge, UK).

———. 2023. “Loading the DICE against pension funds: Flawed economic thinking on climate has put your pension at risk ” In. London: Carbon Tracker.

McLeay, Michael, Amar Radia, and Ryland Thomas. 2014. ‘Money in the modern economy: an introduction’, Bank of England Quarterly Bulletin, 2014 Q1: 4-13.

Meadows, Donella H., Jorgen Randers, and Dennis Meadows. 1972. The limits to growth (Signet: New York).

Nordhaus, William D. 1973. ‘World Dynamics: Measurement Without Data’, The Economic Journal, 83: 1156-83.

Sraffa, Piero. 1926. ‘The Laws of Returns under Competitive Conditions’, The Economic Journal, 36: 535-50.

———. 1960. Production of commodities by means of commodities: prelude to a critique of economic theory (Cambridge University Press: Cambridge).

Xu, Y., and V. Ramanathan. 2017. ‘Well below 2 °C: Mitigation strategies for avoiding dangerous to catastrophic climate changes’, Proceedings of the National Academy of Sciences of the United States of America, 114: 10315-23.