It has always been easy to find data on government debt, because mainstream economic theory, via concepts like “Ricardian Equivalence” (Barro 1973, Barro 1978, Barro 1989, Barro 1991), has argued that this is an important economic variable, and economic statisticians collect the data that economists assert is significant. Private debt data, on the other hand, was available only by historical accident—as in the case of the US Federal Reserve’s Flow of Funds data, which was designed in the early post-WWII period before concepts like Ricardian Equivalence raised their misleading heads—because mainstream economists argued that private debt was a “pure redistribution” and, to quote Ben Bernanke, “Absent implausibly large differences in marginal spending propensities among the groups, … pure redistributions should have no significant macro¬economic effects” (Bernanke 2000, p. 24)

That changed in 2014, when the Bank of International Settlements released a database on private debt. The BIS stepped outside the mainstream because it had the good fortune to have, in Bill White, a Research Director who took Hyman Minsky’s “Financial Instability Hypothesis” seriously (Minsky 1963, Minsky 1977, Minsky 1978, Minsky 1982, Minsky 1982), when mainstream economists simply ignored him. Bill White has since moved to the OECD, but the tradition he established at the BIS lives on.

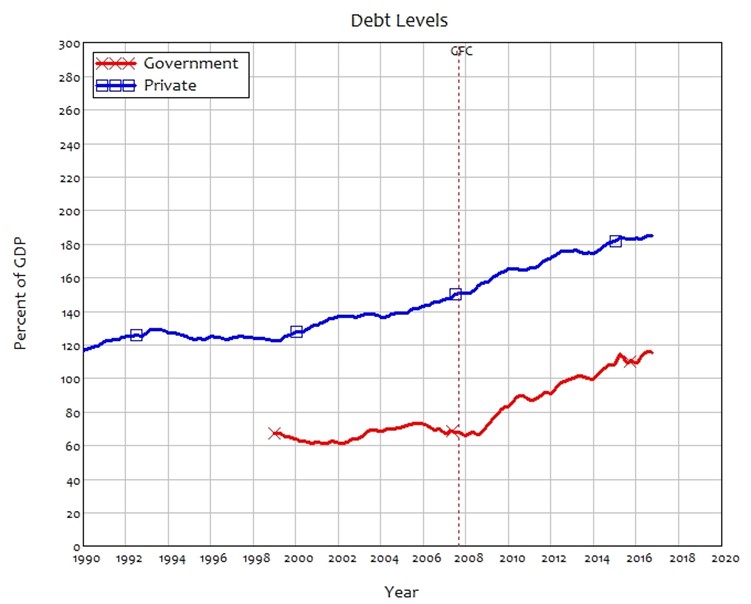

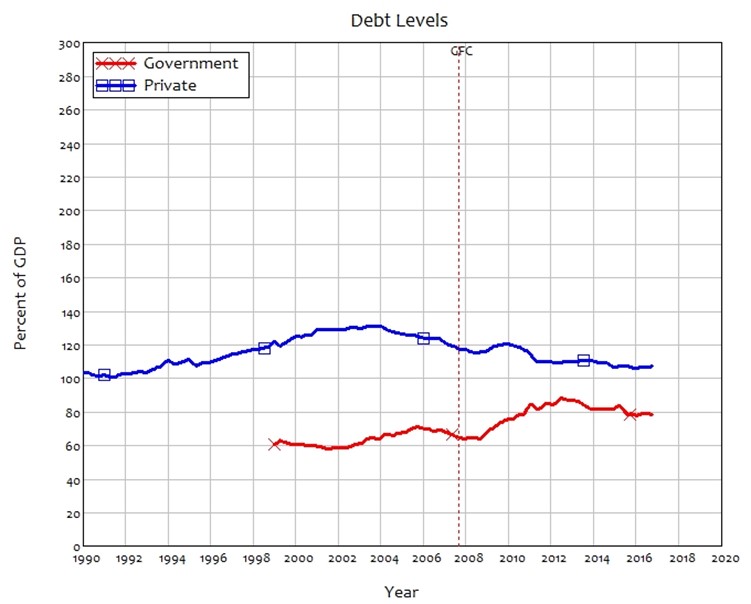

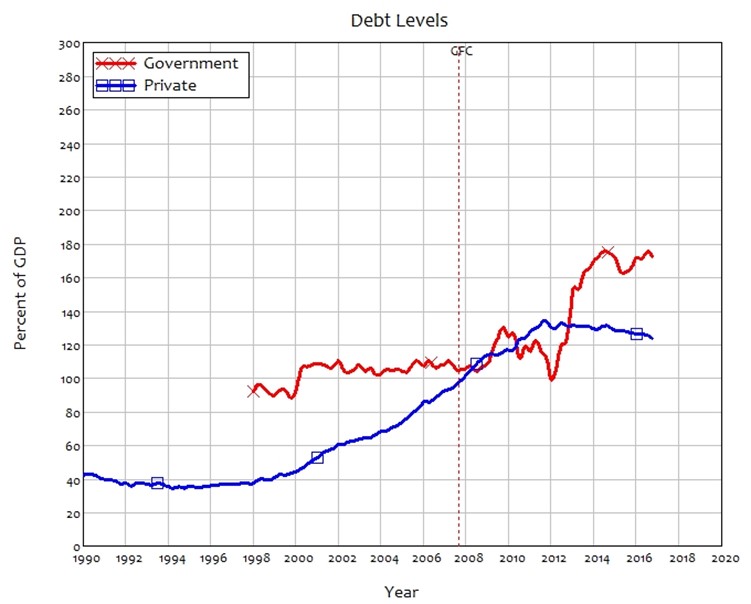

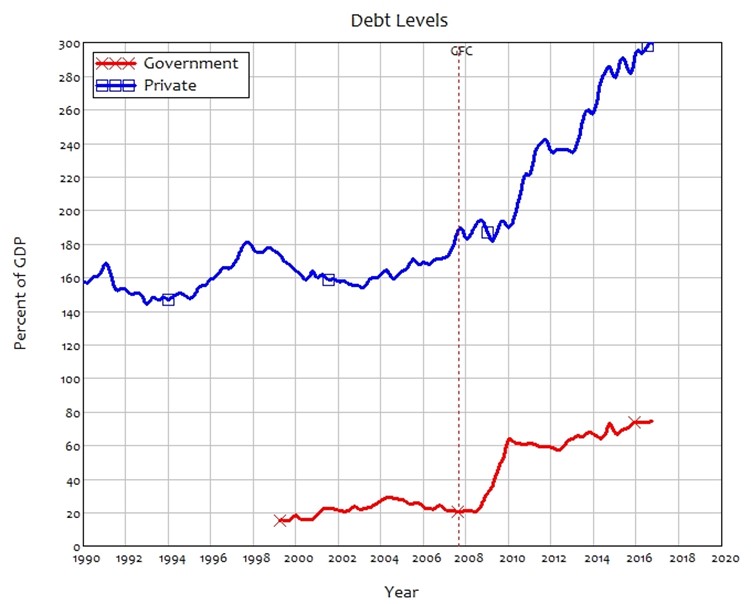

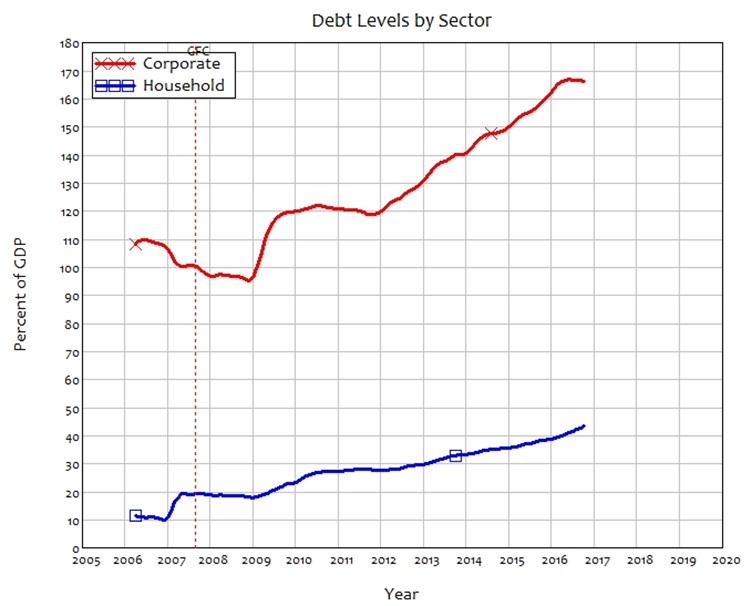

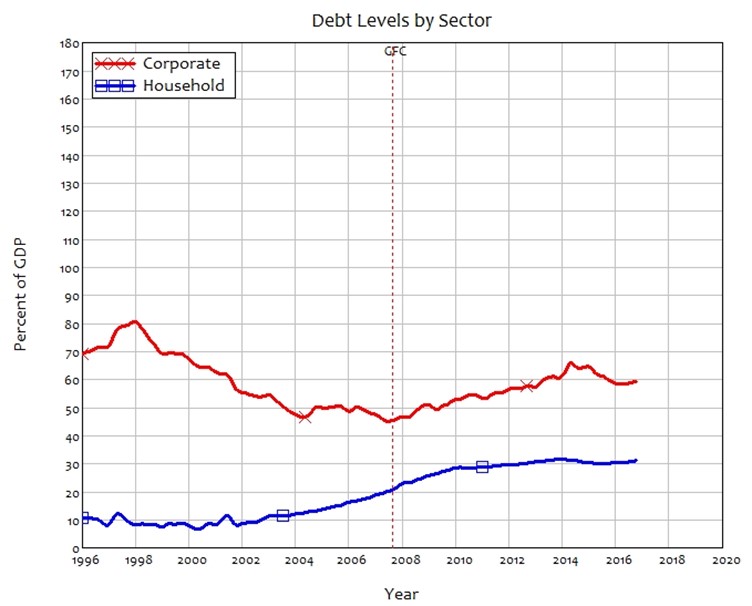

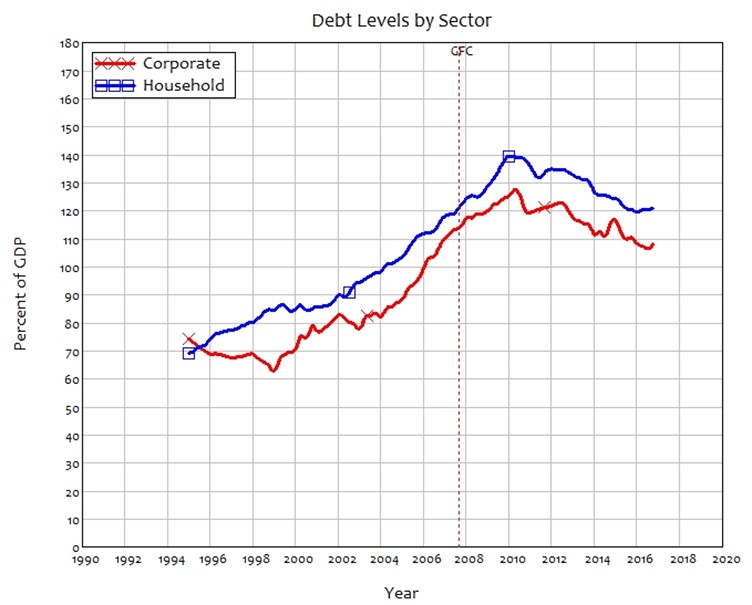

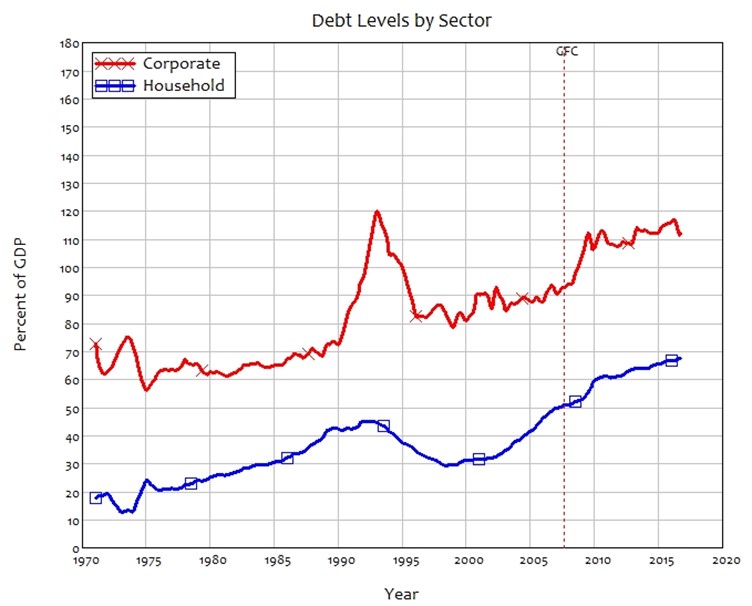

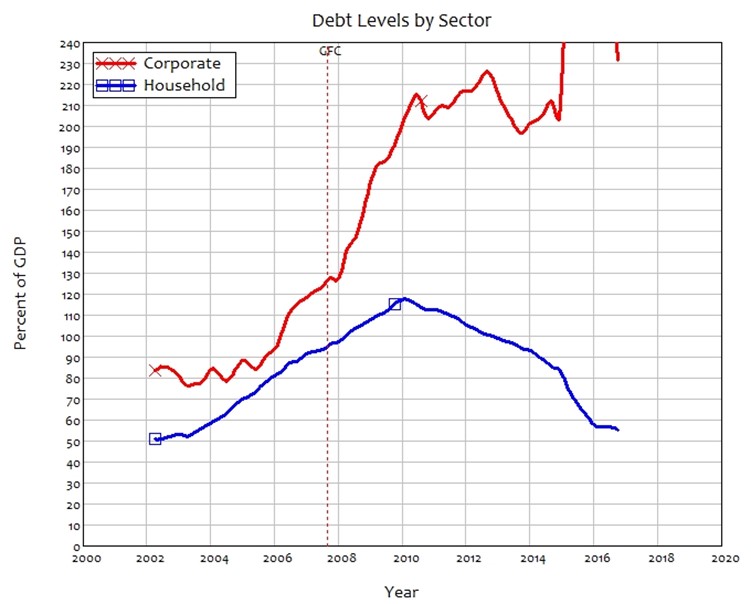

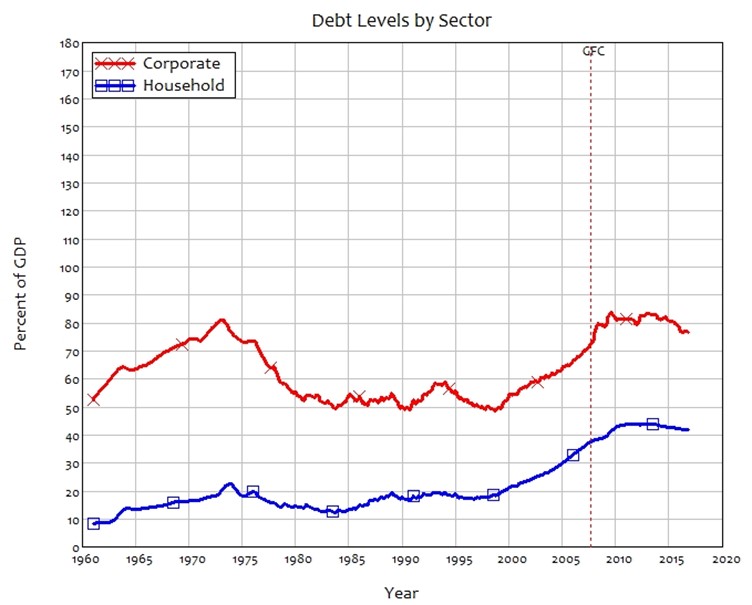

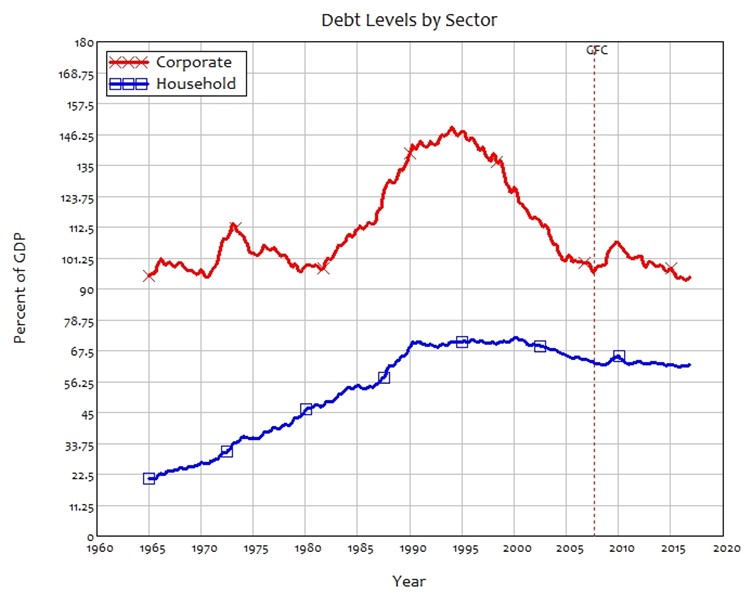

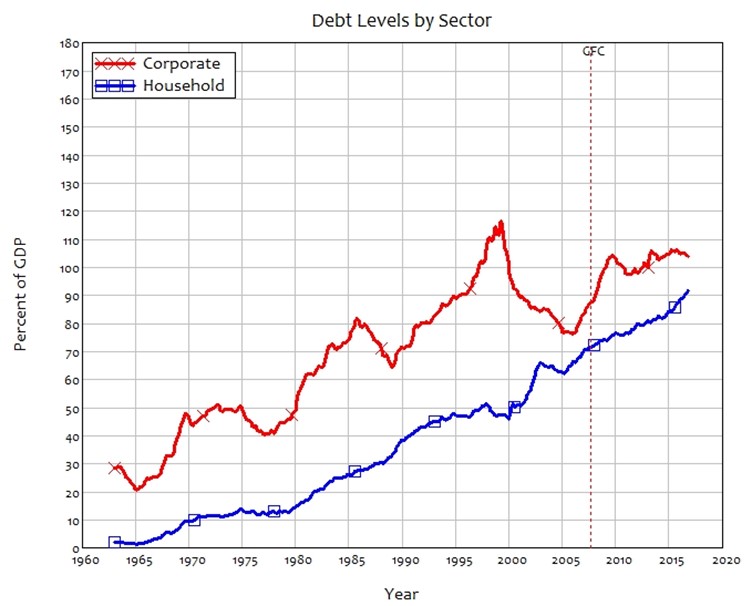

That data made this book possible. But the size of the book—a mere 25,000 words—made putting all the data in the book impossible. Thankfully the web enables a way around this. While I focused on the data for just the USA, UK, Australia, Japan and China in the book, this web page provides all the data for all countries in the BIS databases—which now include house prices and consumer prices.

The charts here are static snapshots of the data as of Q3 2016, but in a short while I will release Ravel©™, a new tool for dynamically presenting and analysing large data sets like this easily.

Contents

Government and Private Debt Levels 8

Credit and Aggregate Demand 38

Breakdown of Private Sector Debt 68

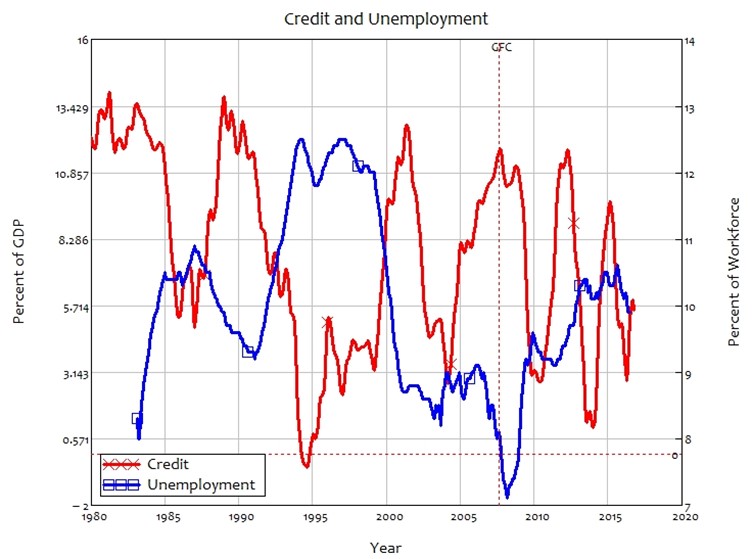

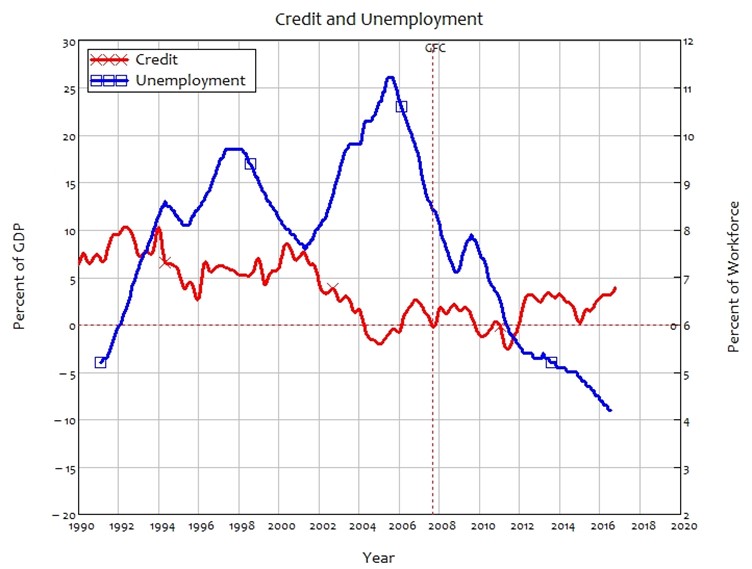

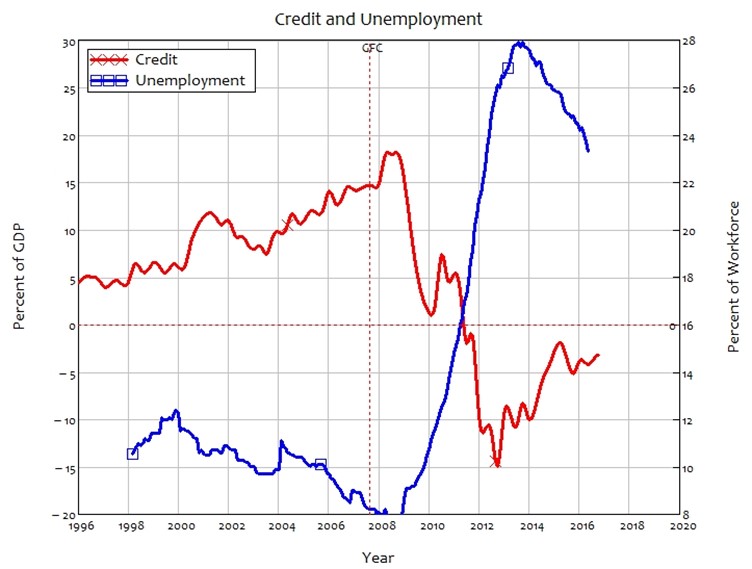

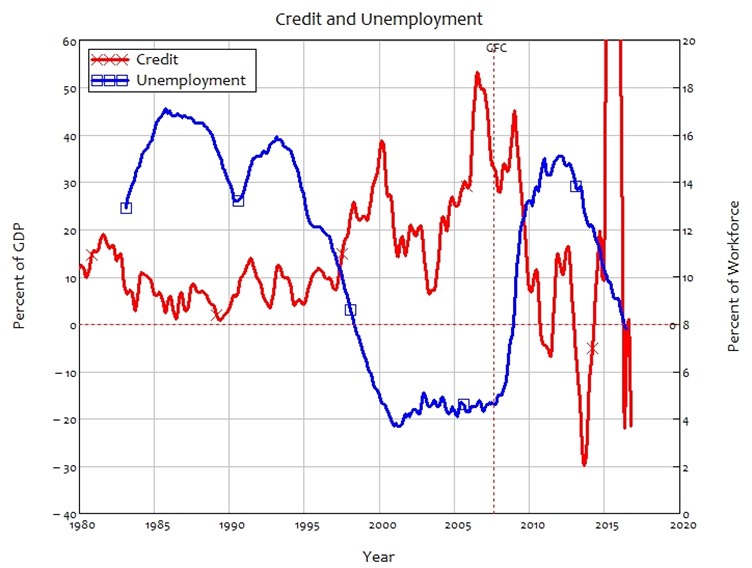

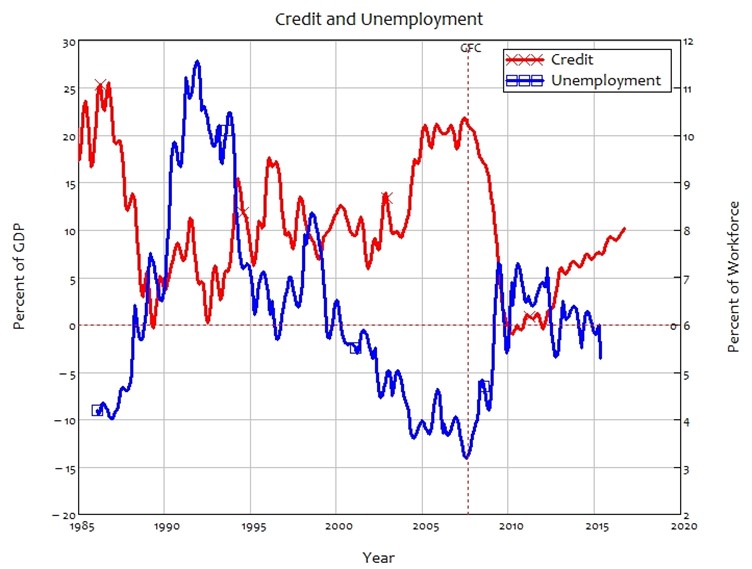

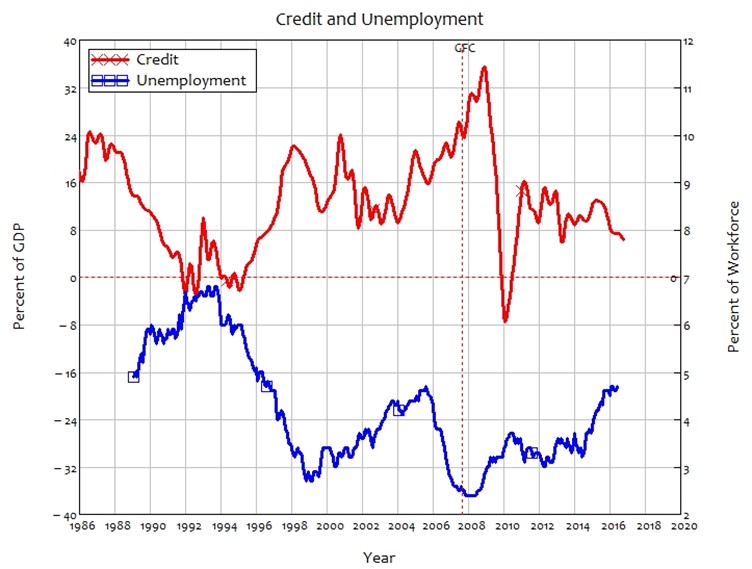

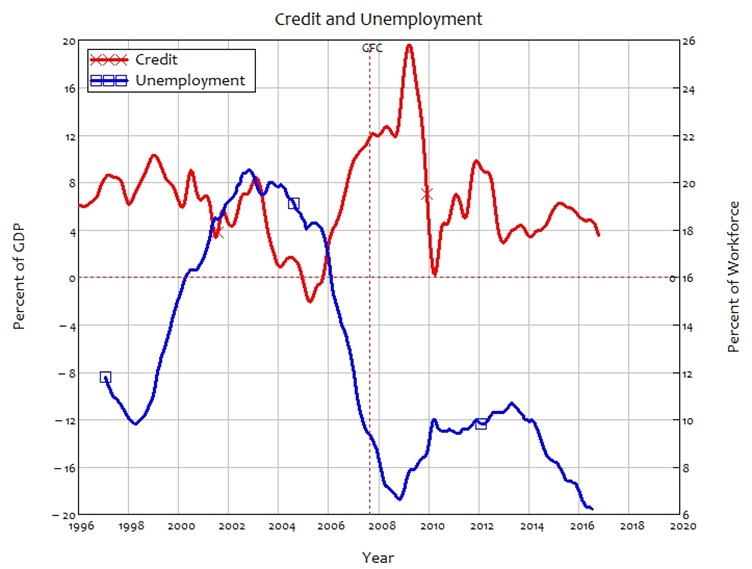

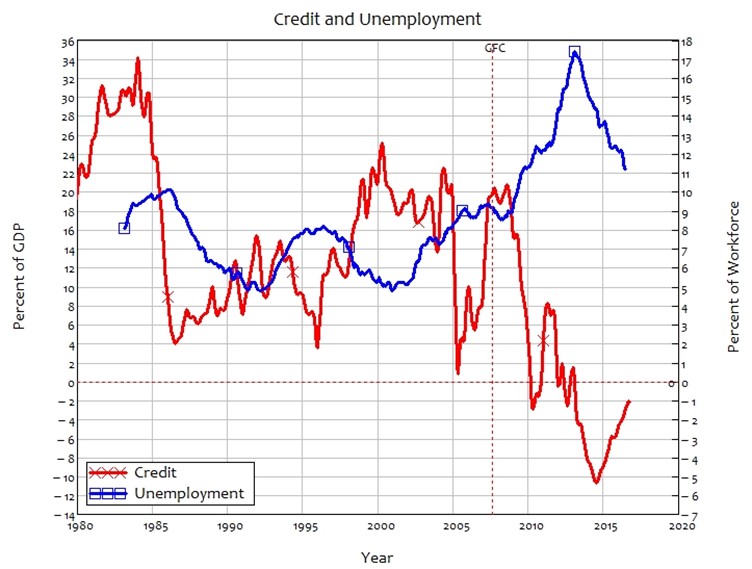

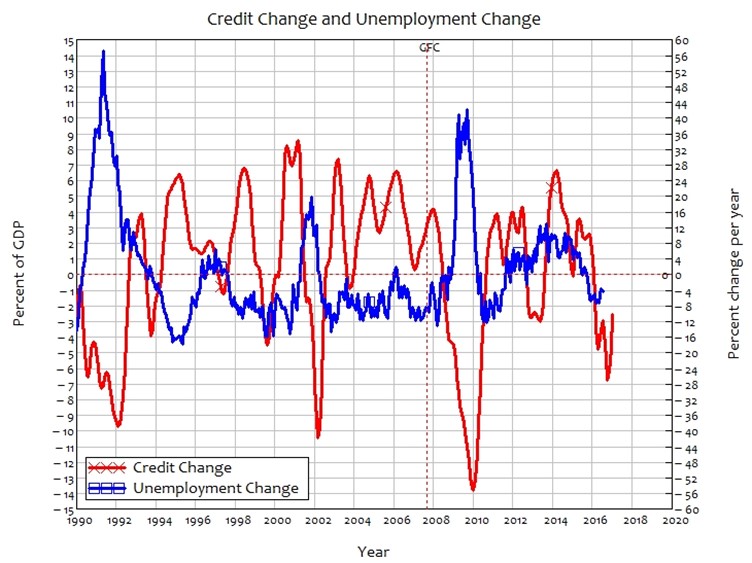

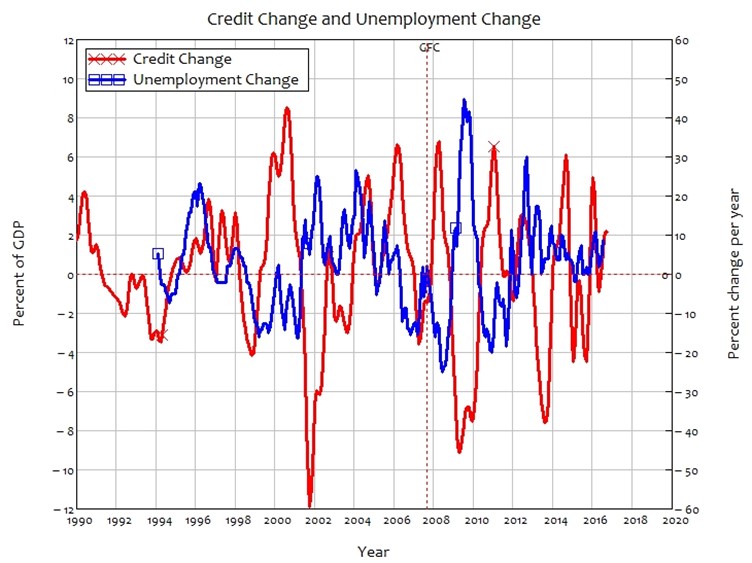

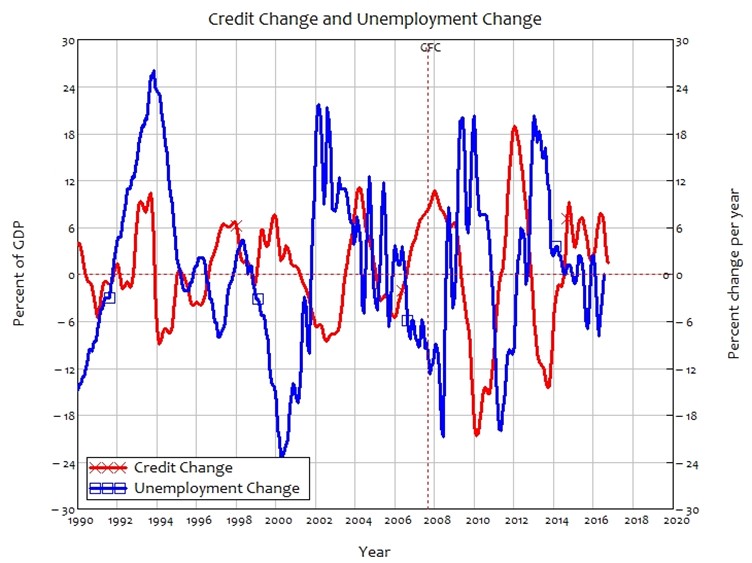

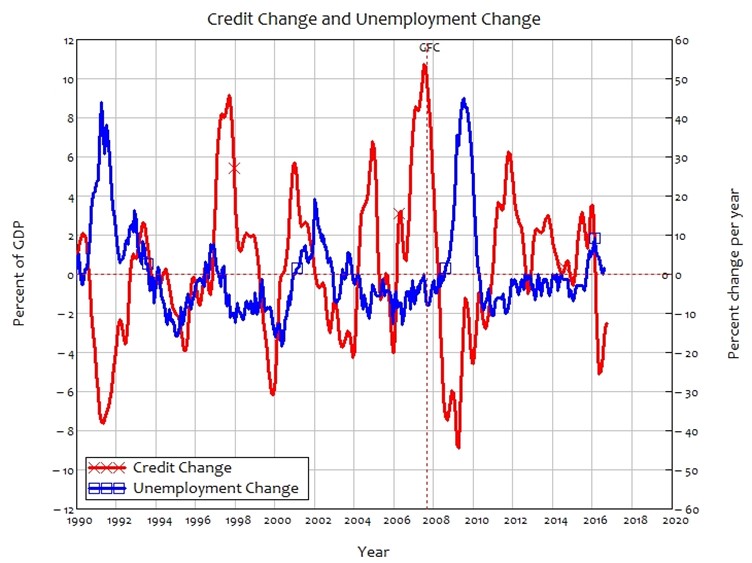

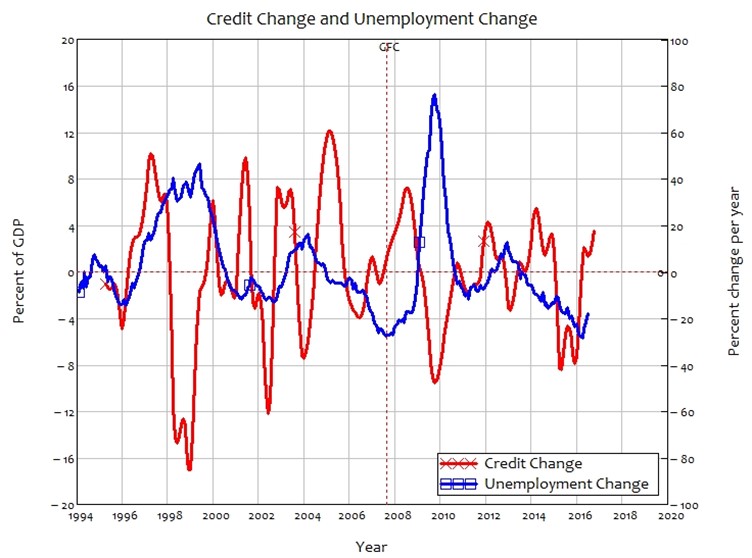

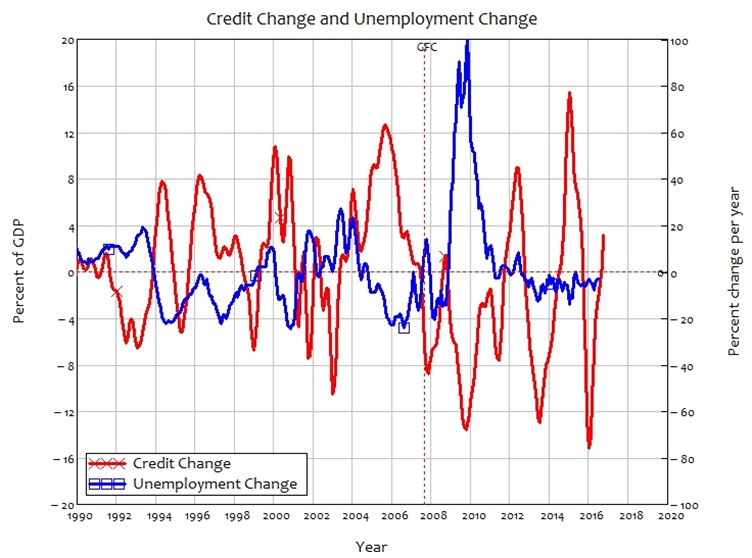

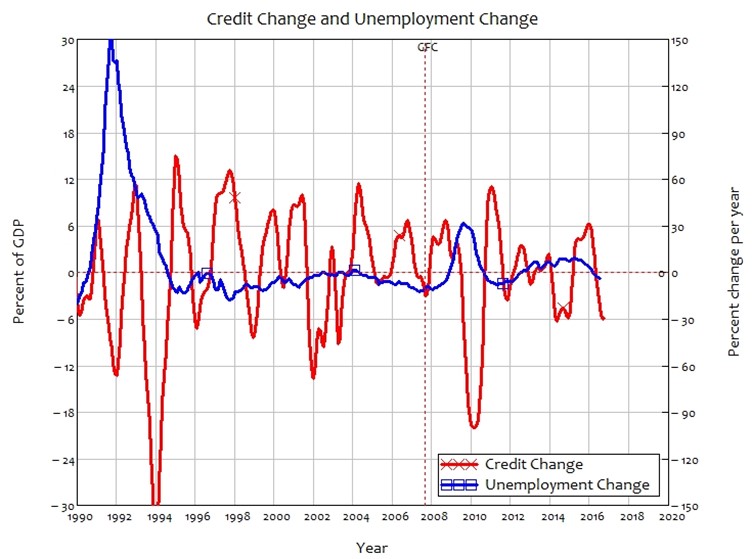

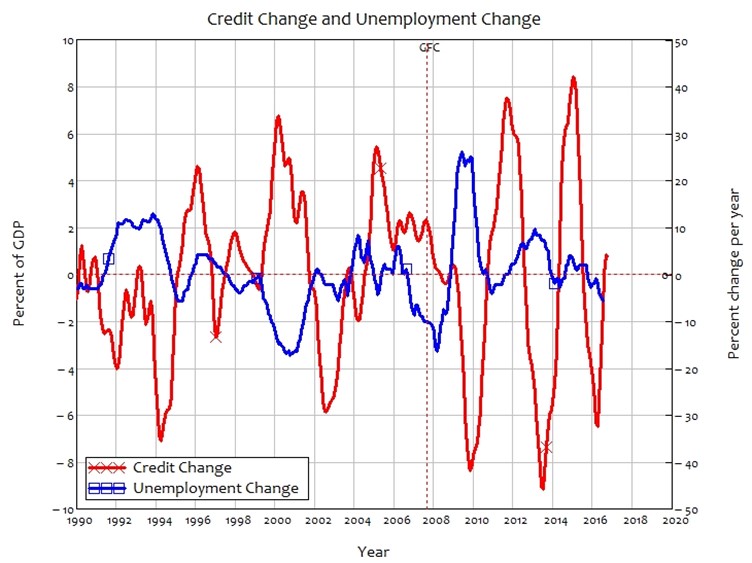

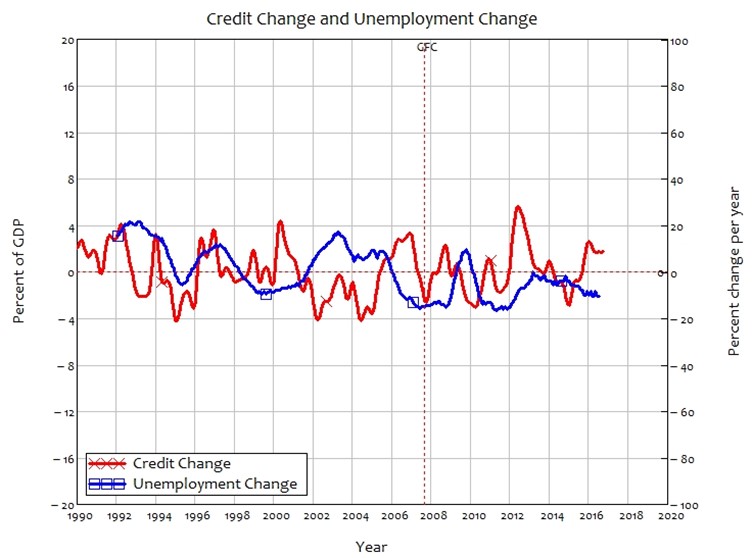

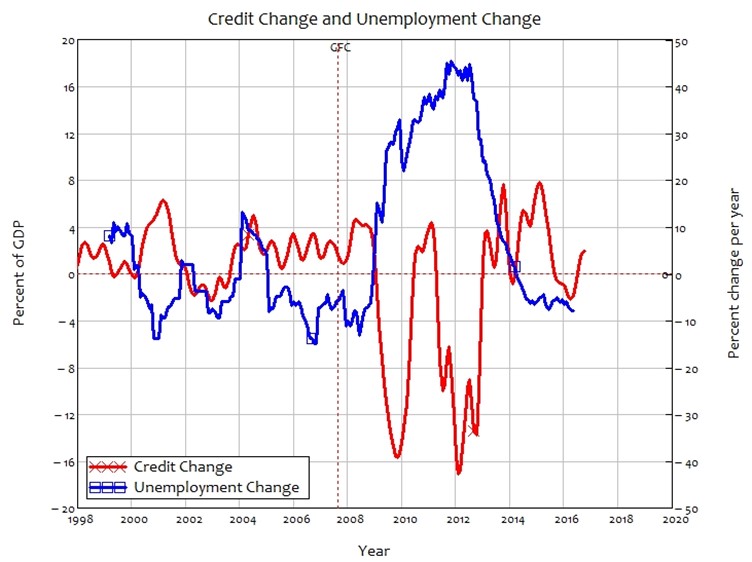

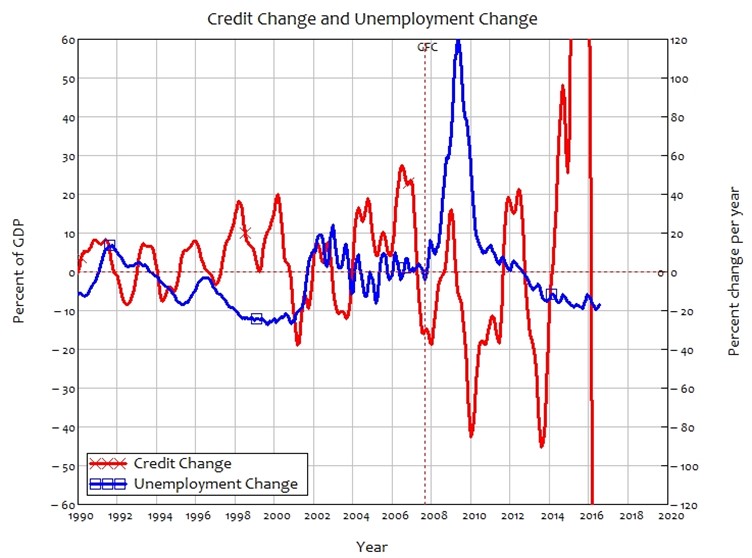

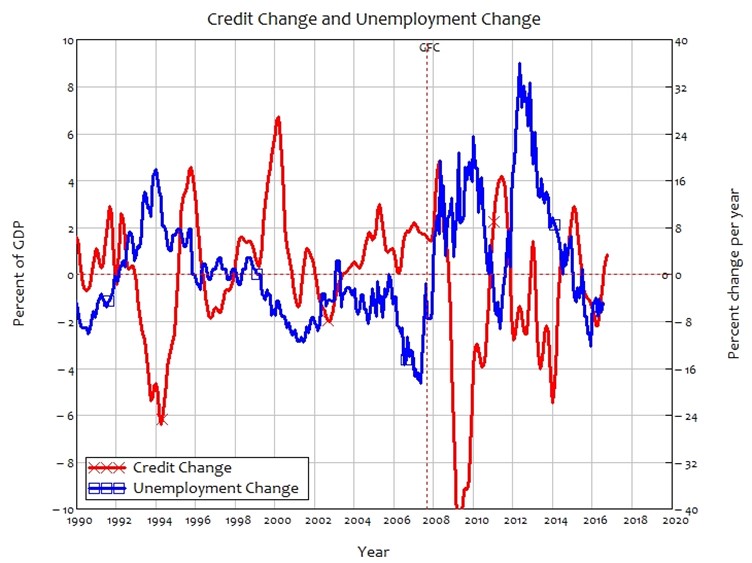

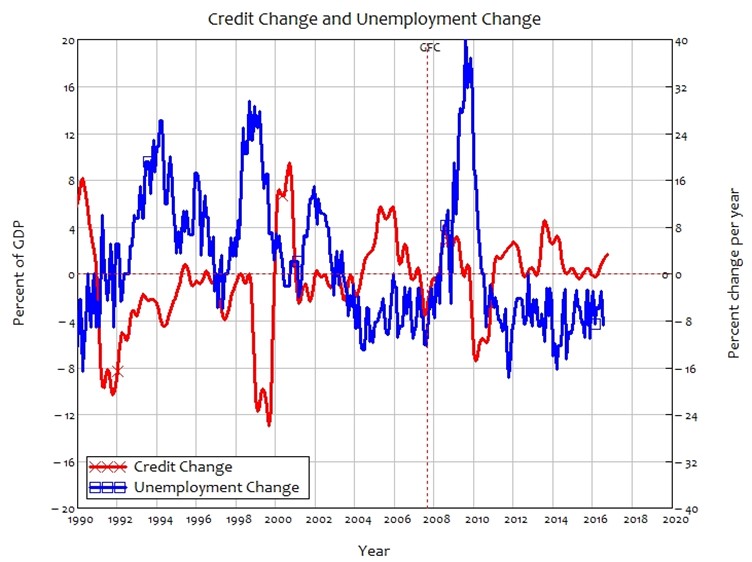

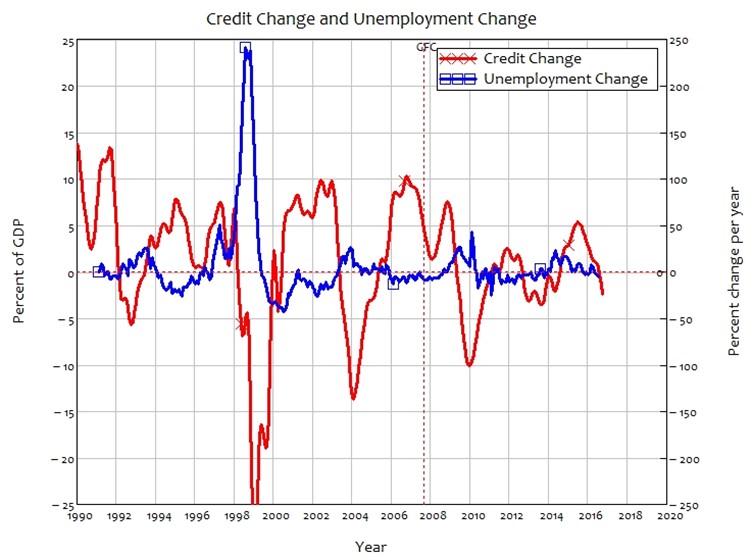

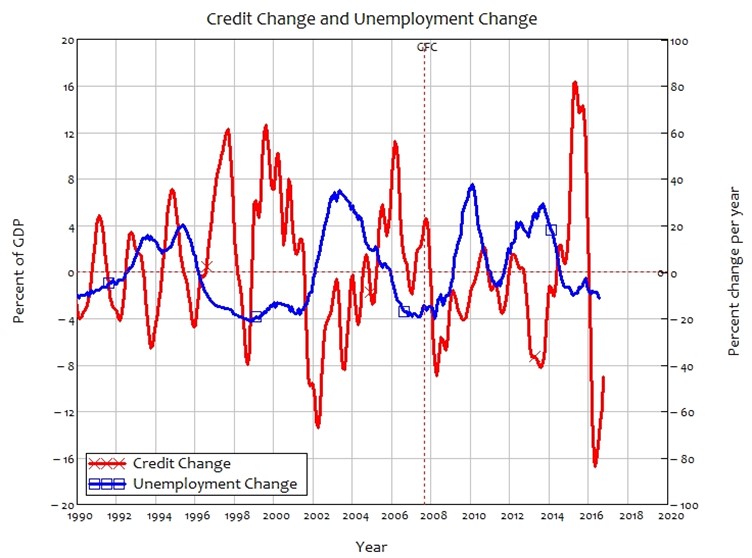

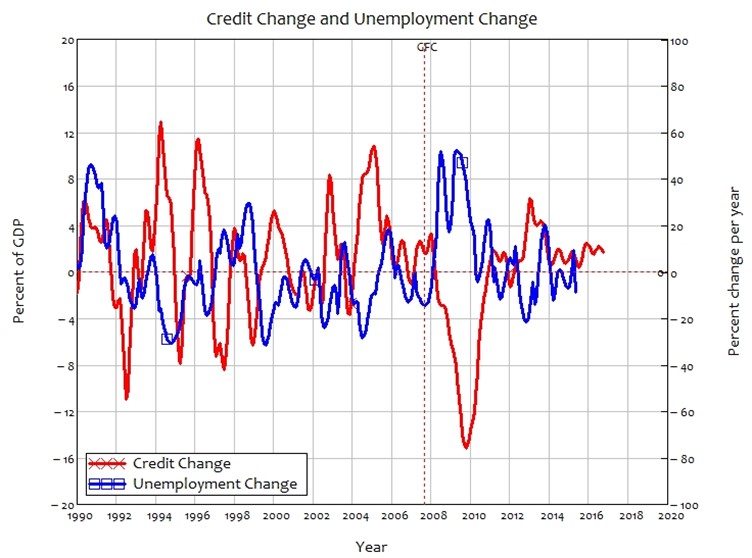

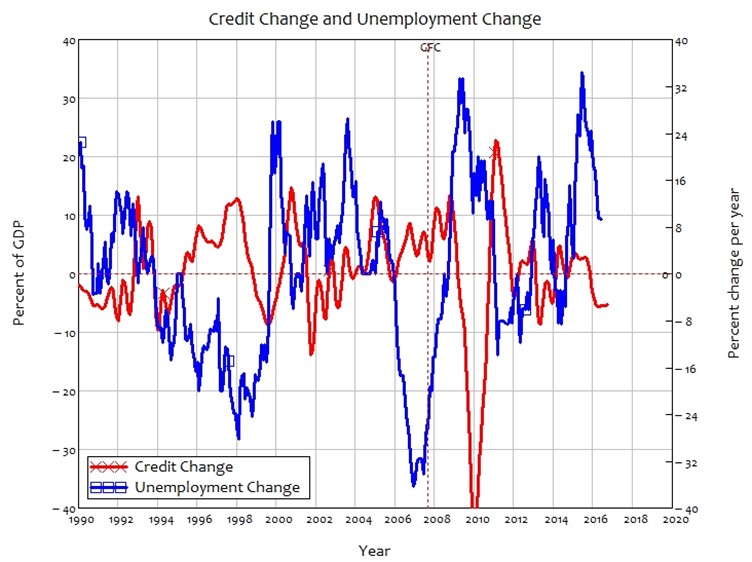

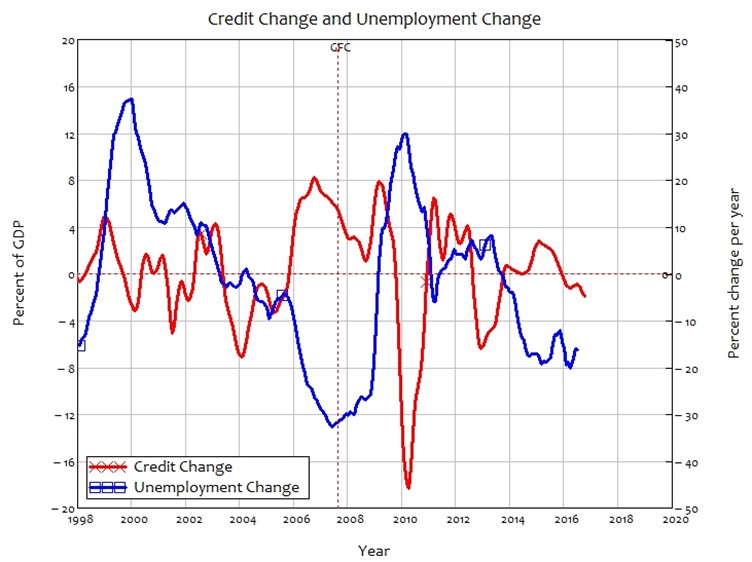

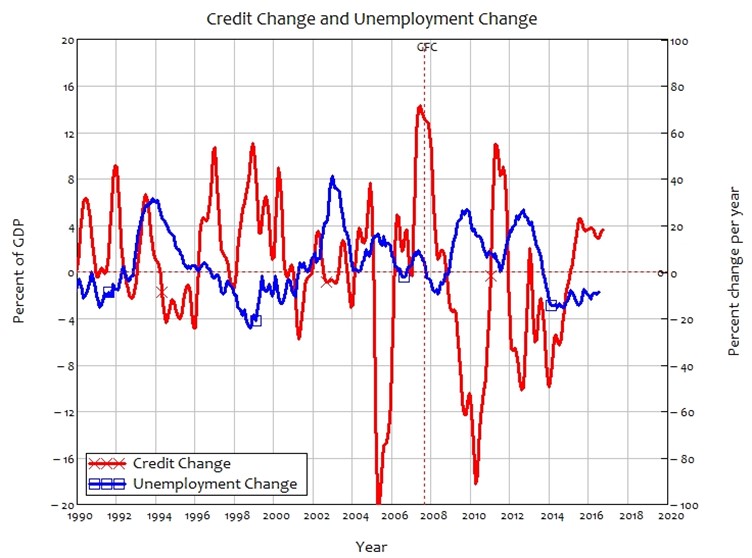

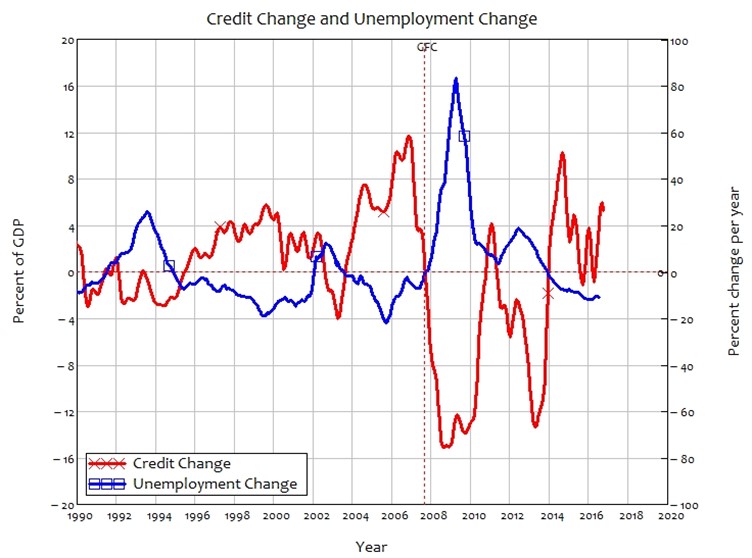

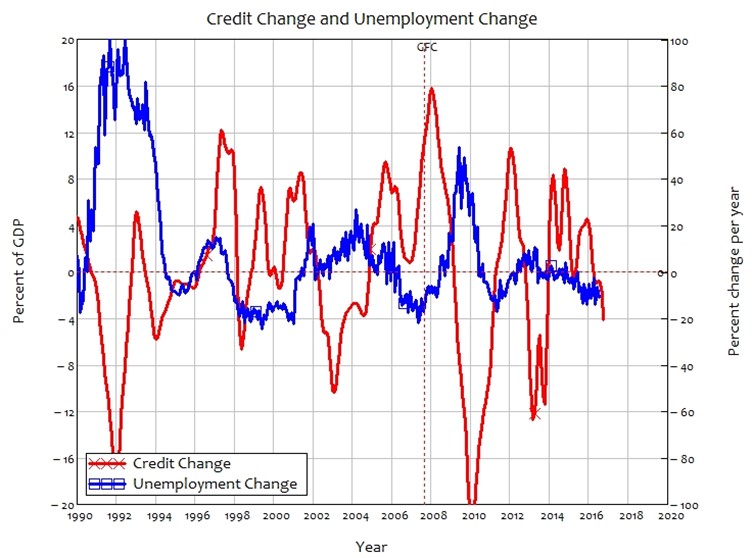

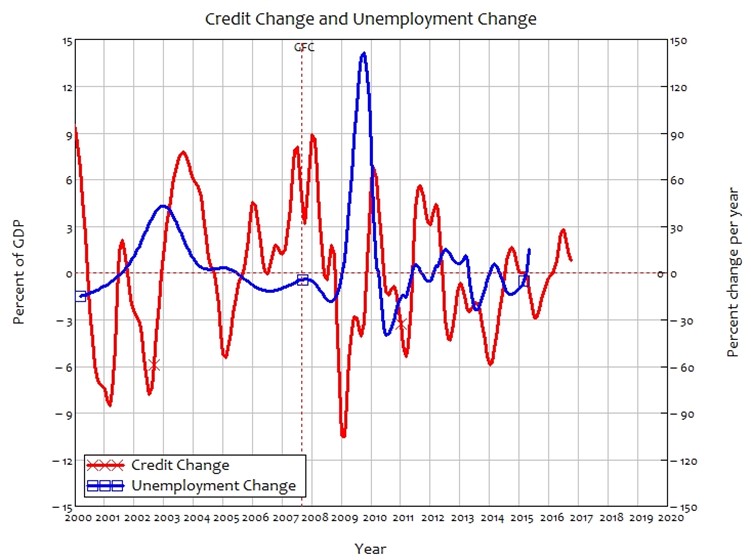

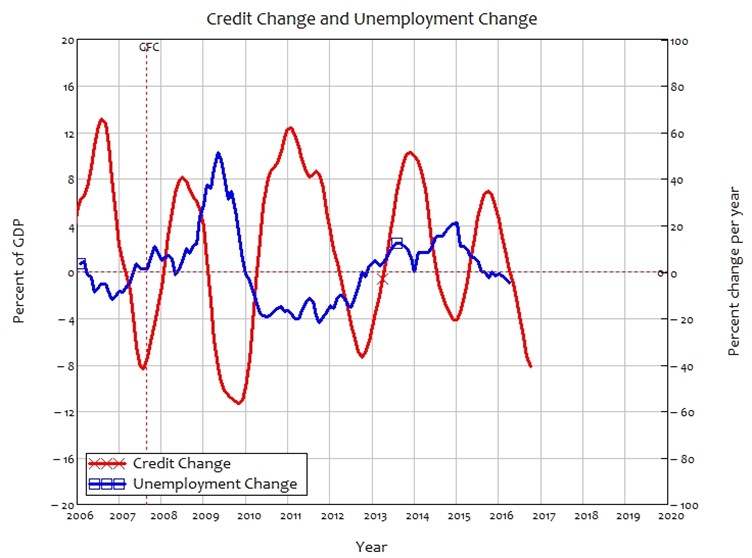

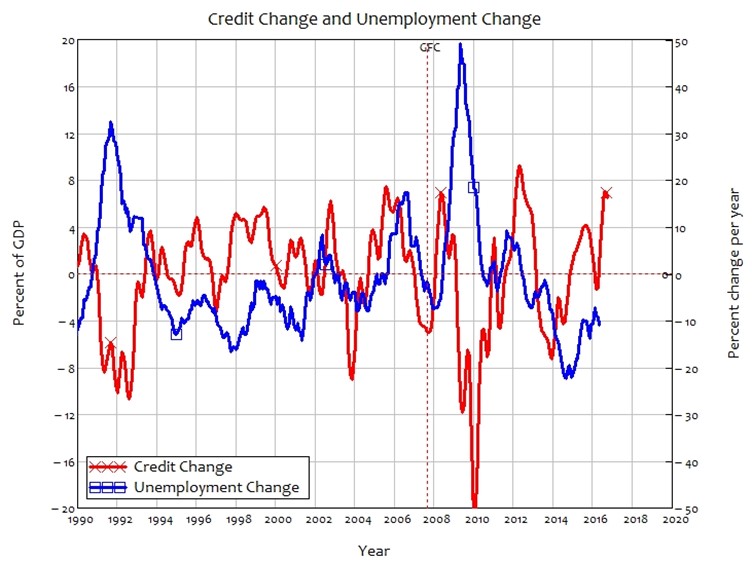

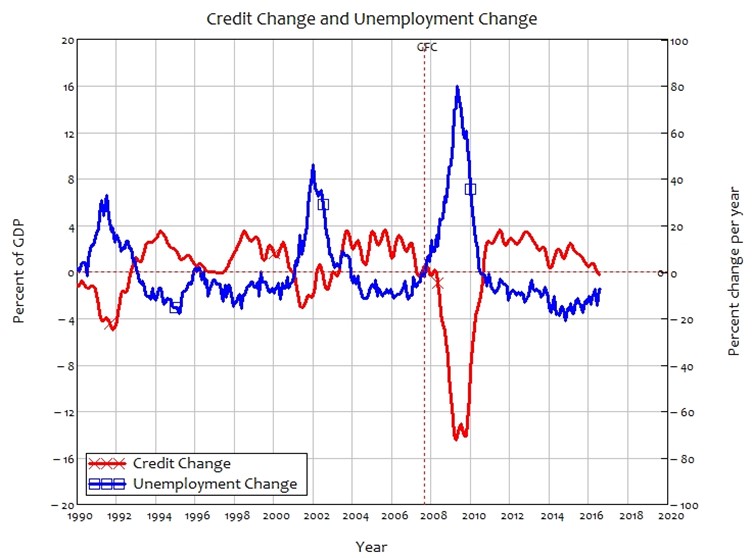

Change in Credit and Change in Unemployment 122

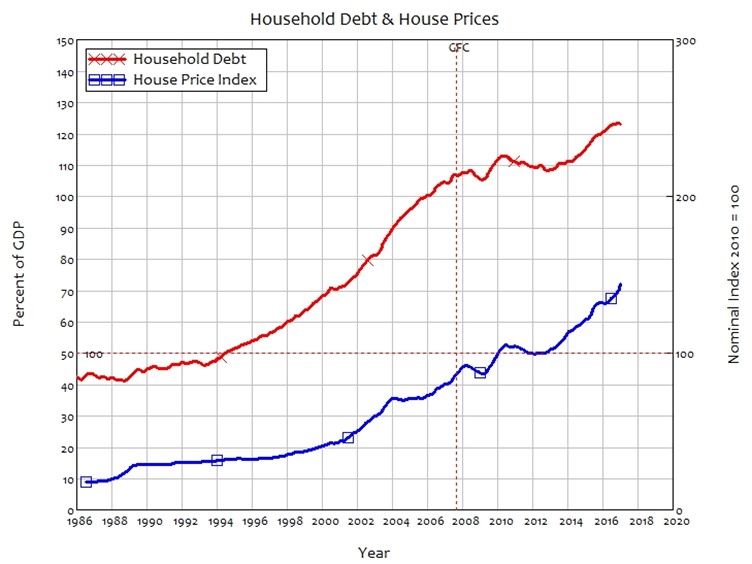

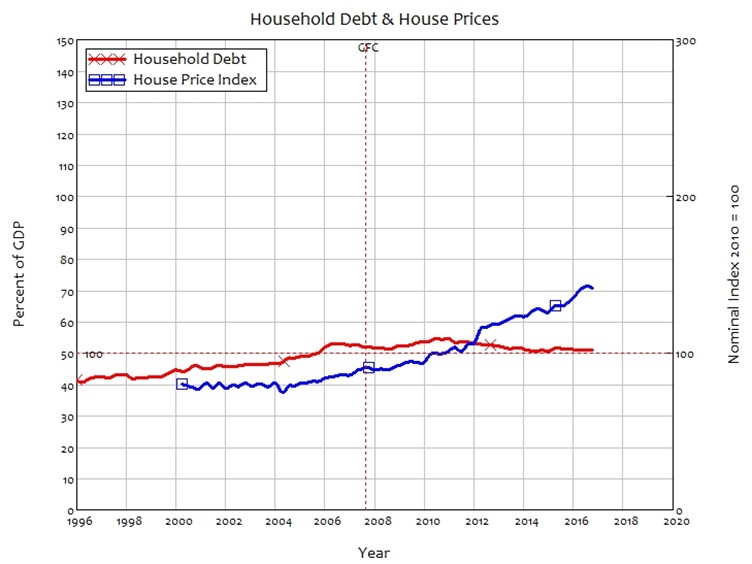

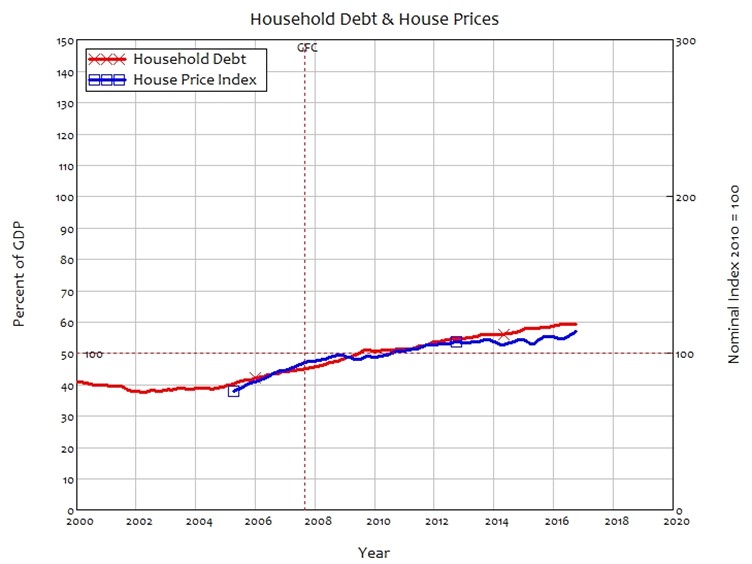

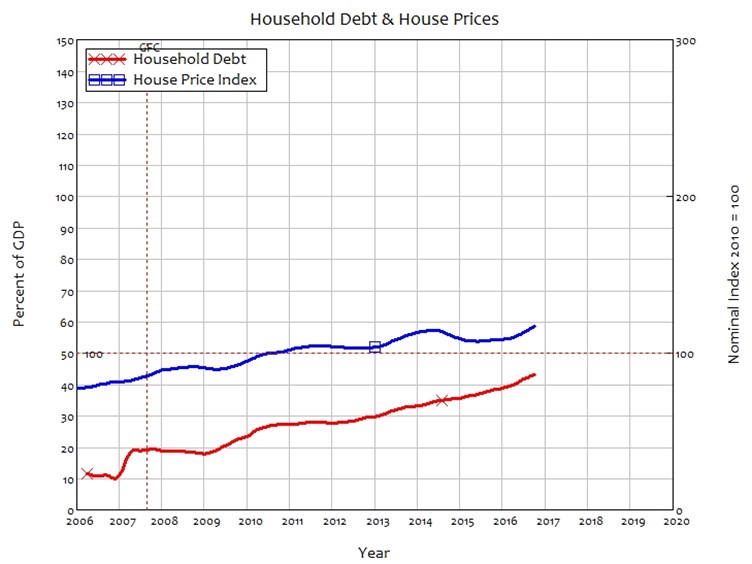

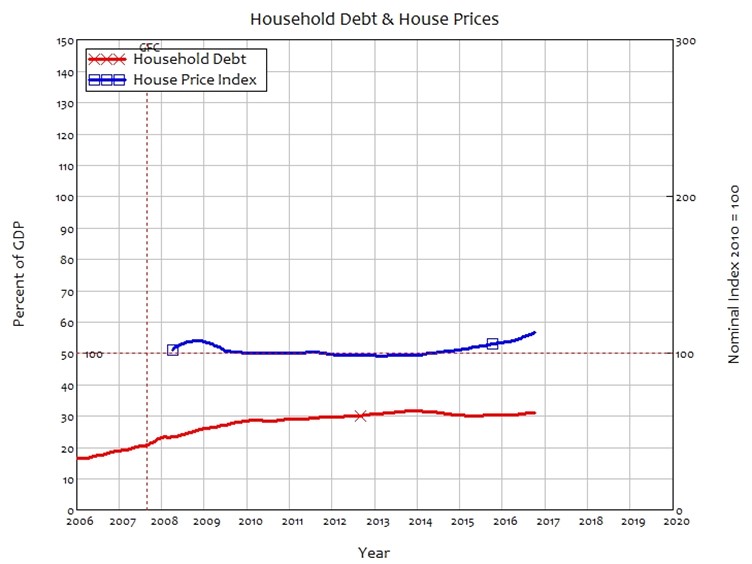

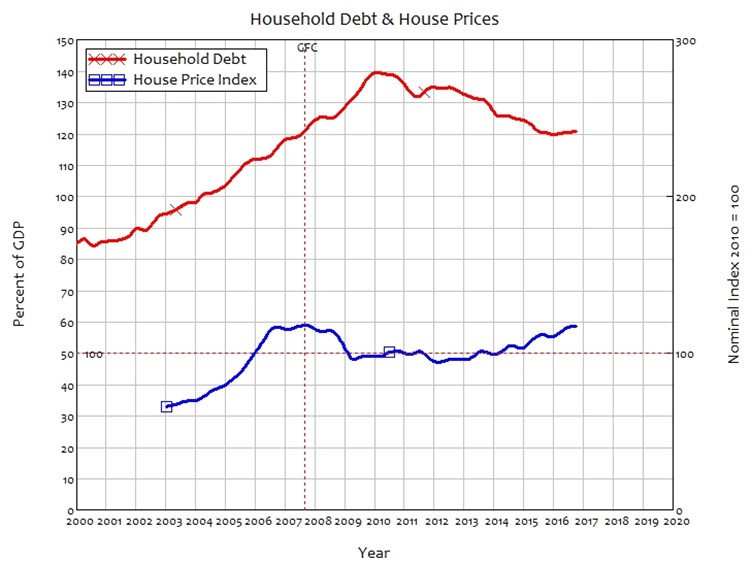

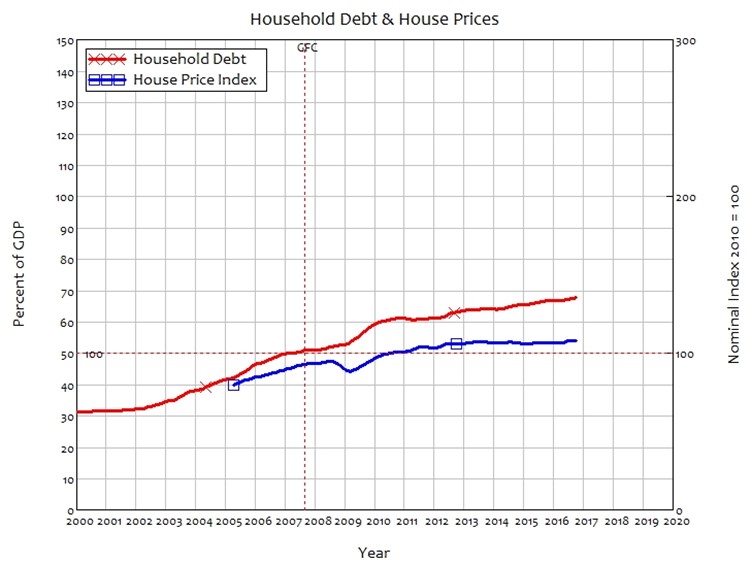

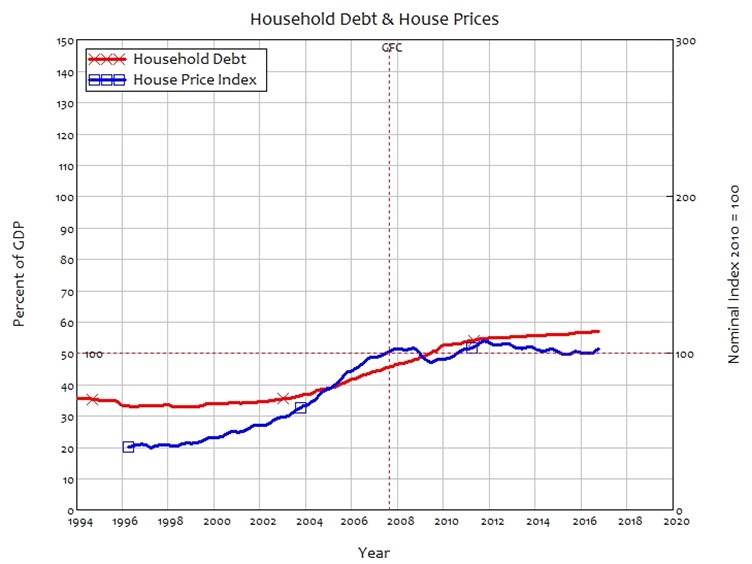

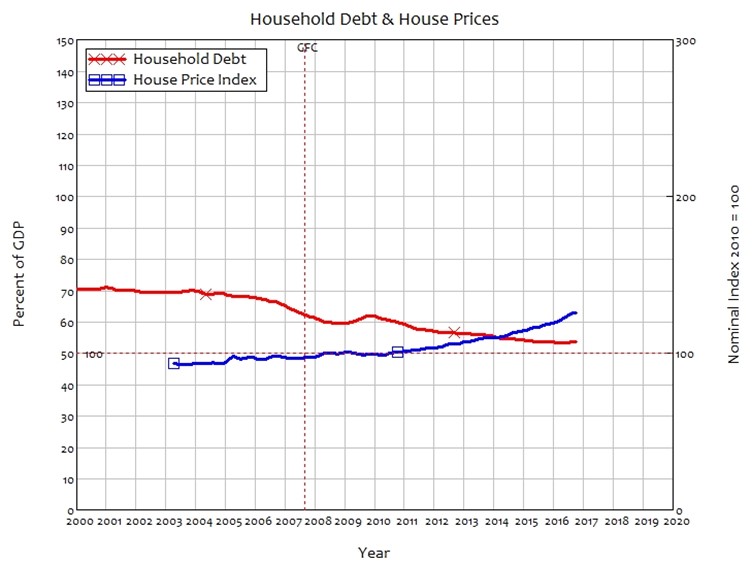

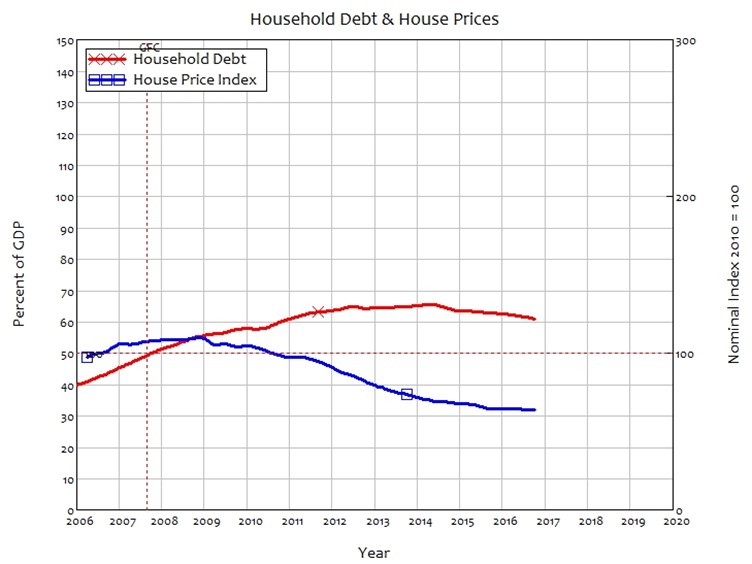

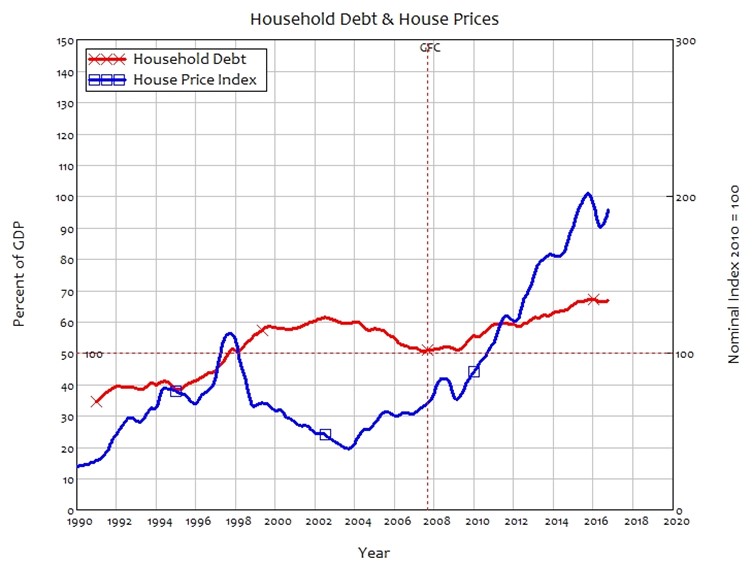

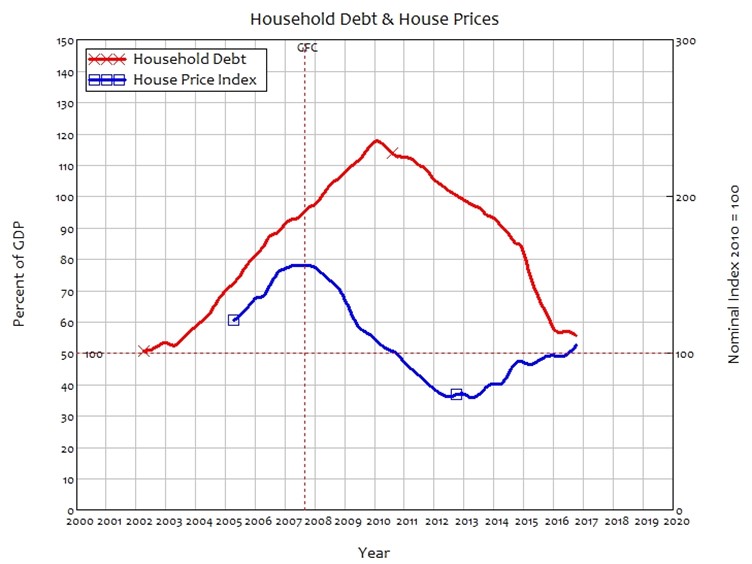

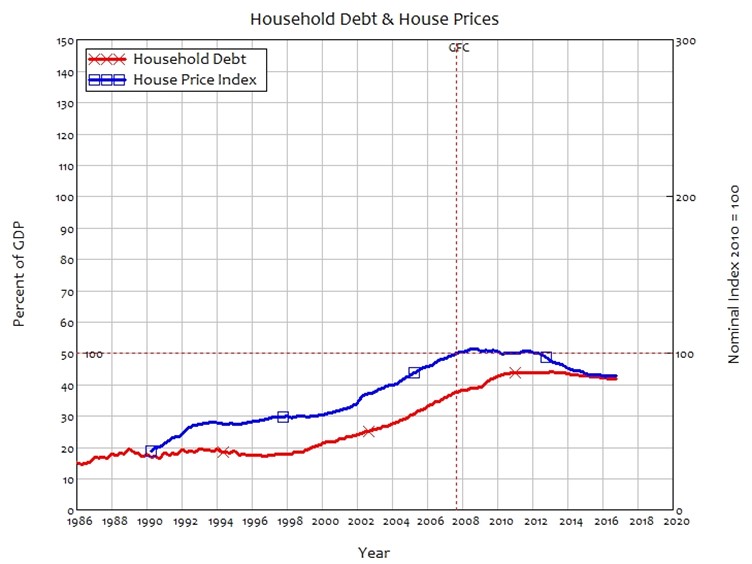

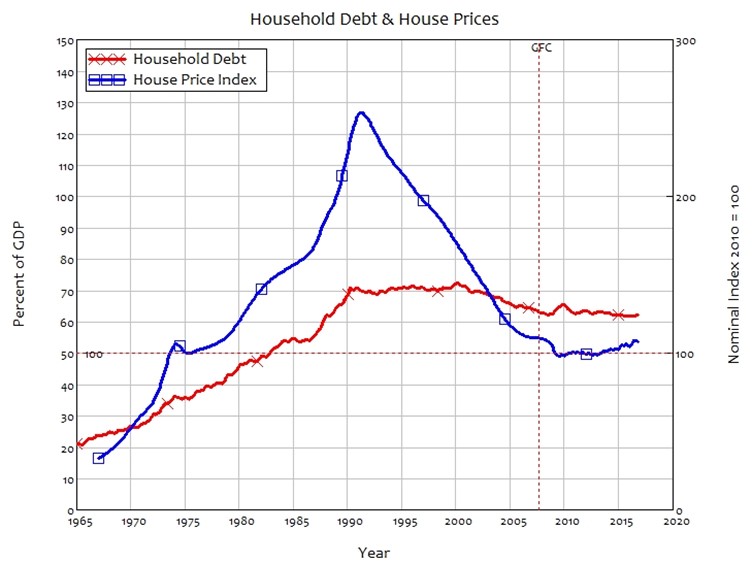

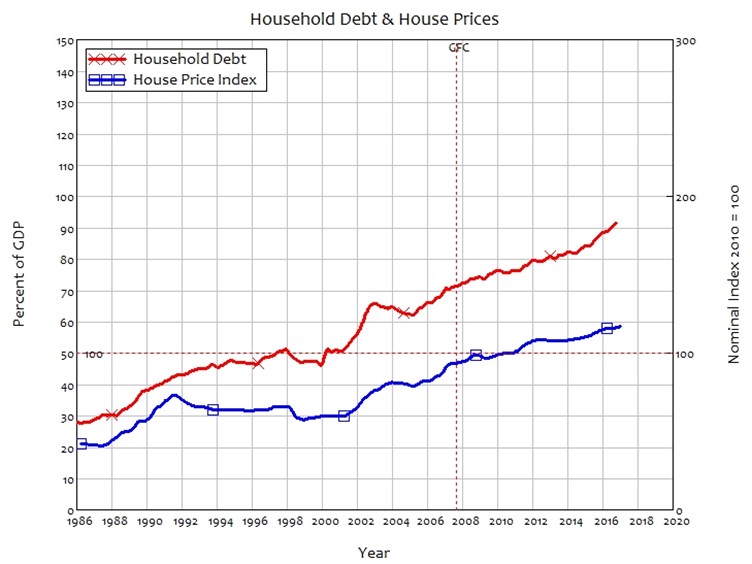

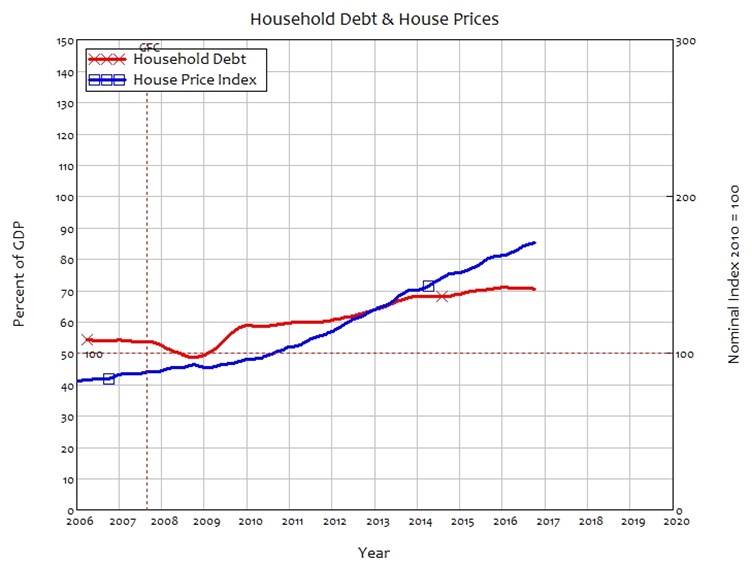

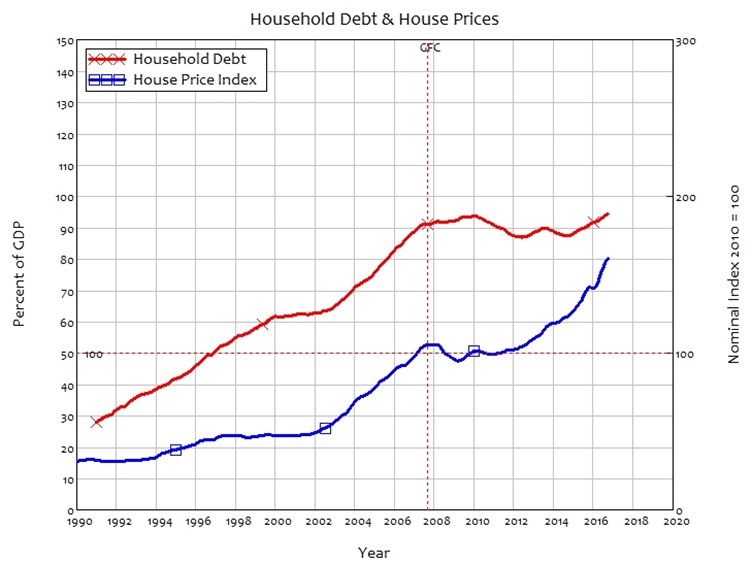

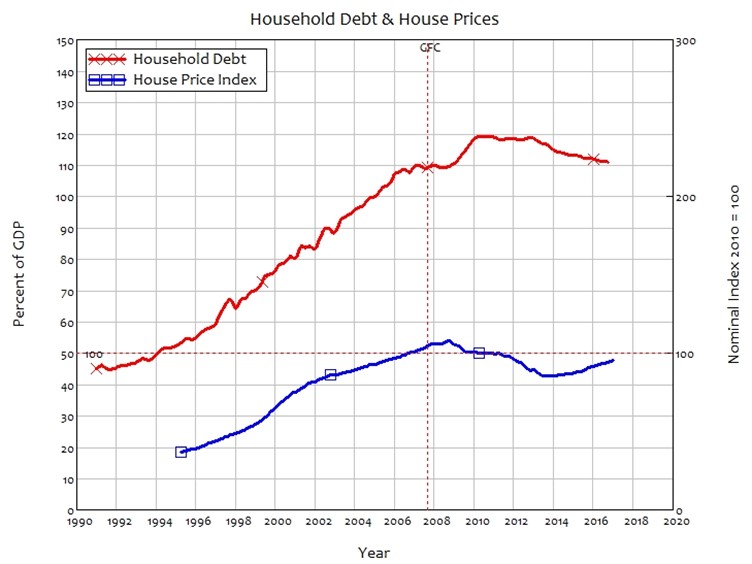

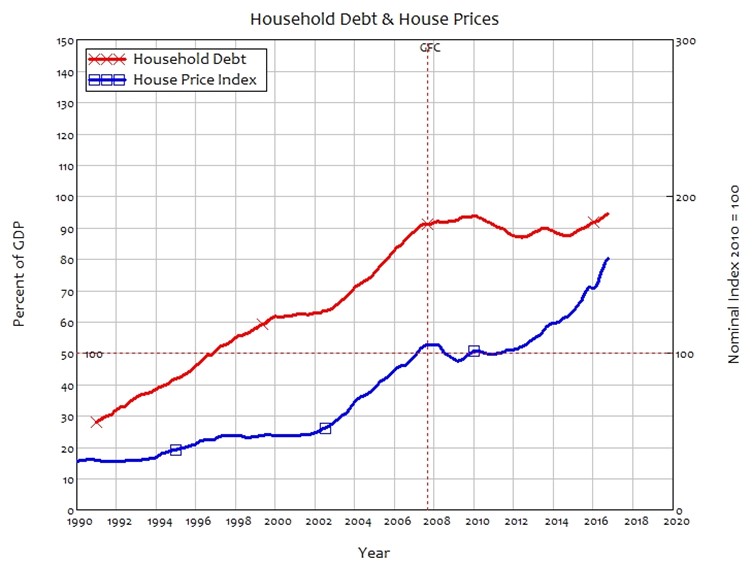

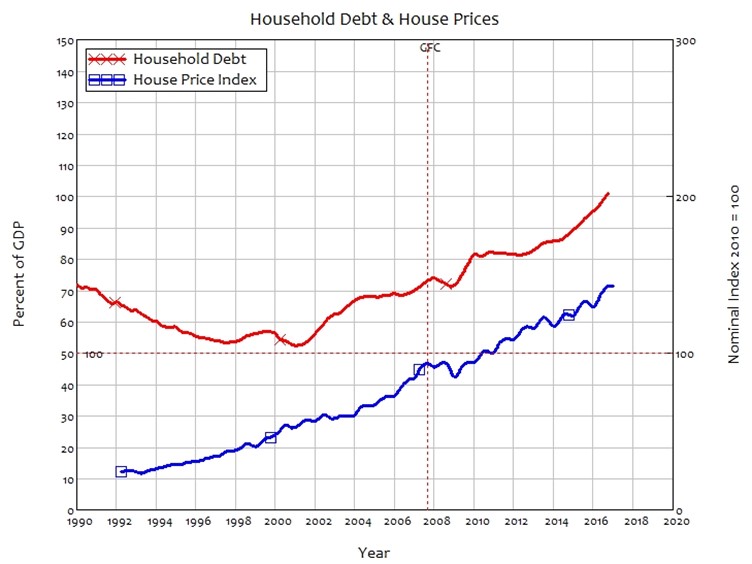

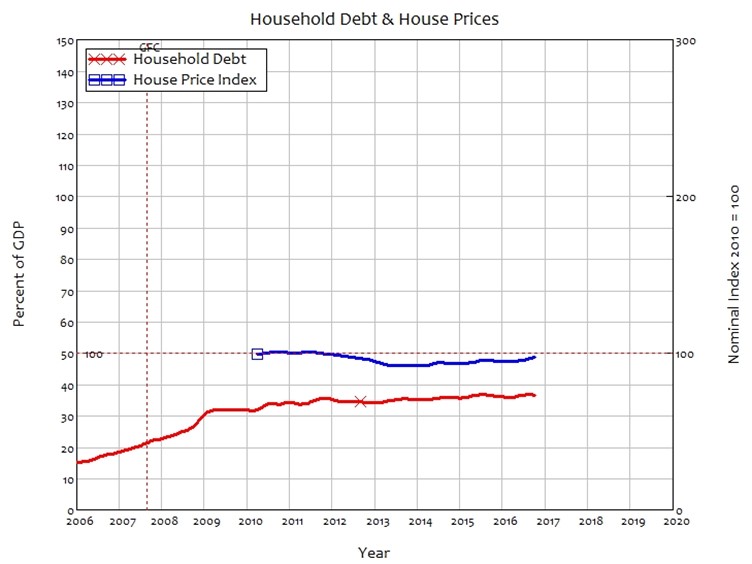

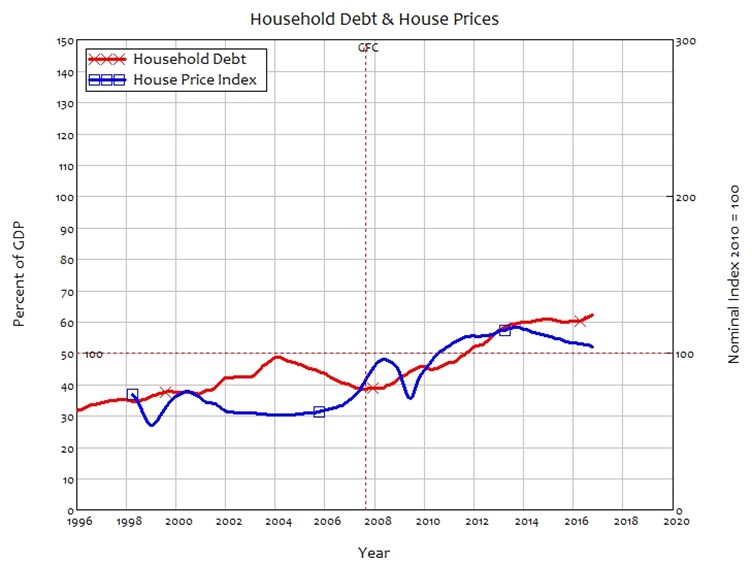

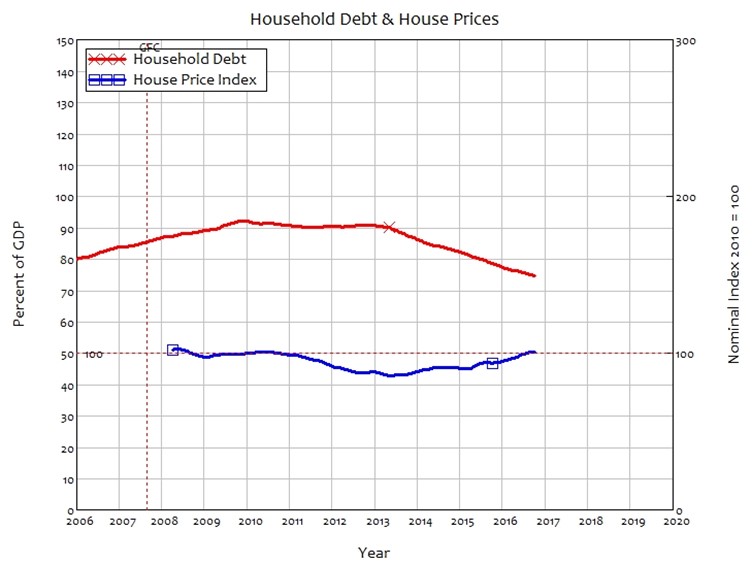

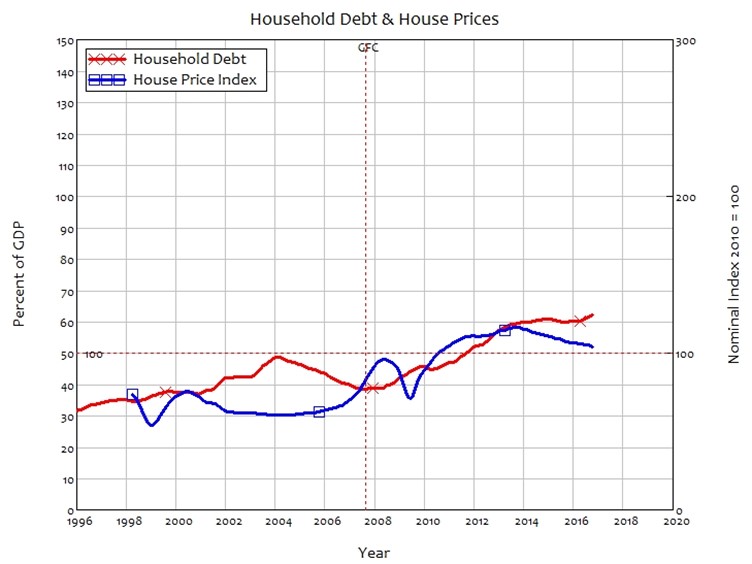

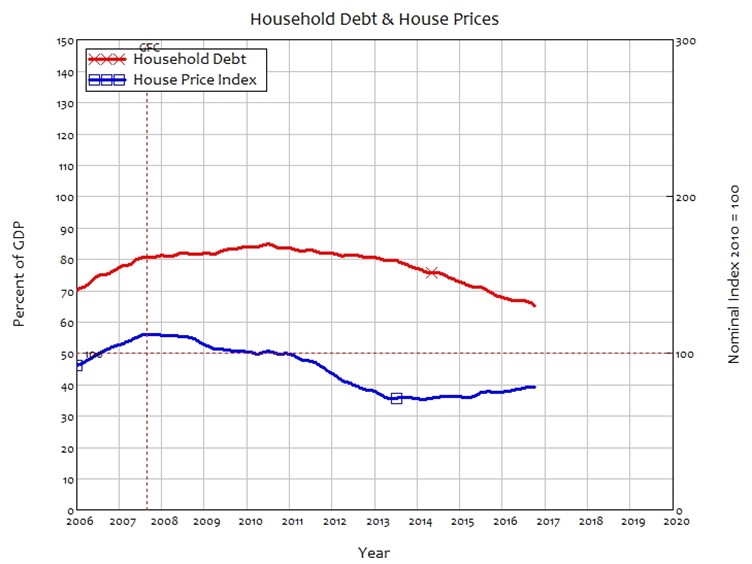

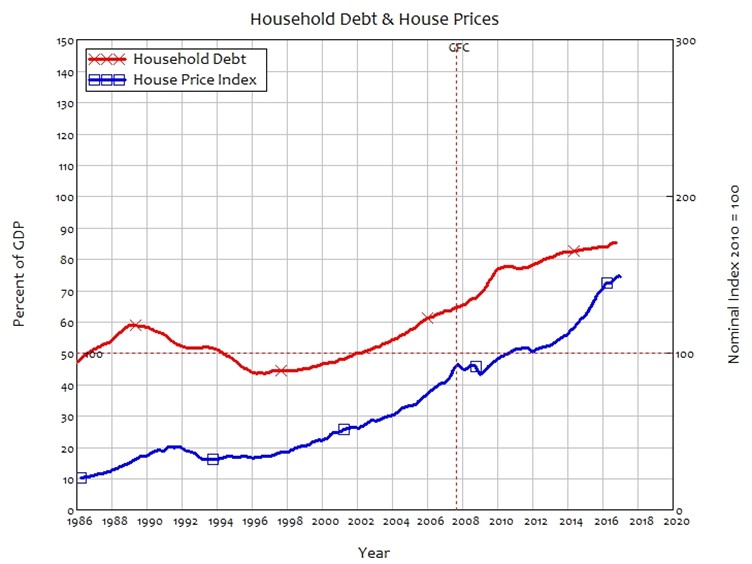

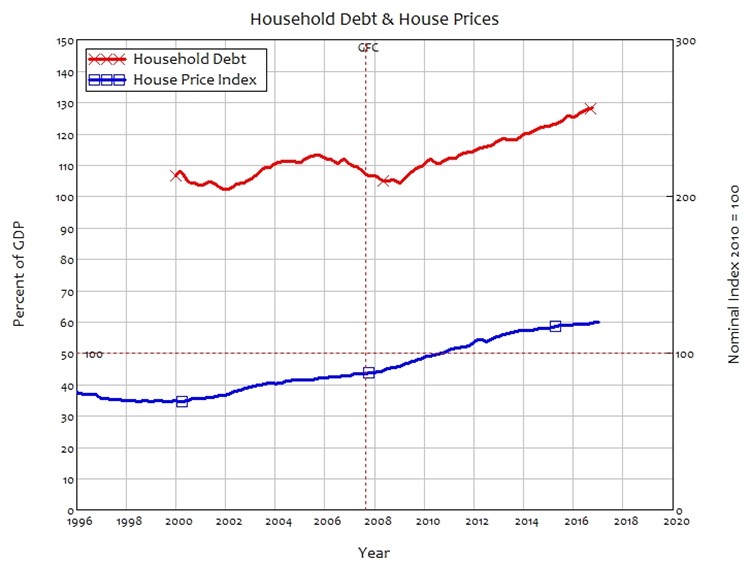

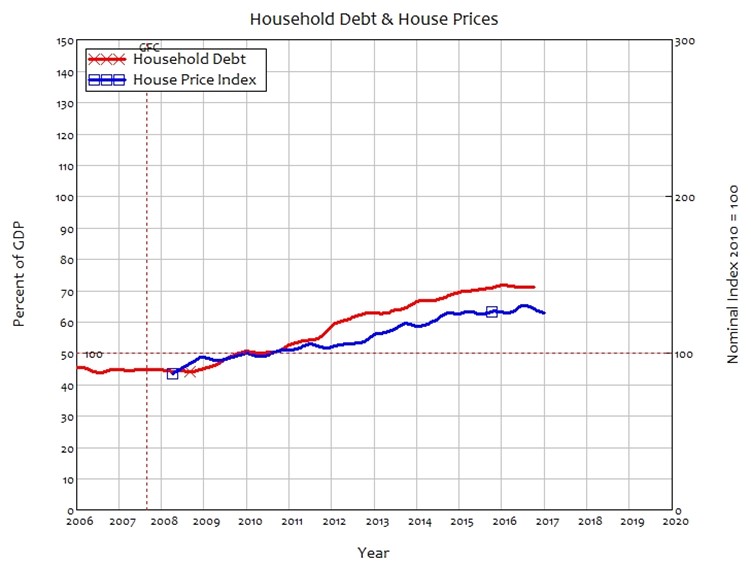

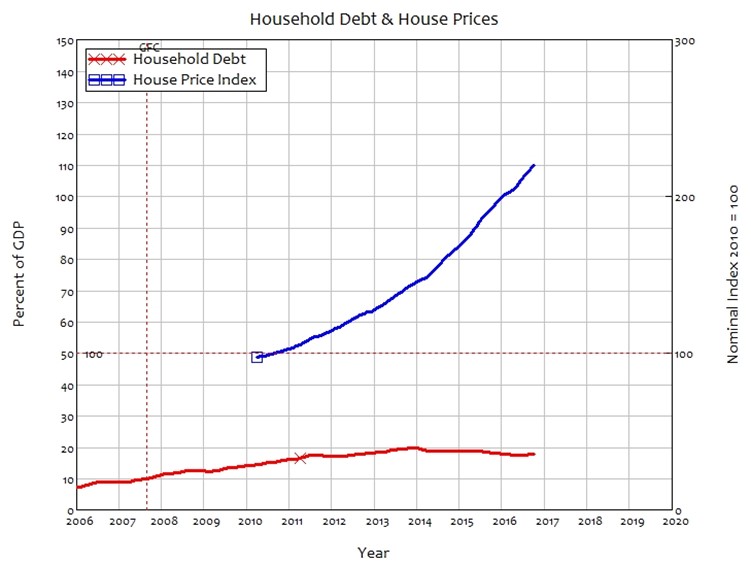

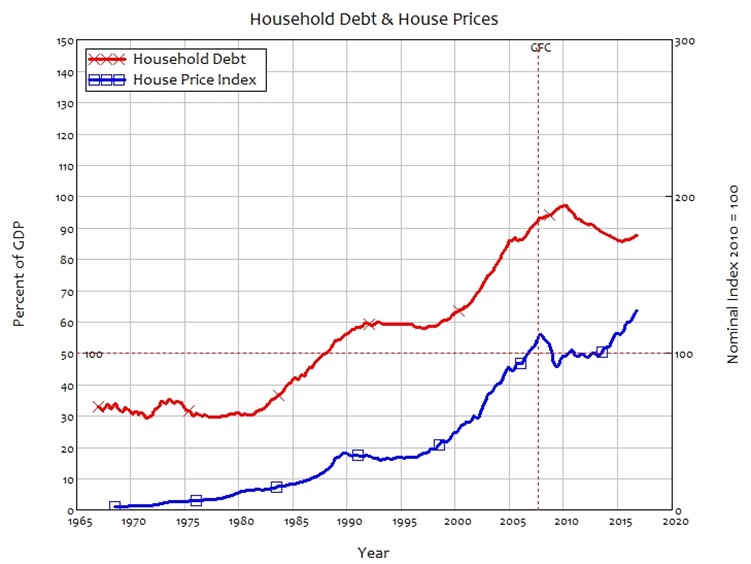

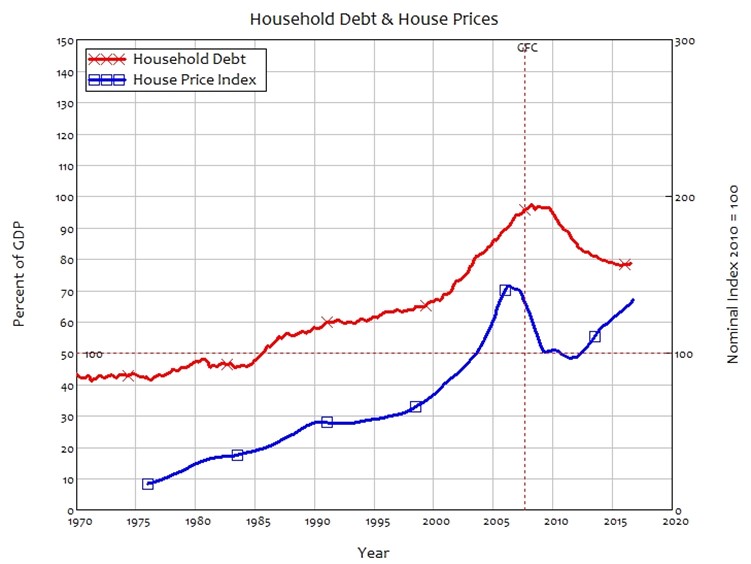

Household Debt and House Prices 147

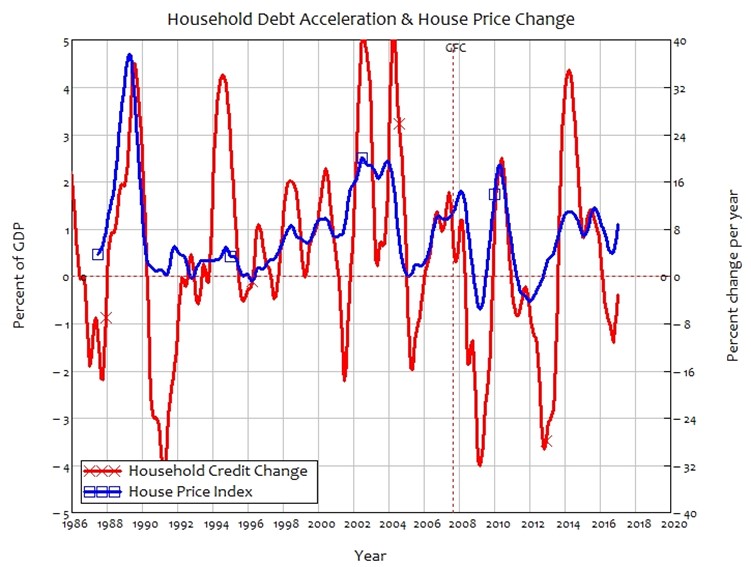

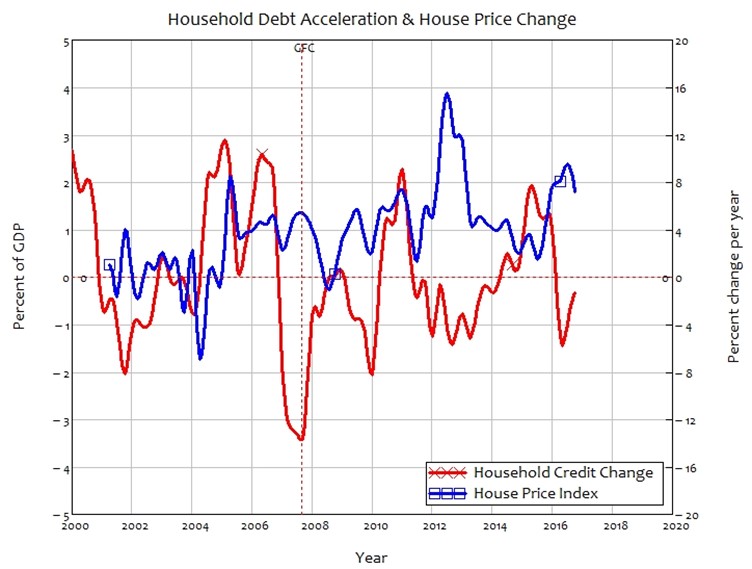

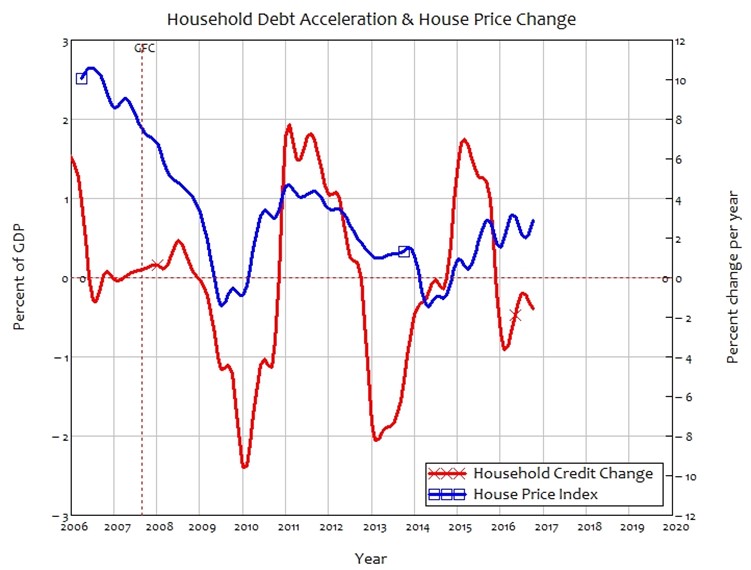

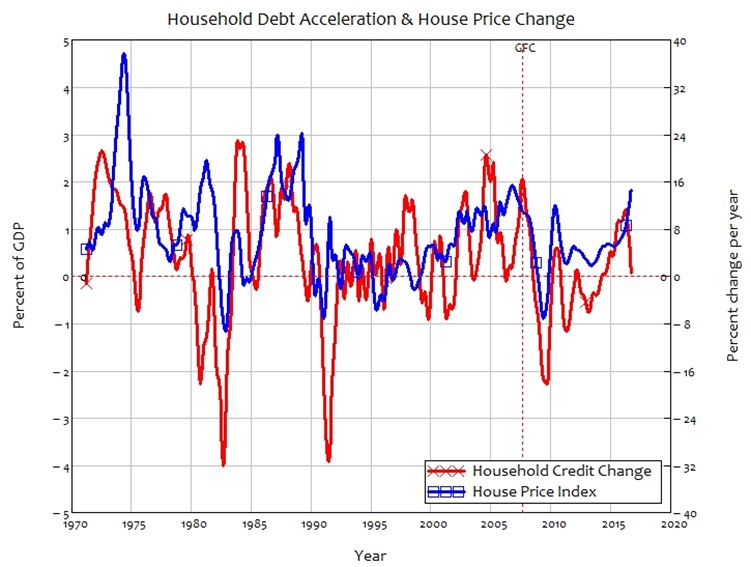

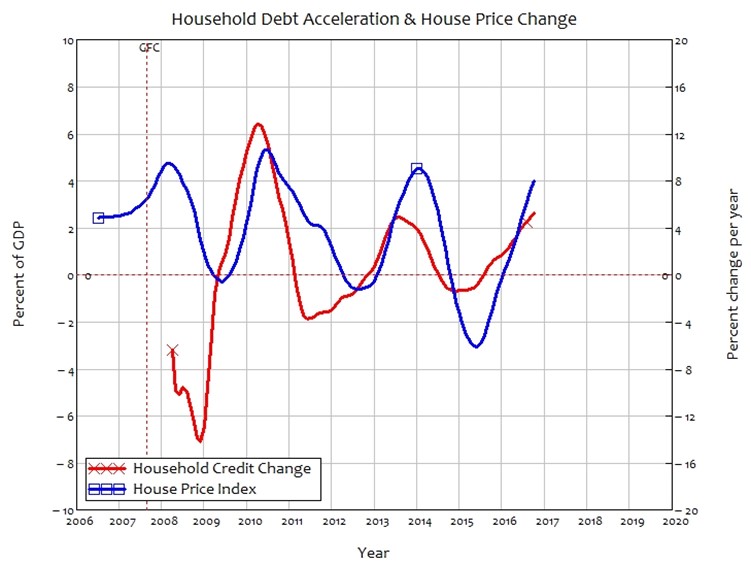

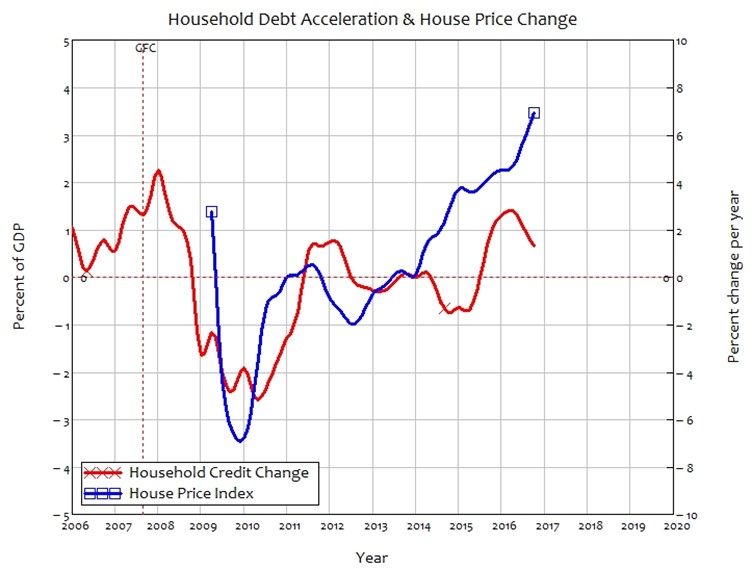

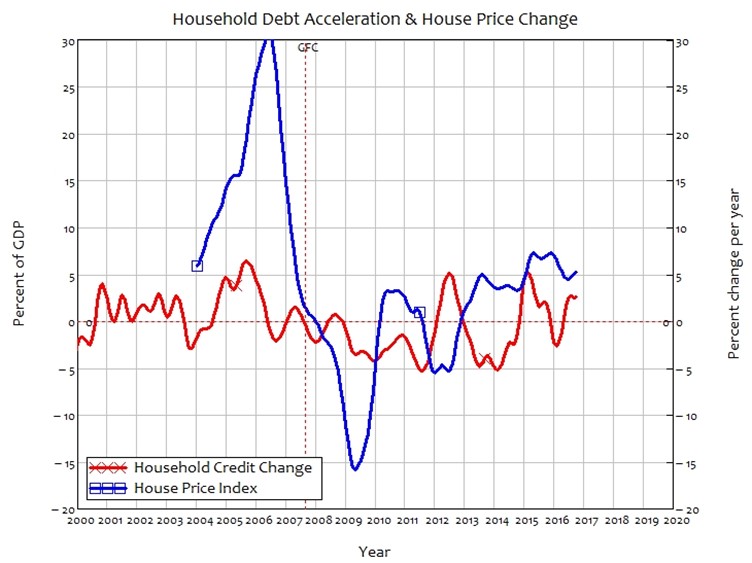

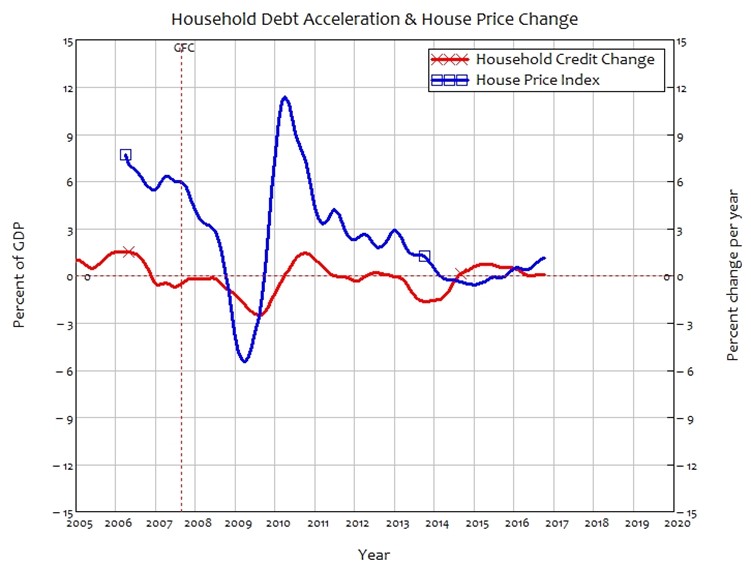

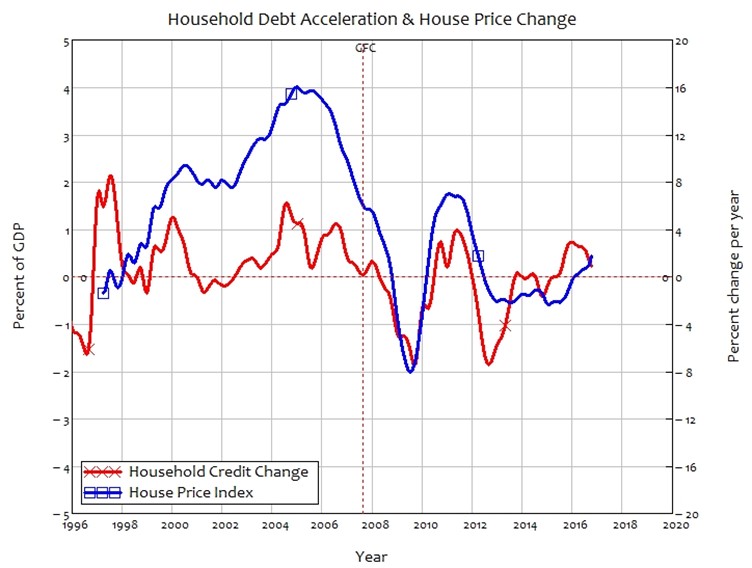

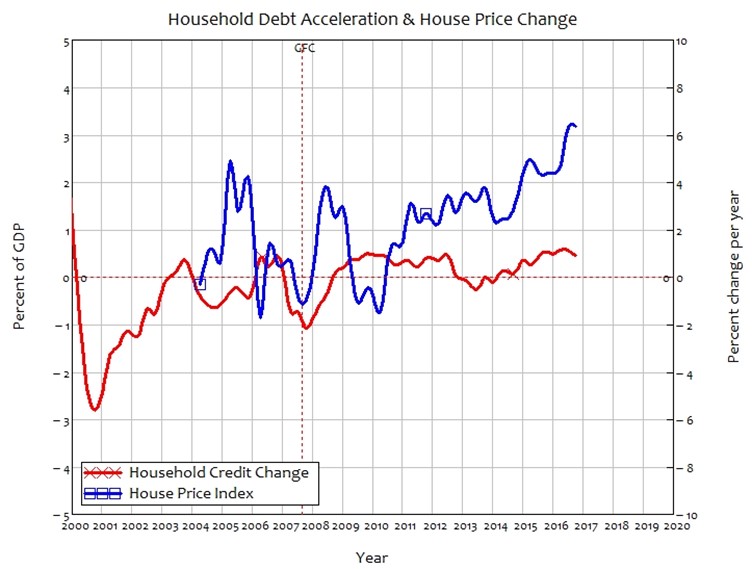

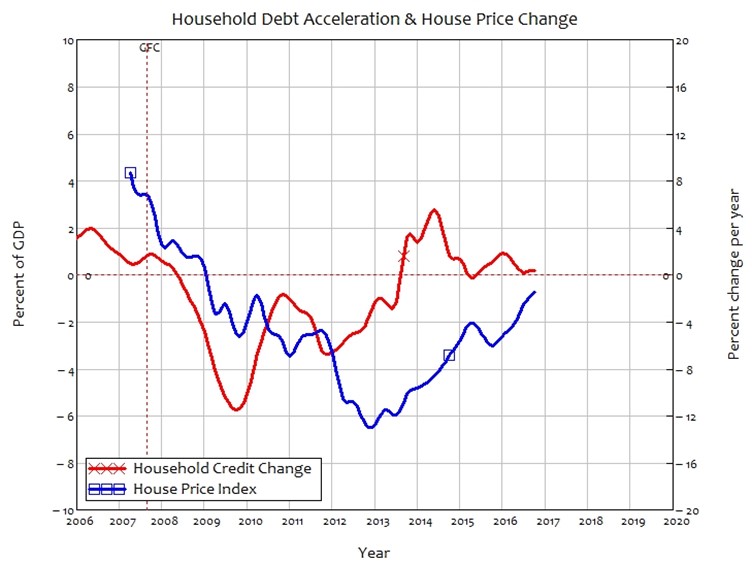

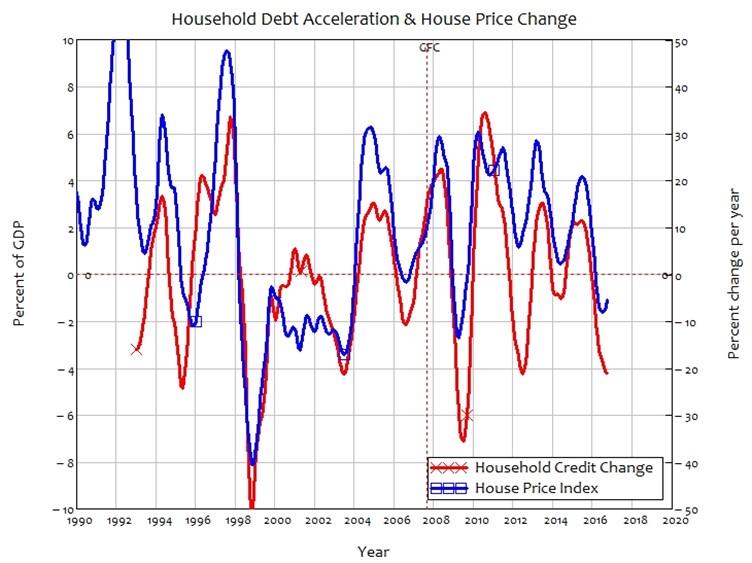

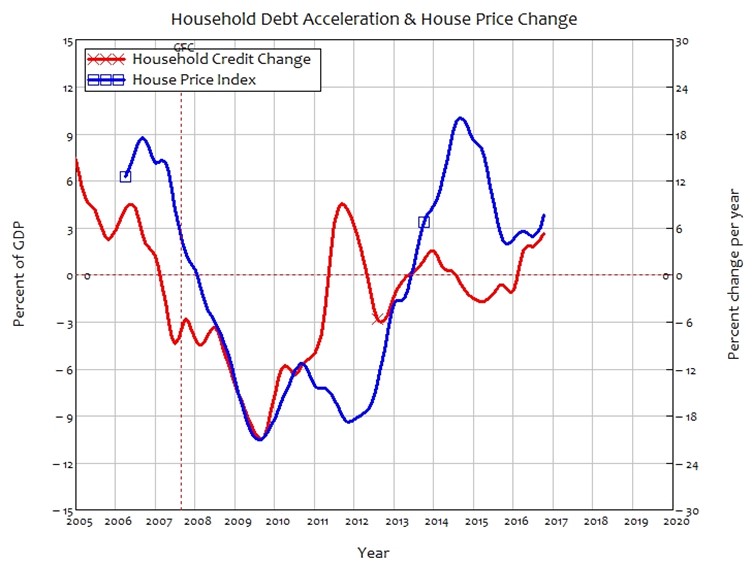

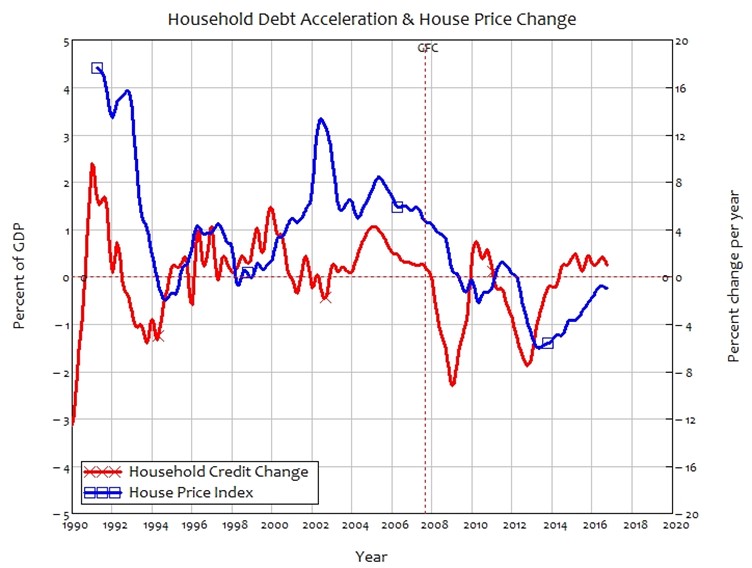

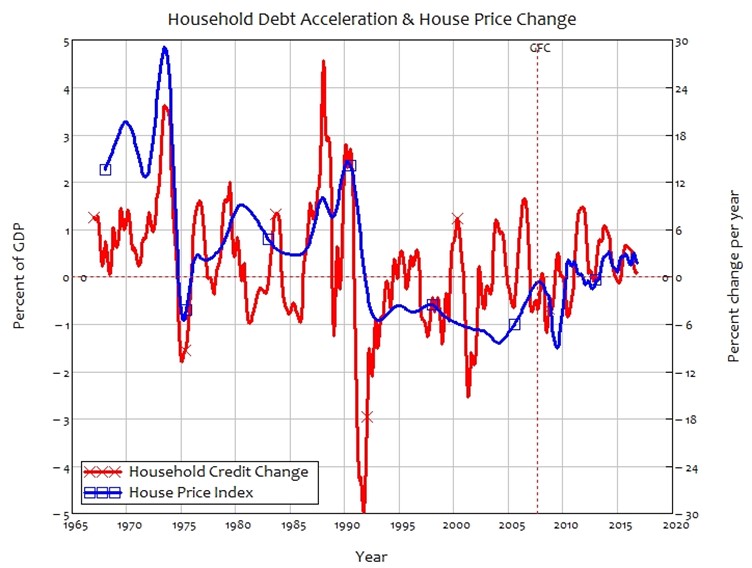

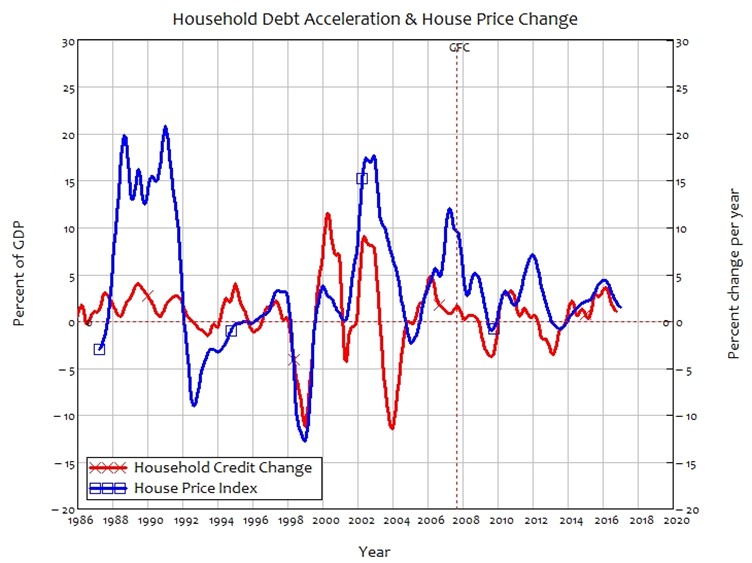

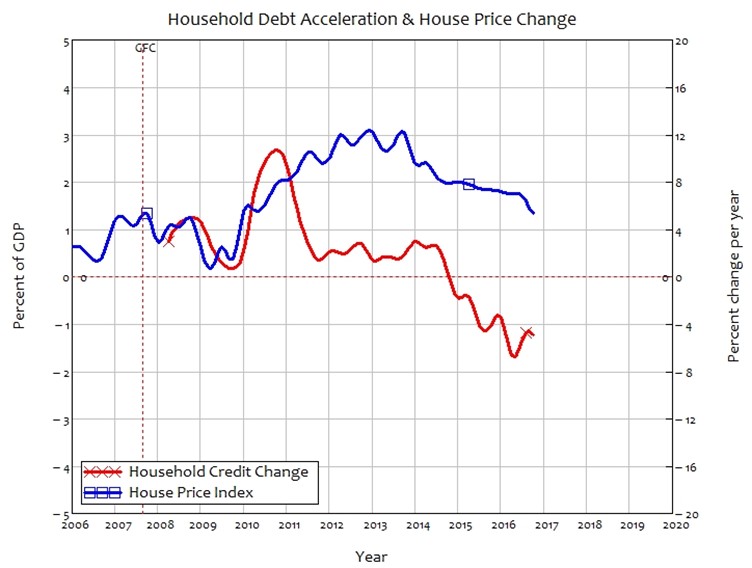

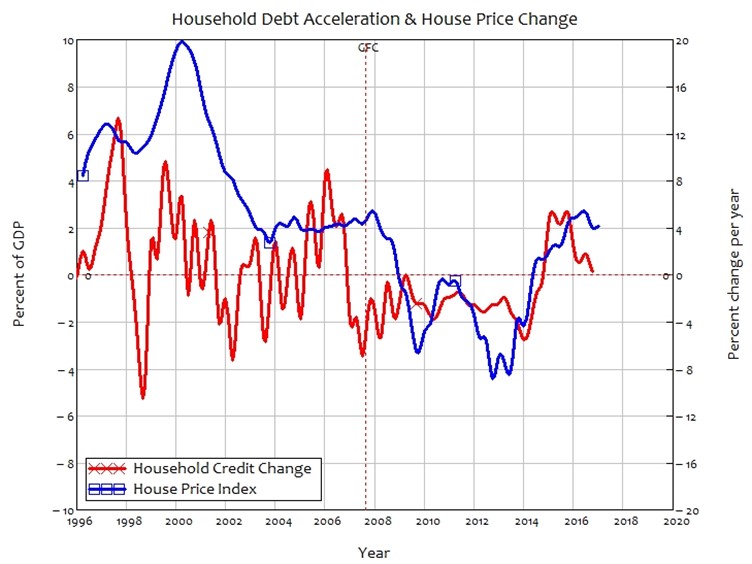

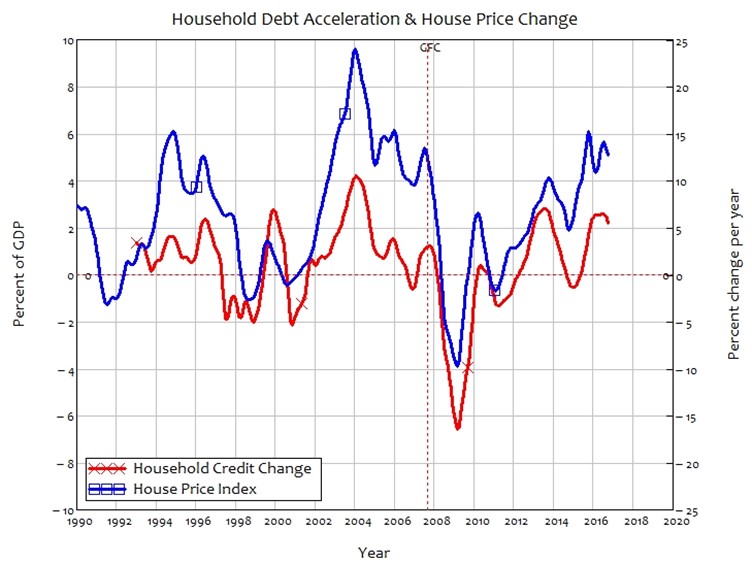

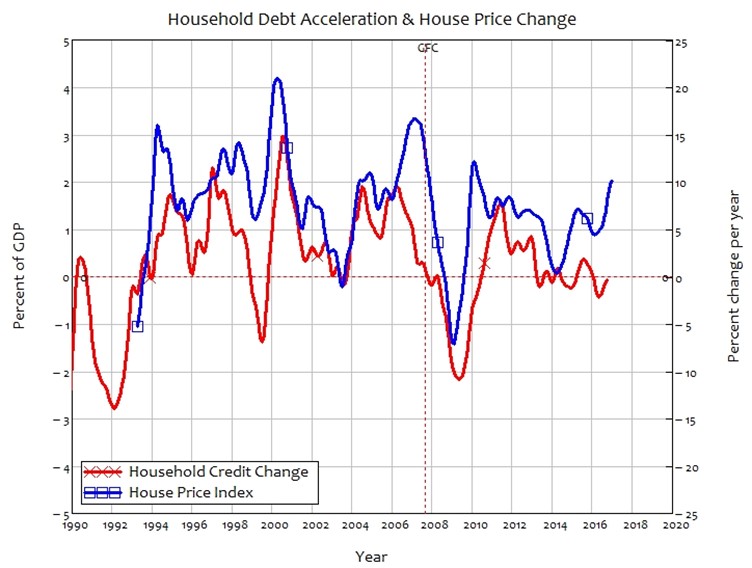

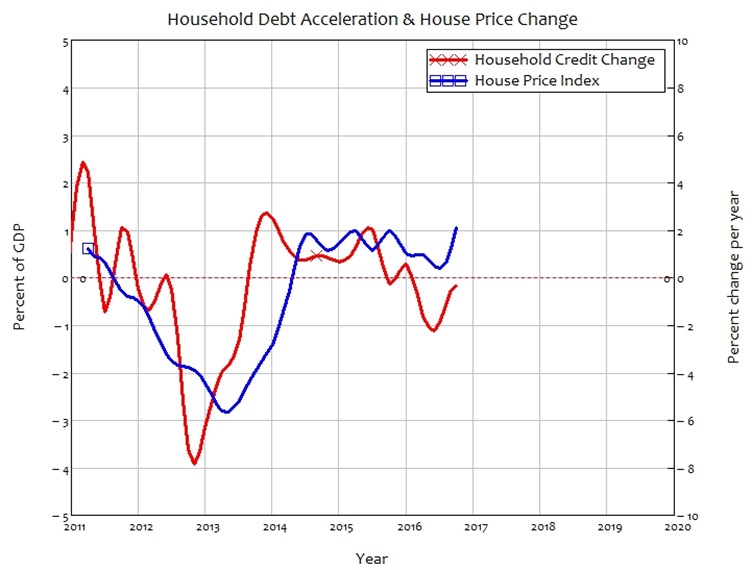

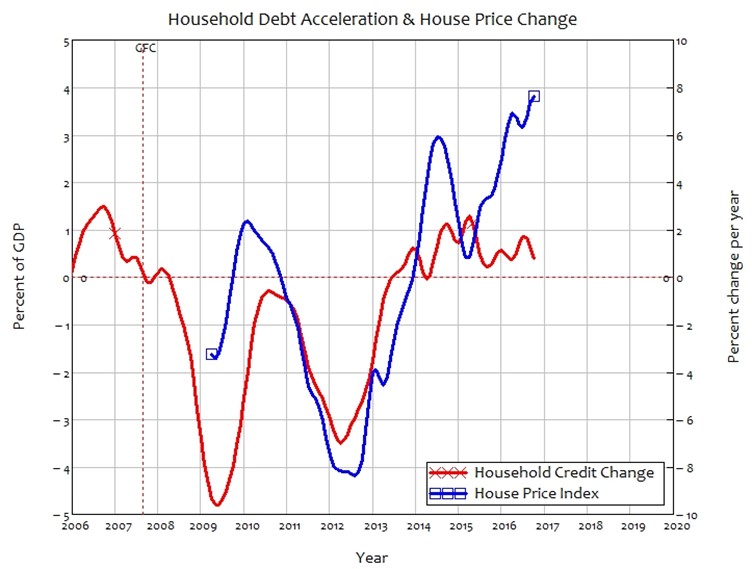

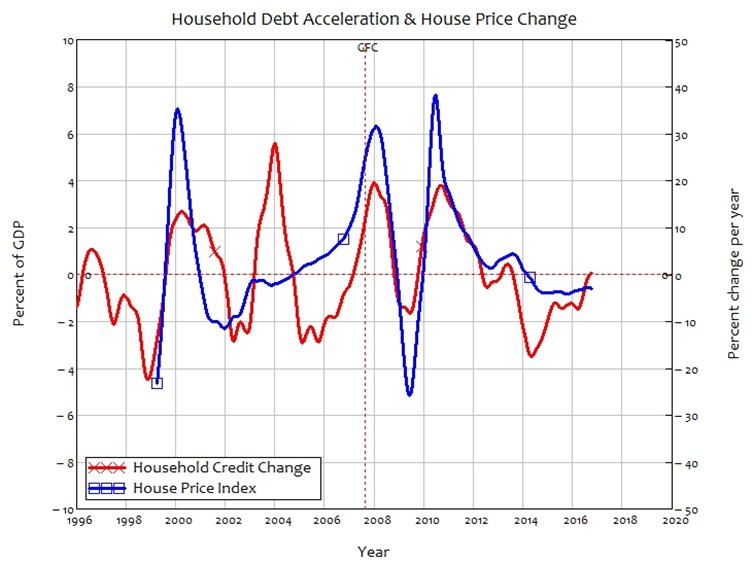

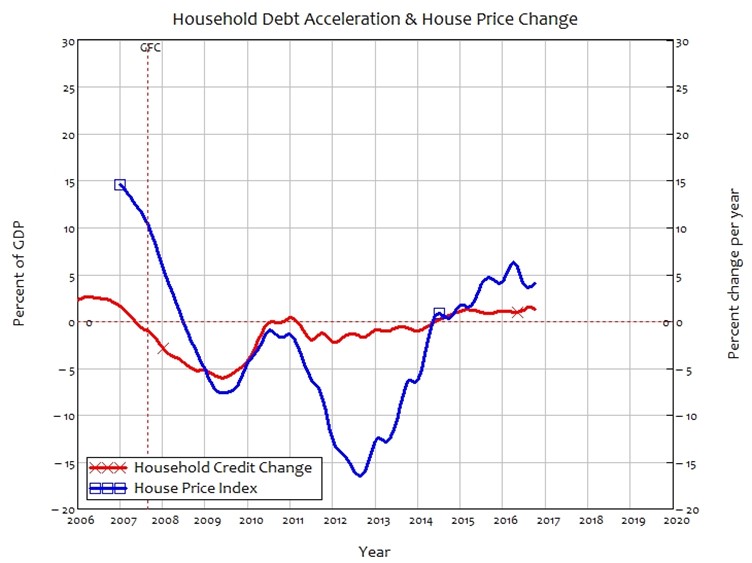

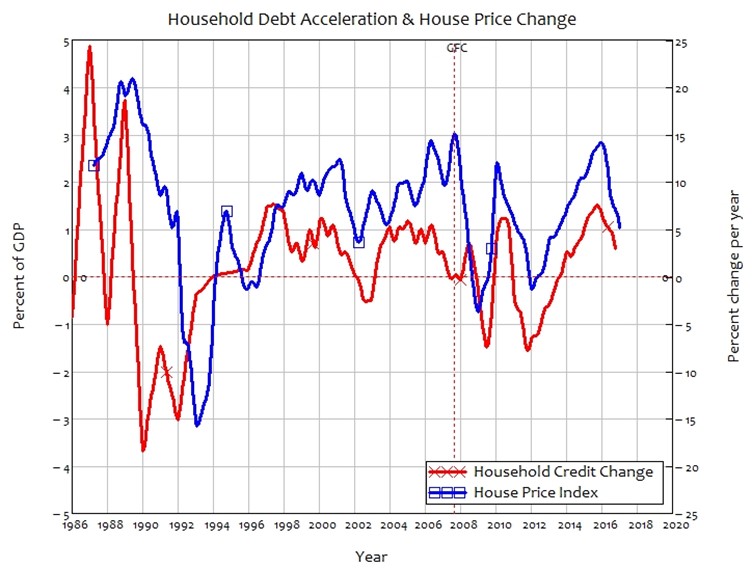

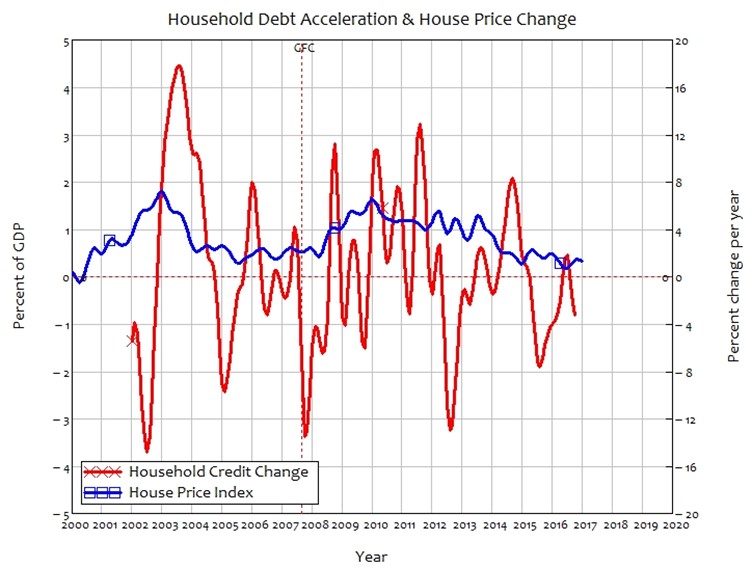

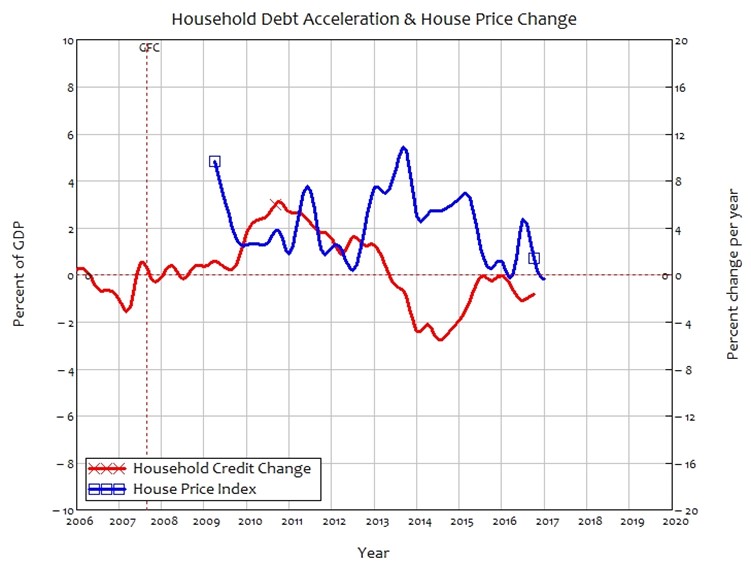

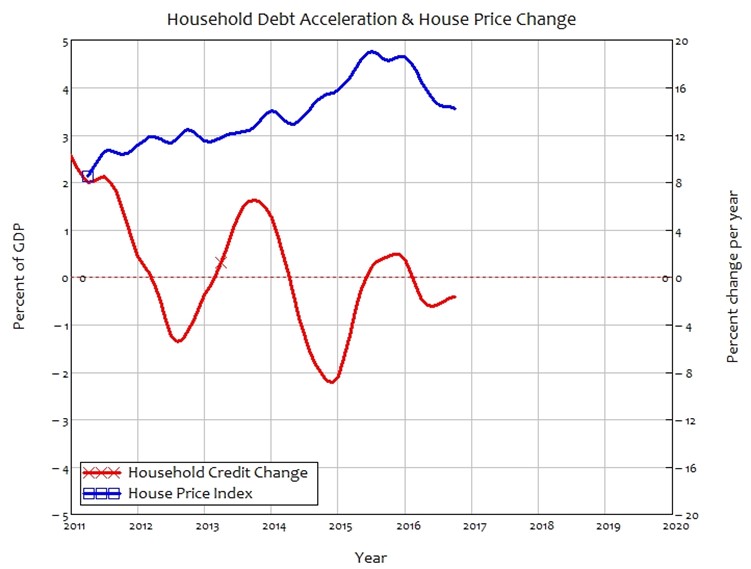

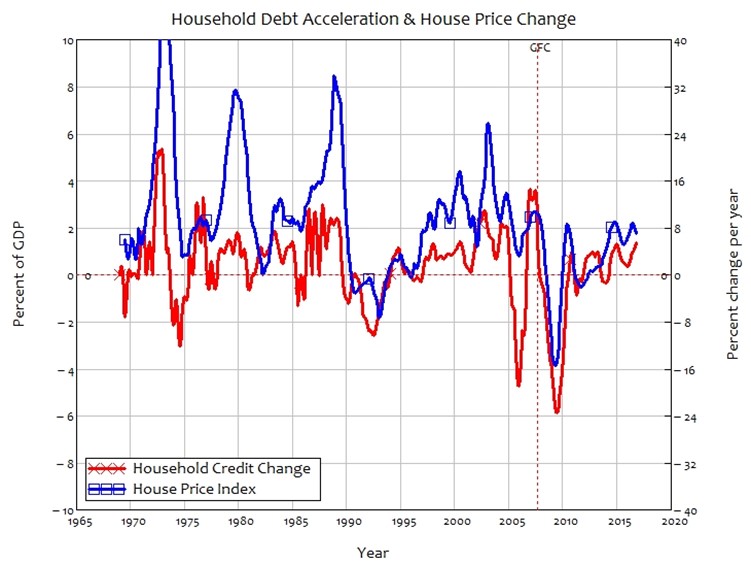

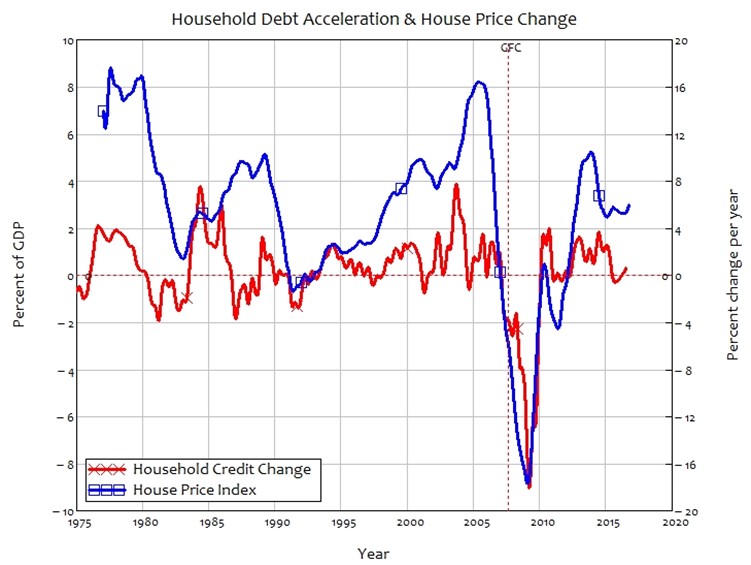

Change in Household Credit and Change in House Prices 178

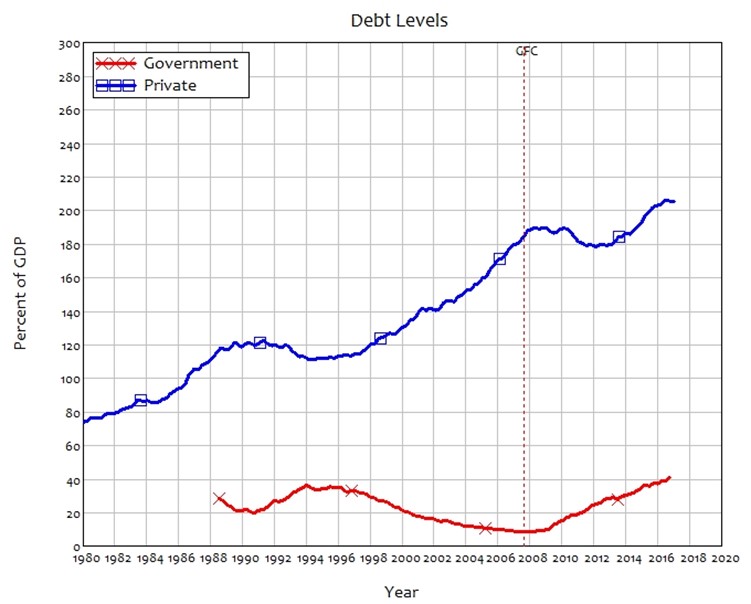

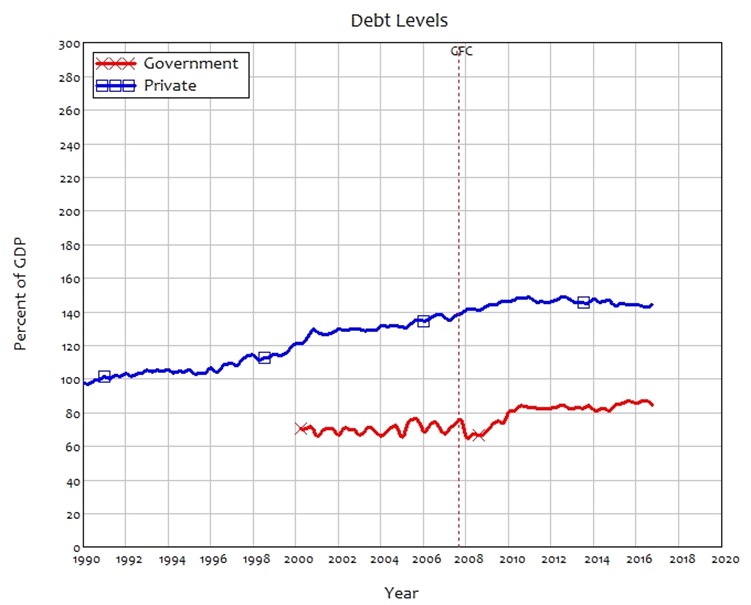

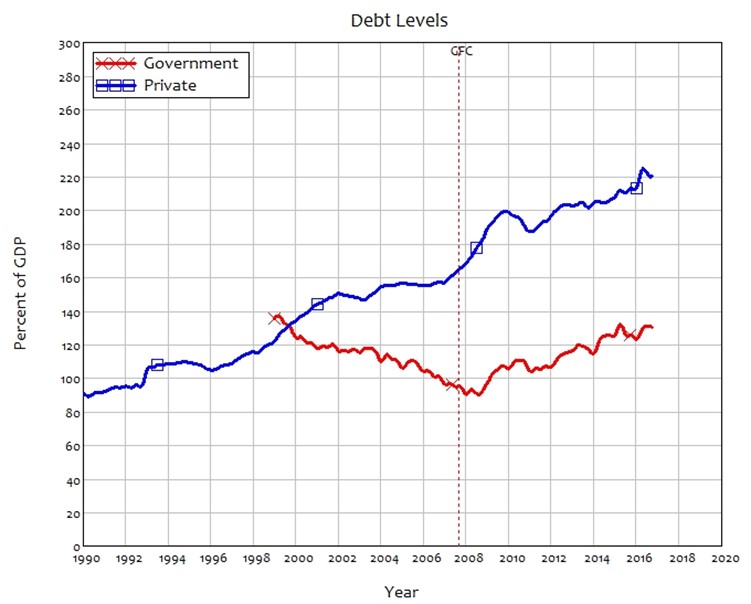

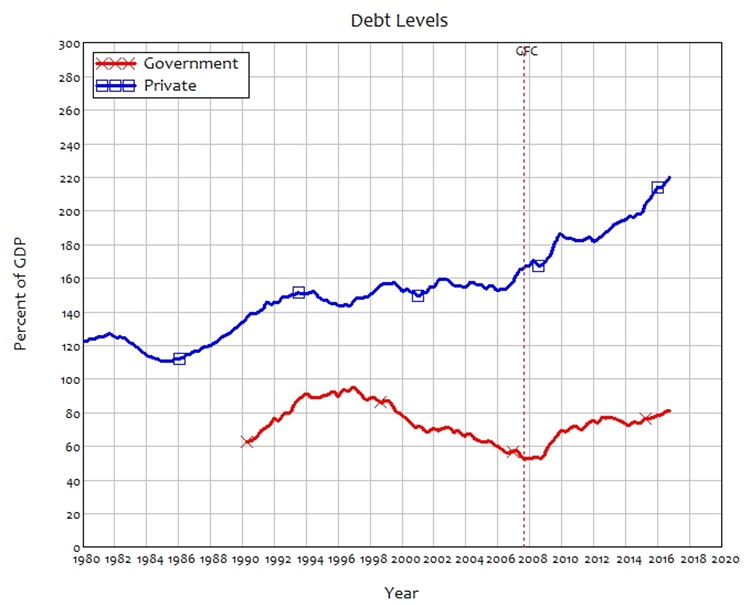

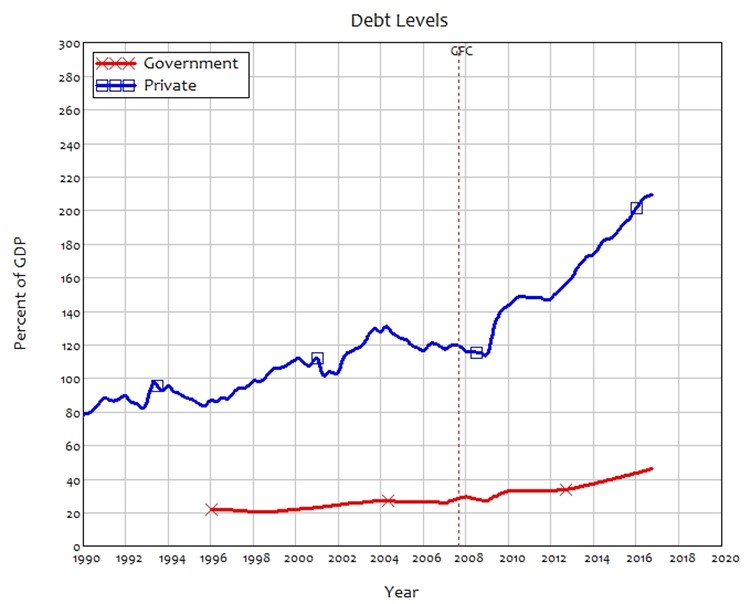

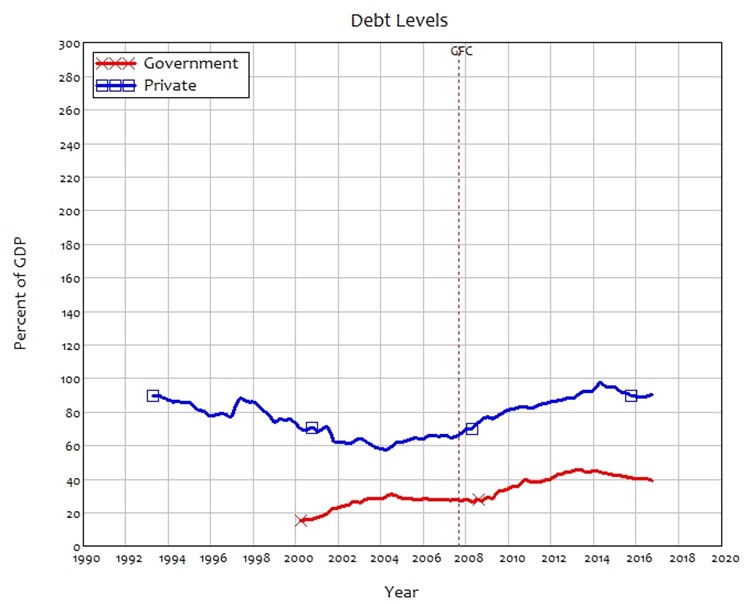

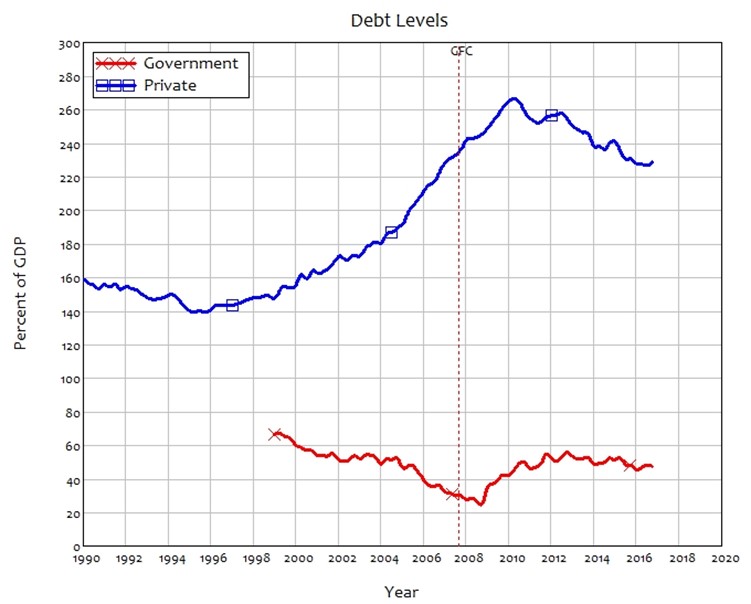

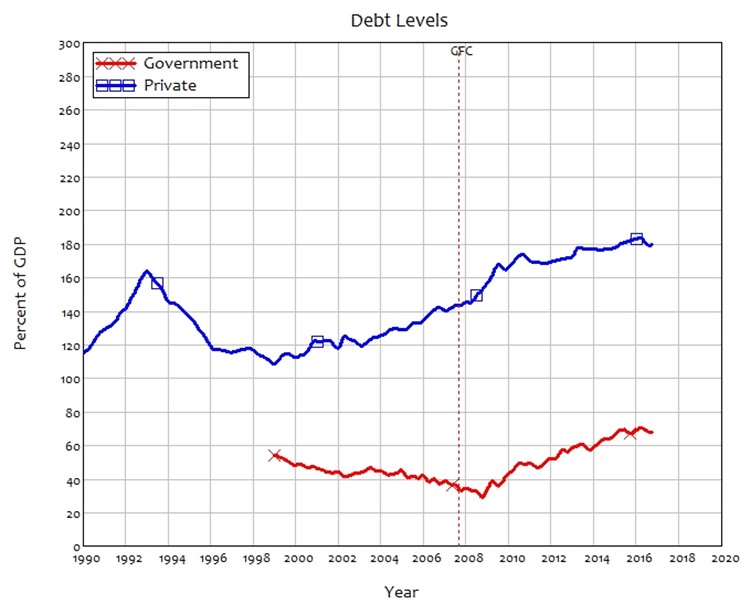

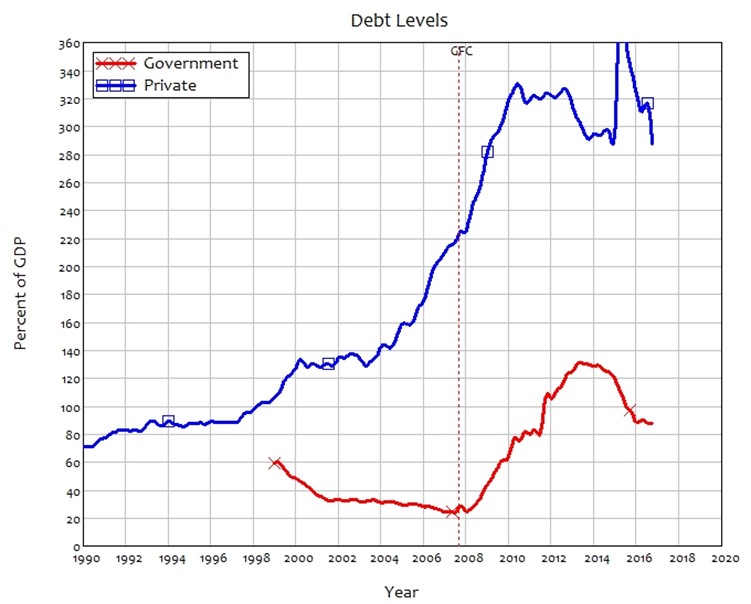

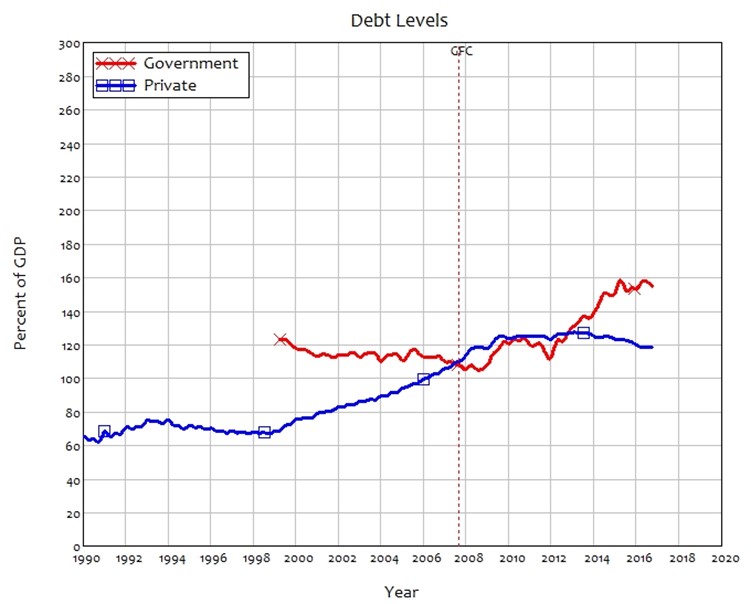

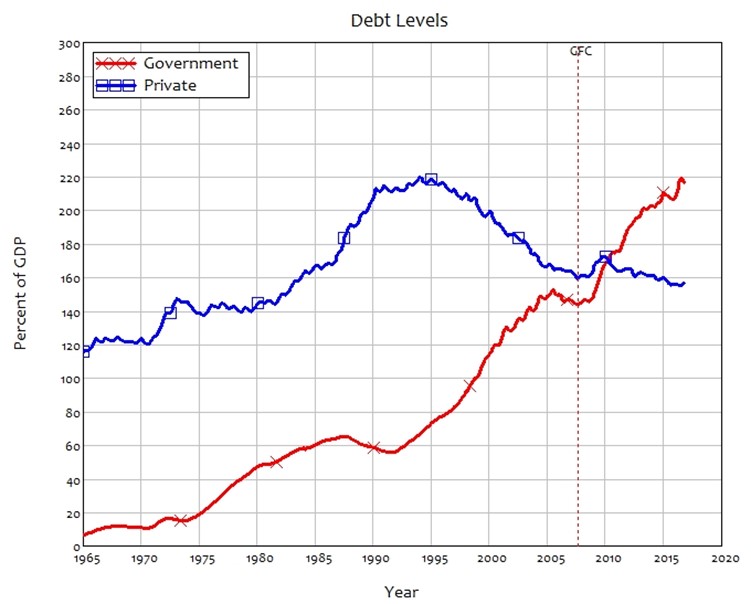

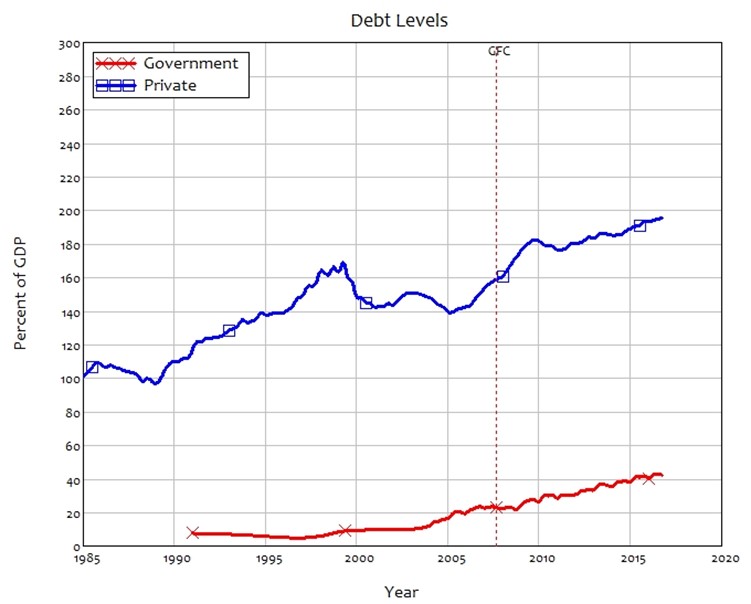

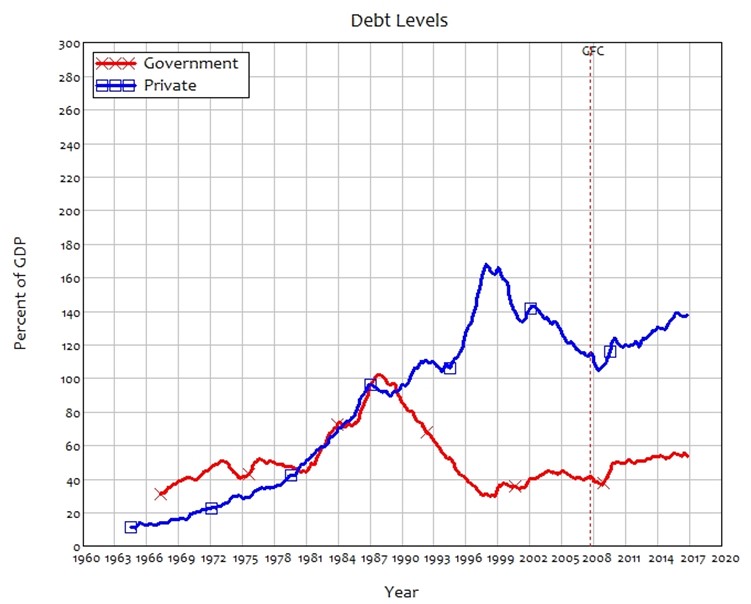

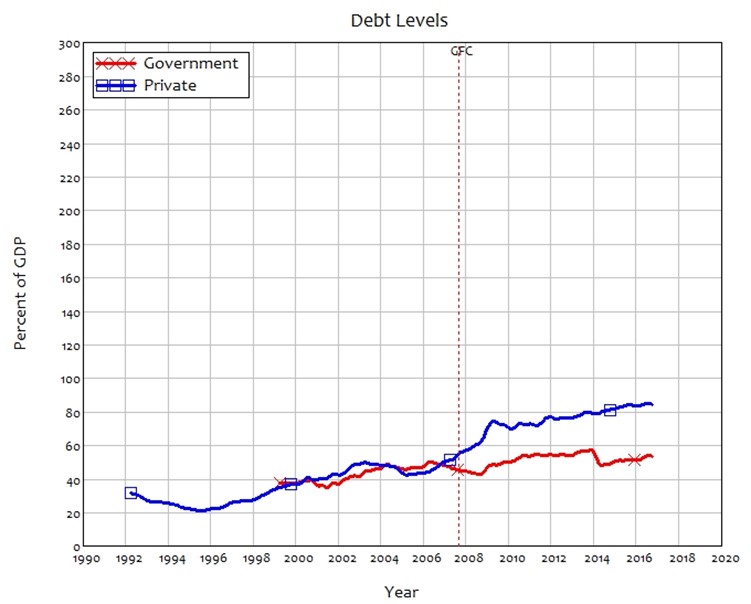

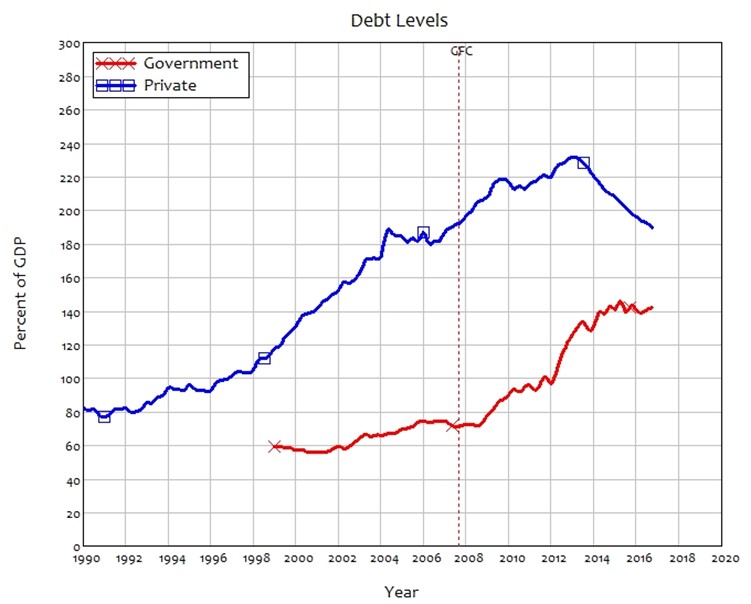

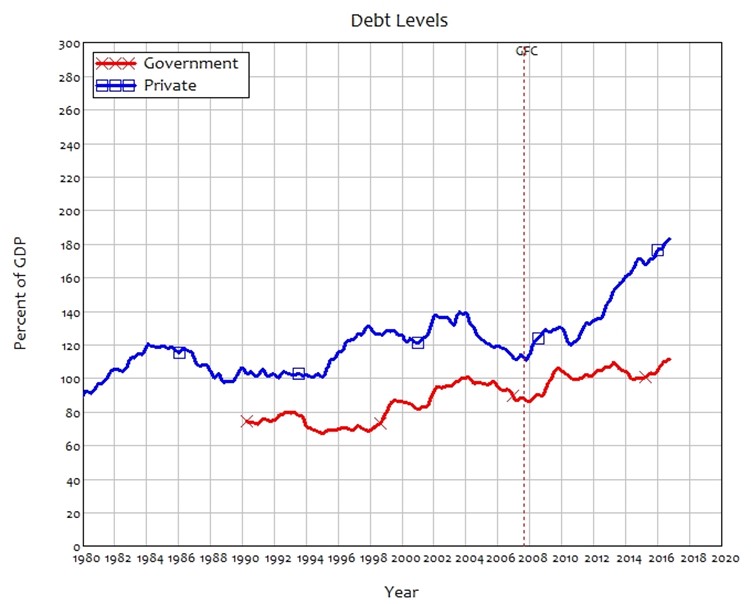

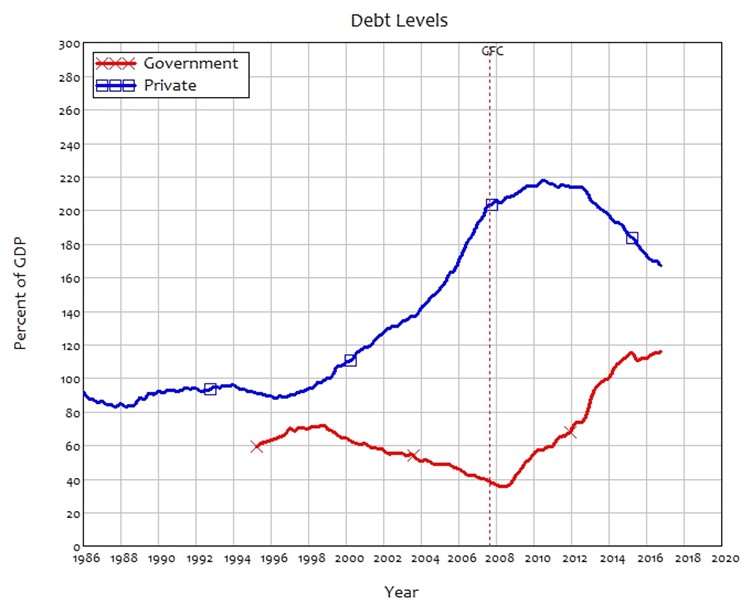

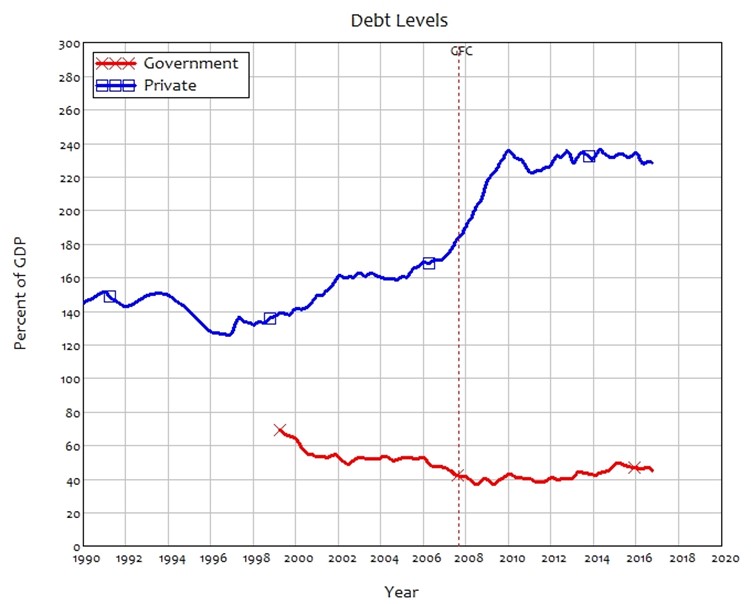

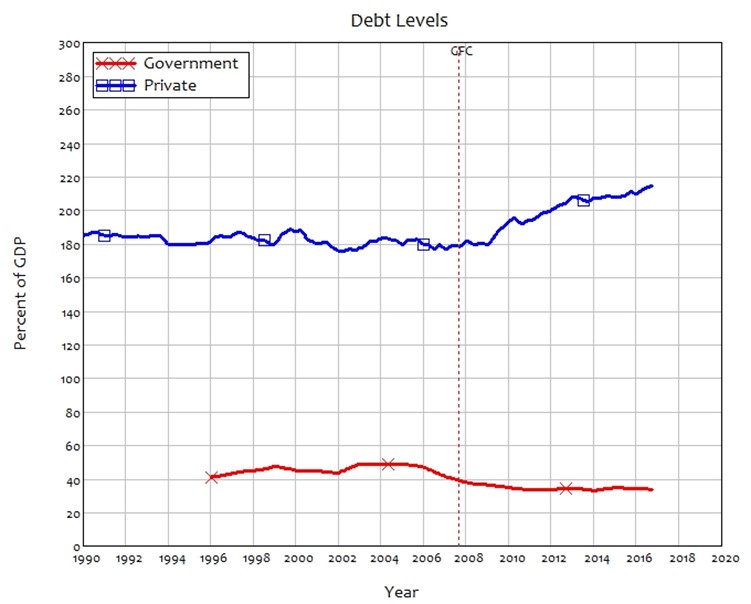

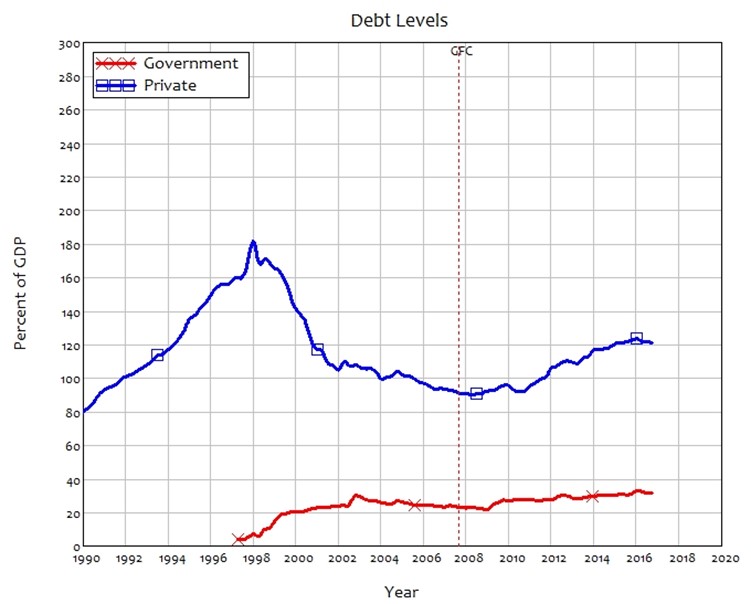

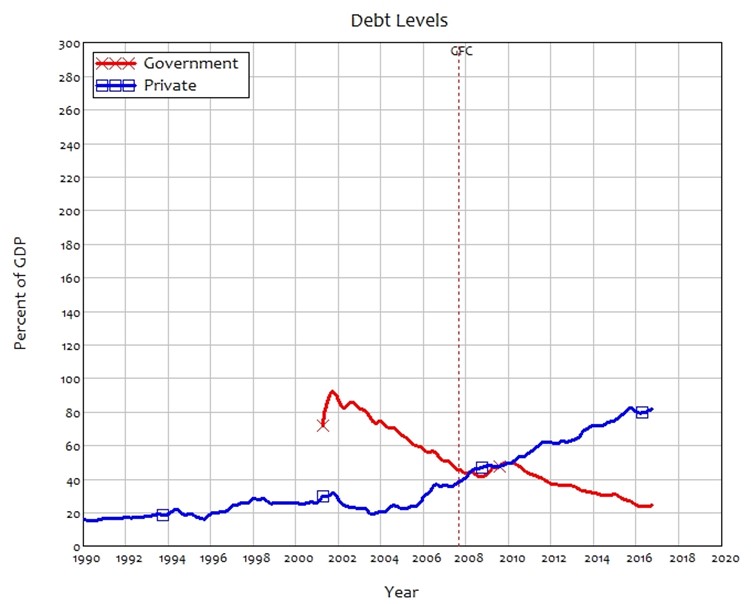

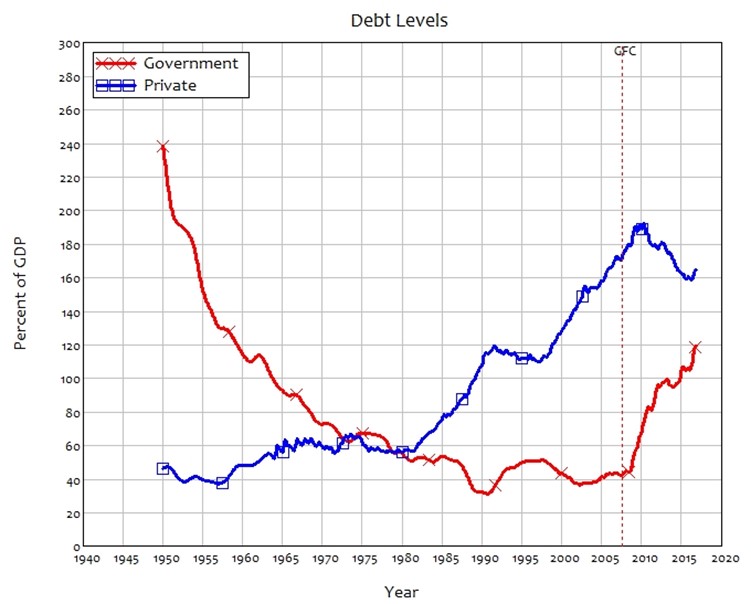

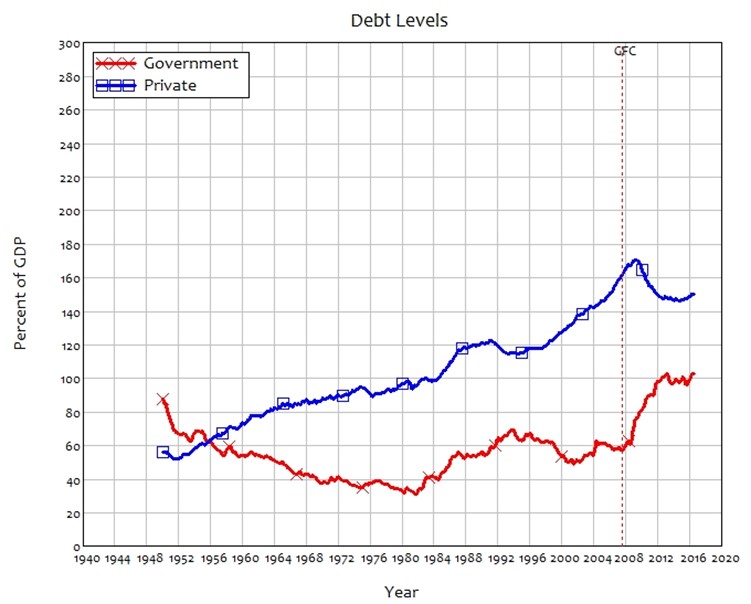

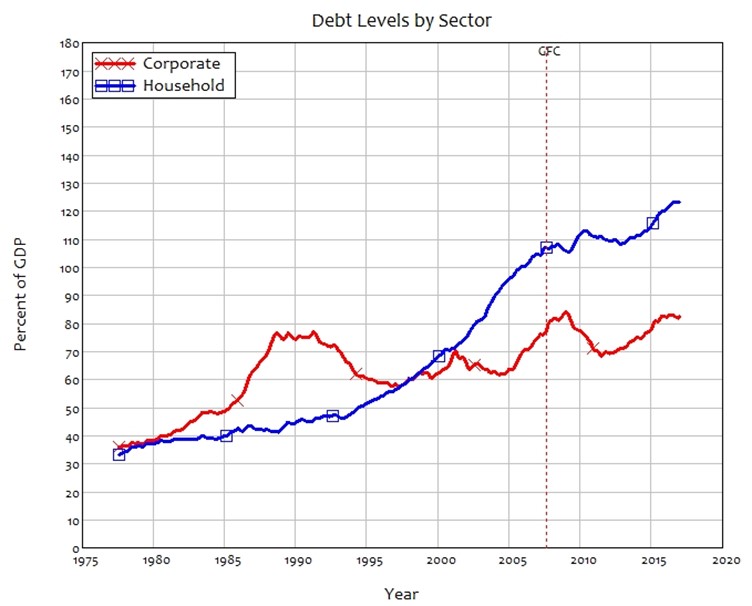

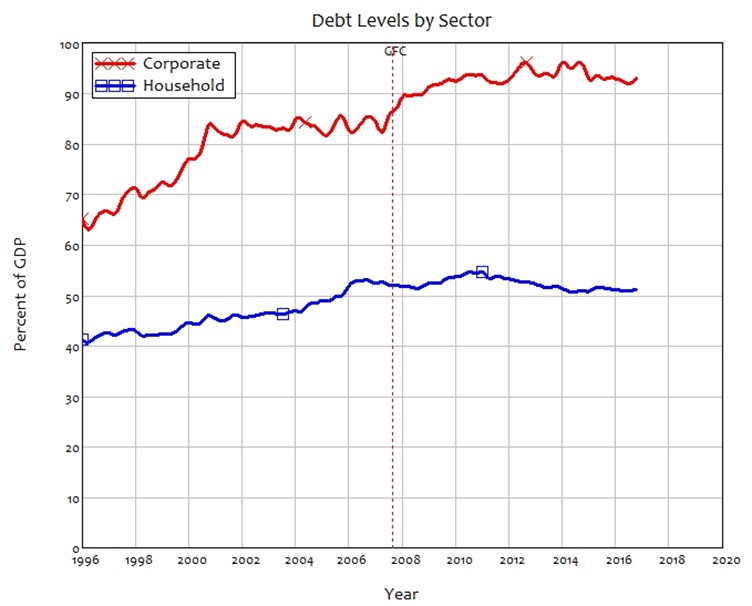

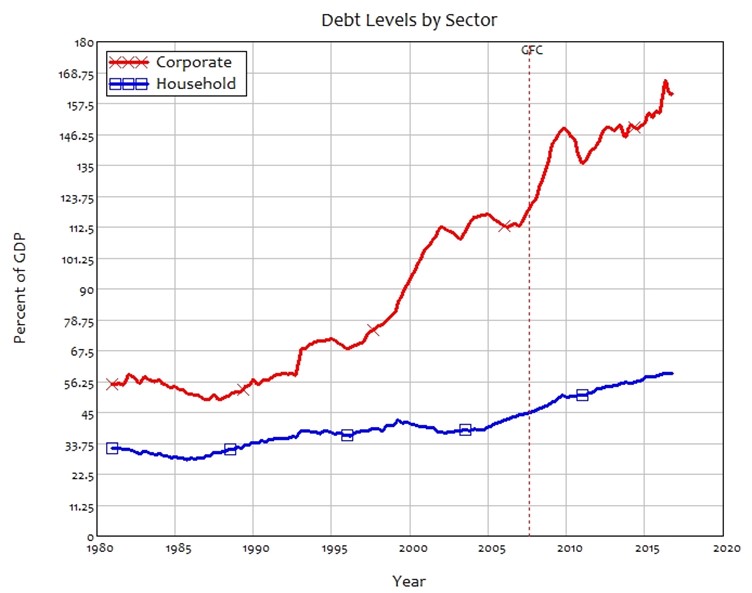

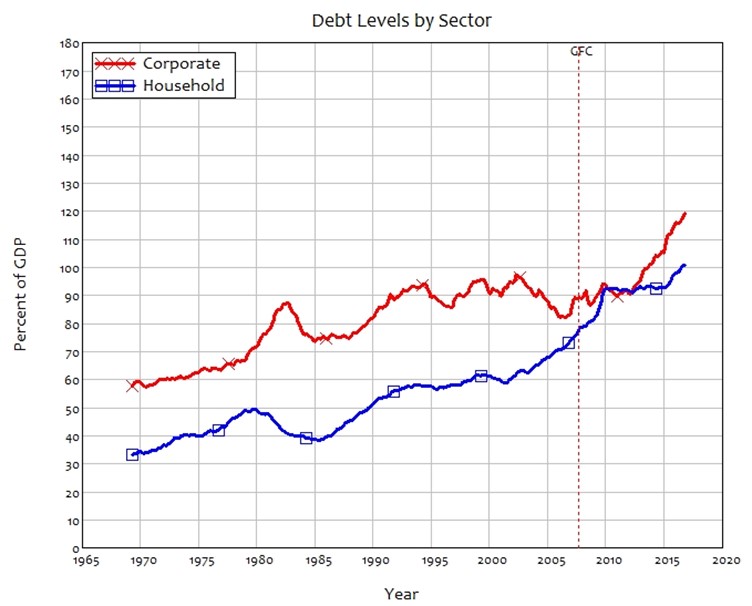

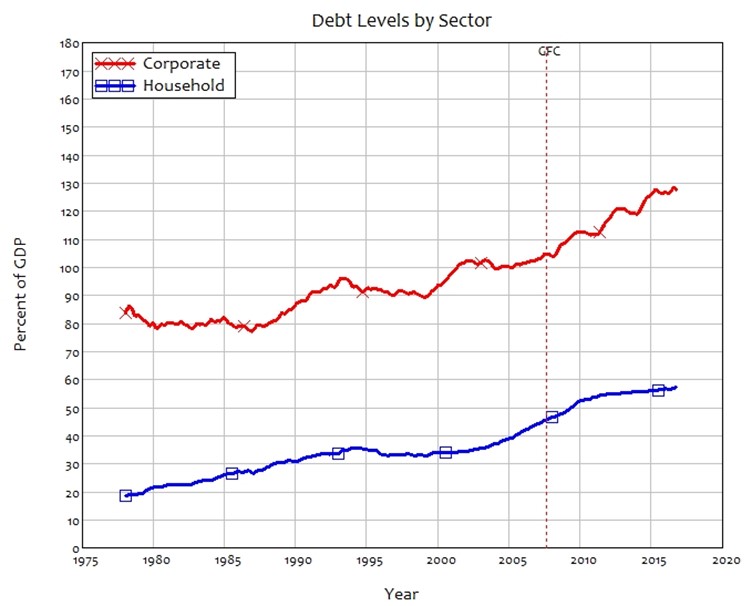

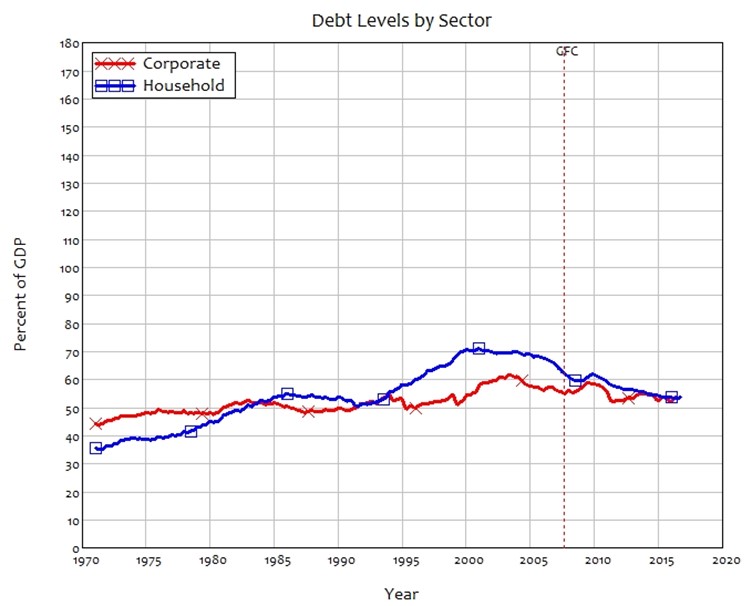

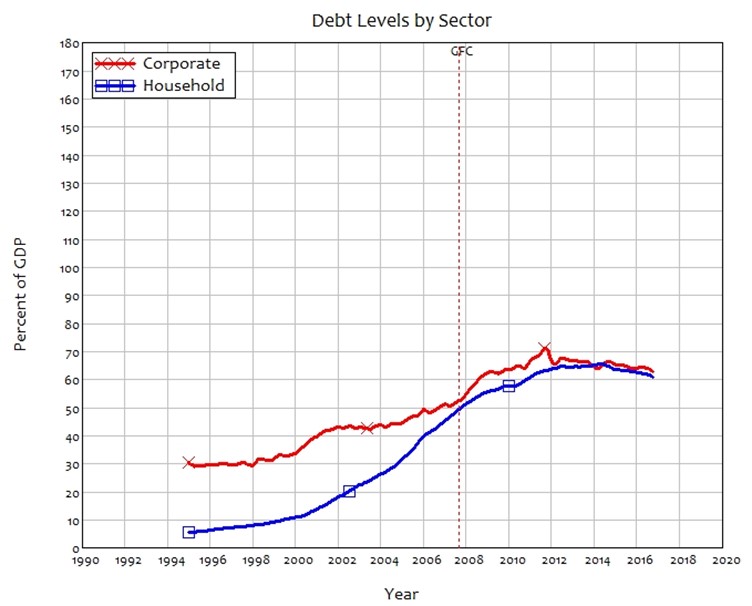

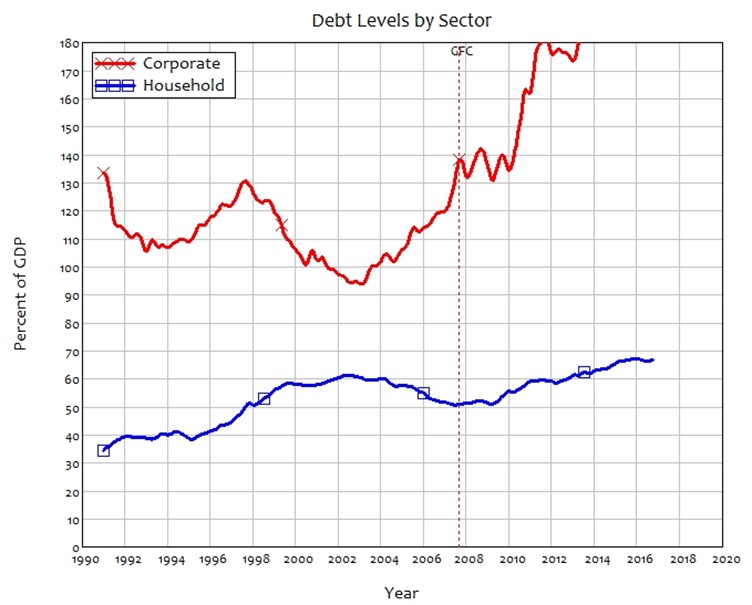

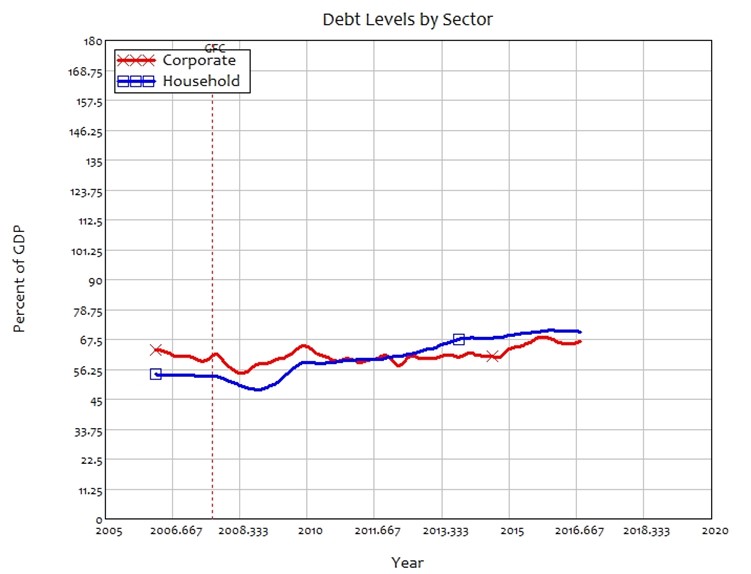

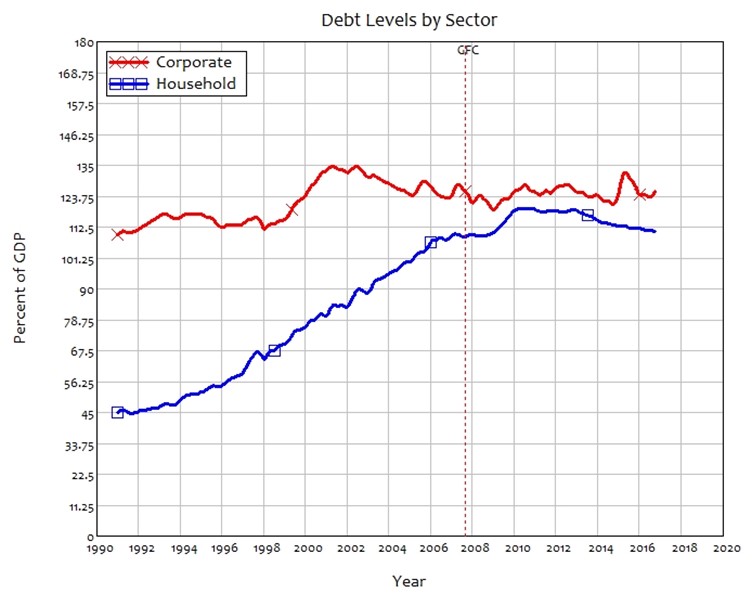

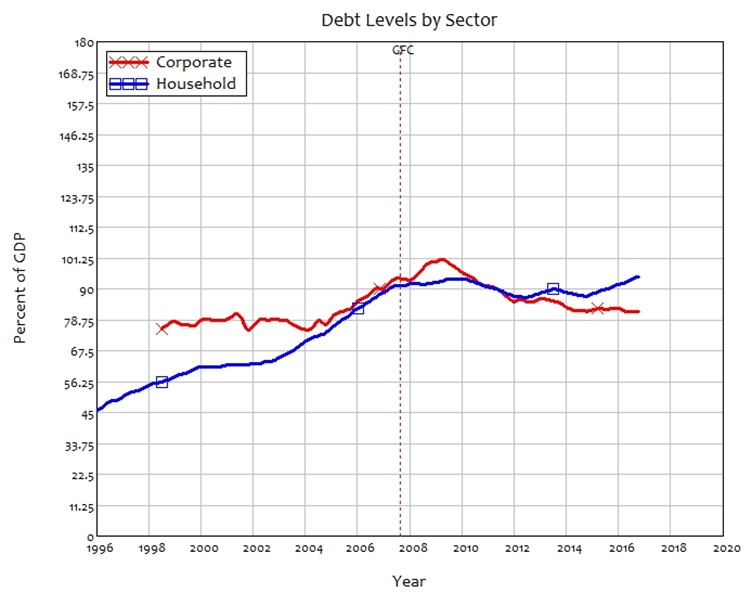

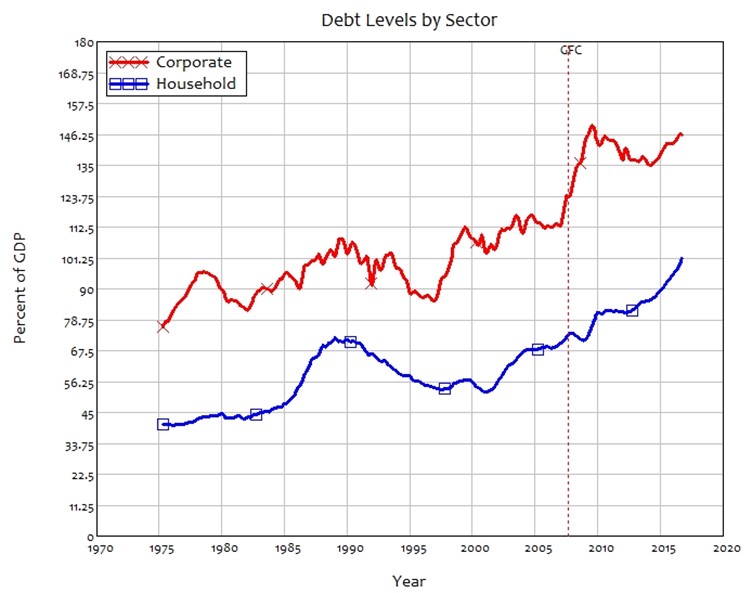

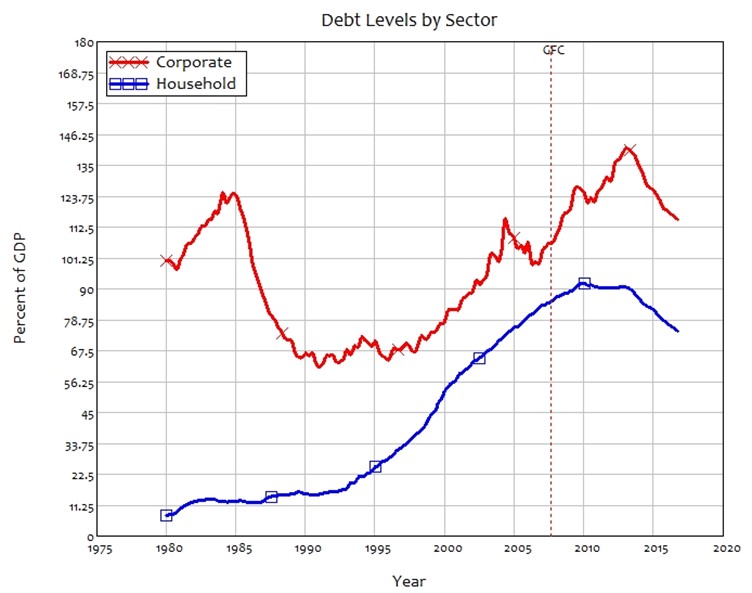

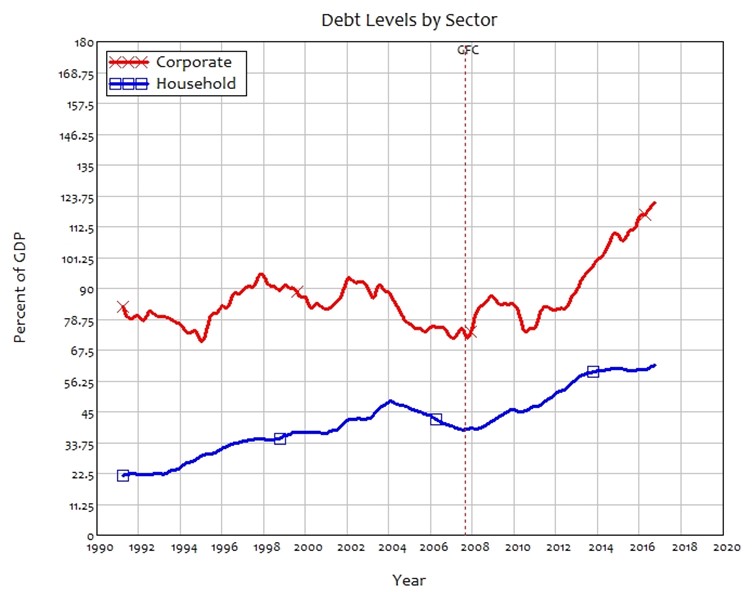

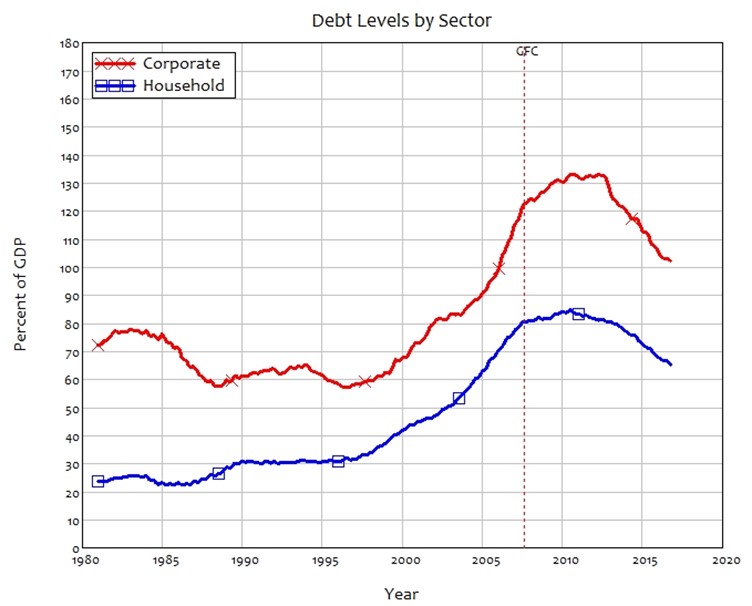

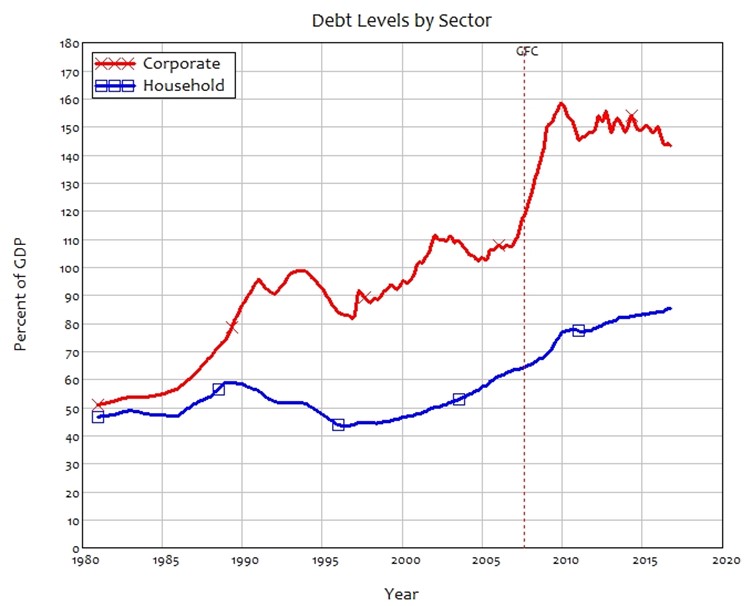

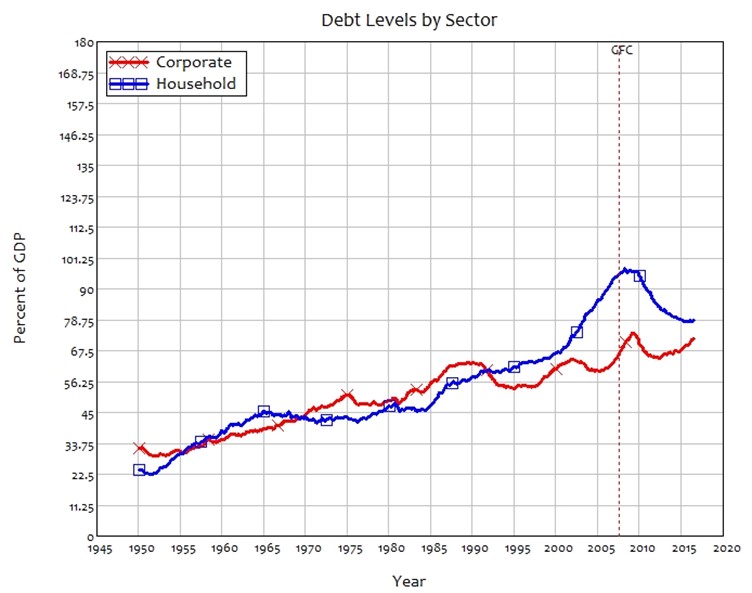

Government and Private Debt Levels

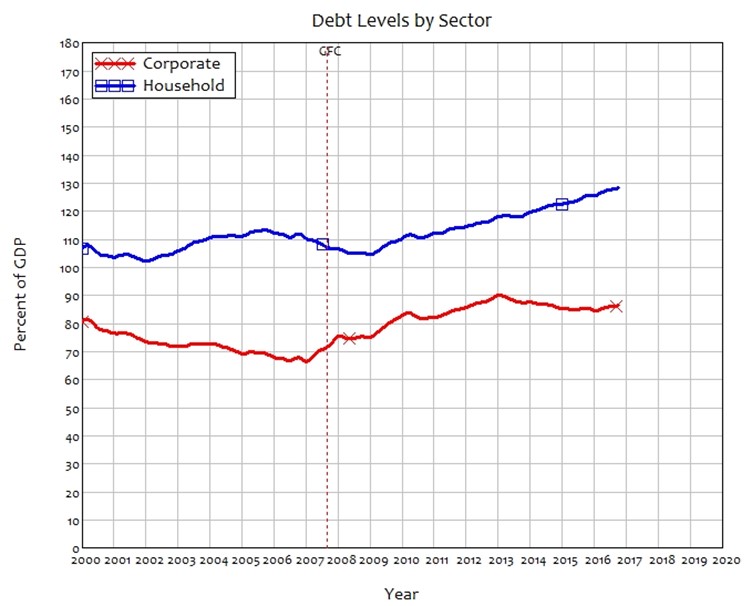

Australia

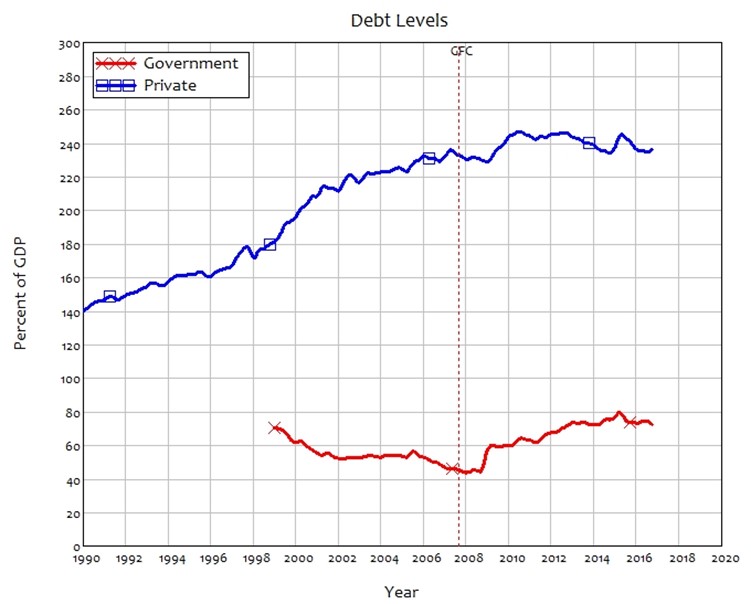

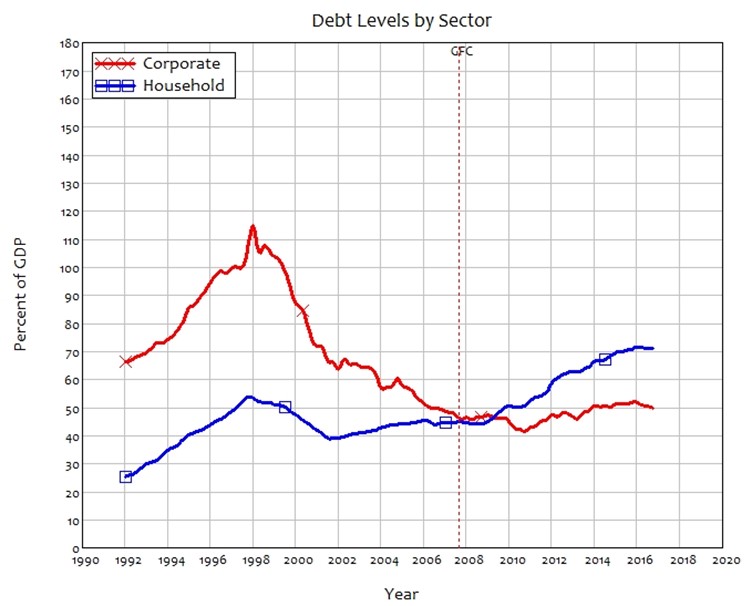

Austria

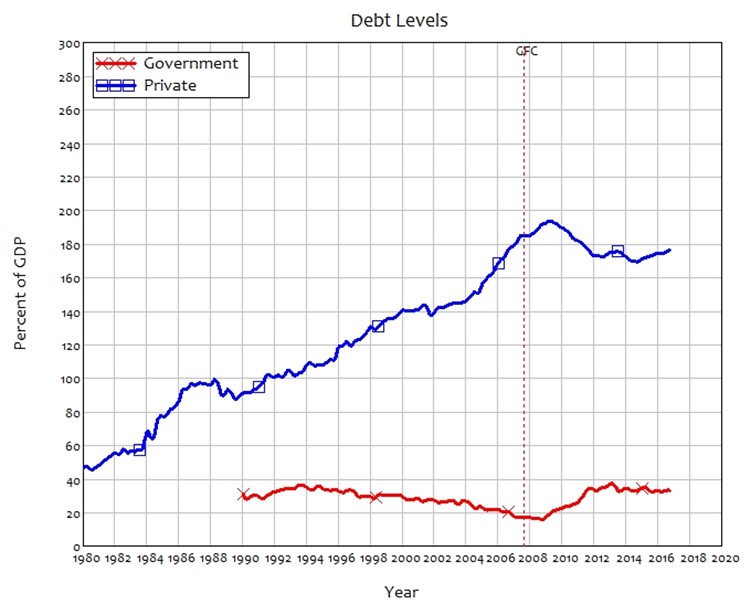

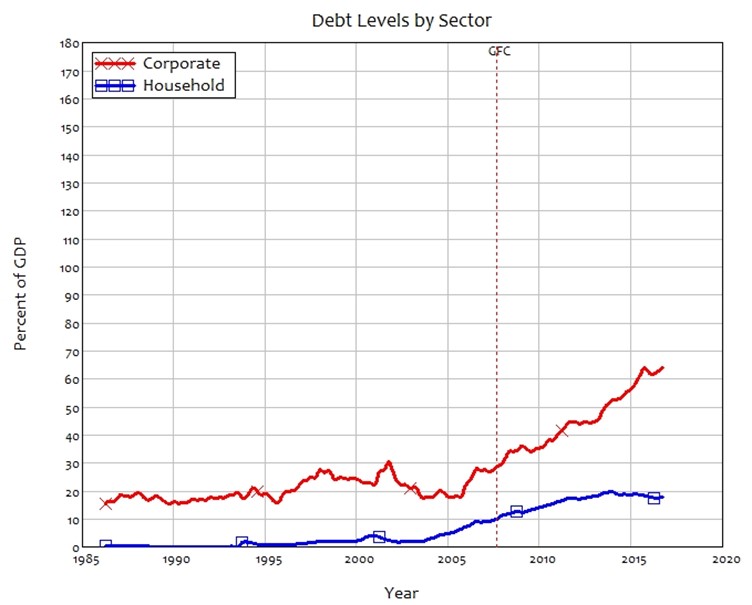

Belgium

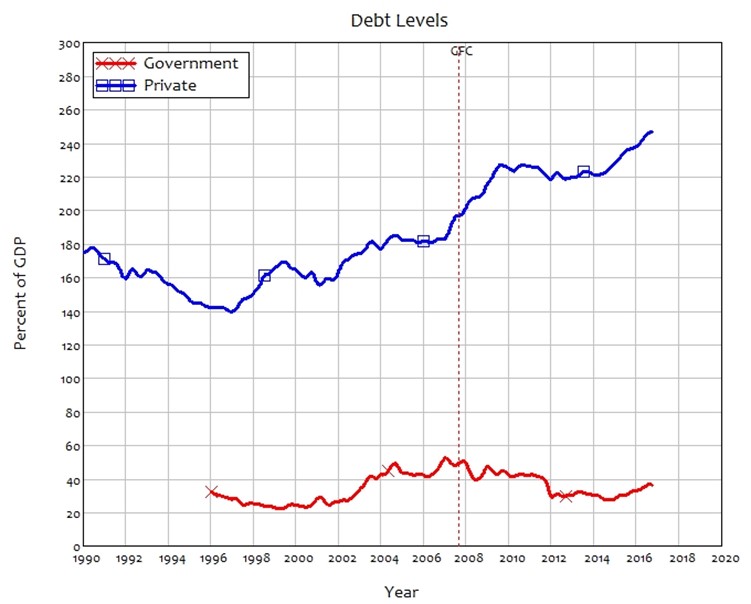

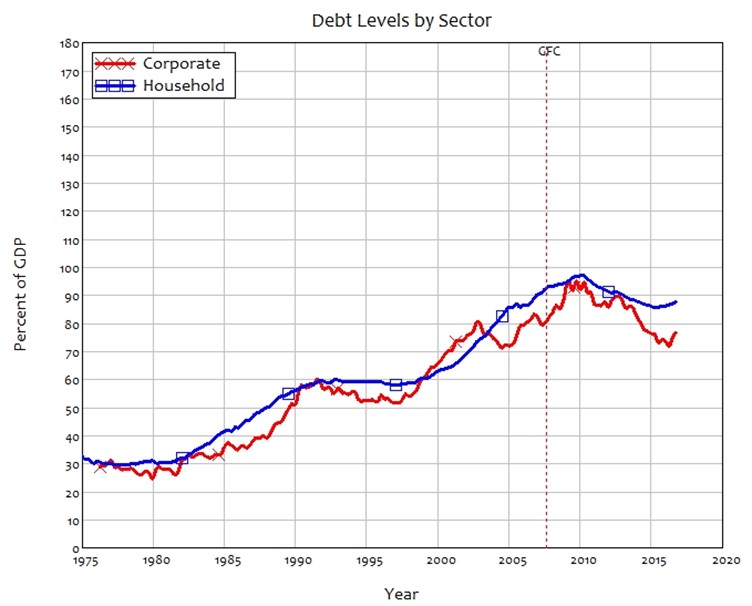

Canada

China

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Ireland

Italy

Japan

Korea

Malaysia

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Spain

Sweden

Switzerland

Thailand

Turkey

UK

USA

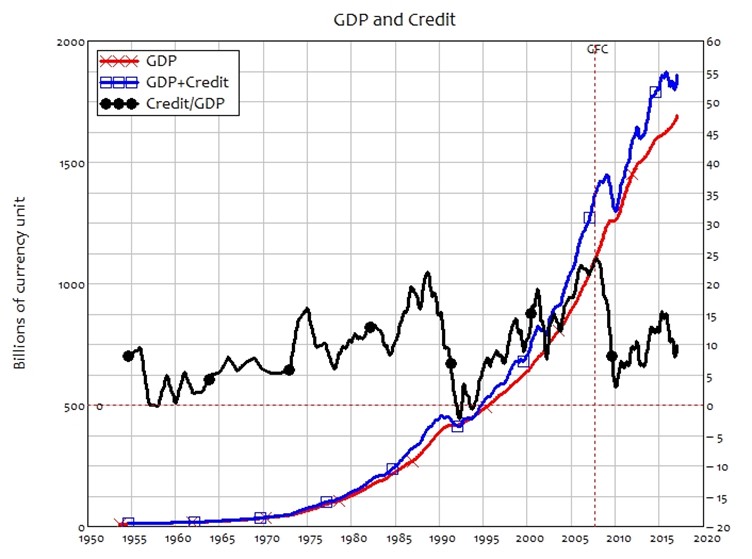

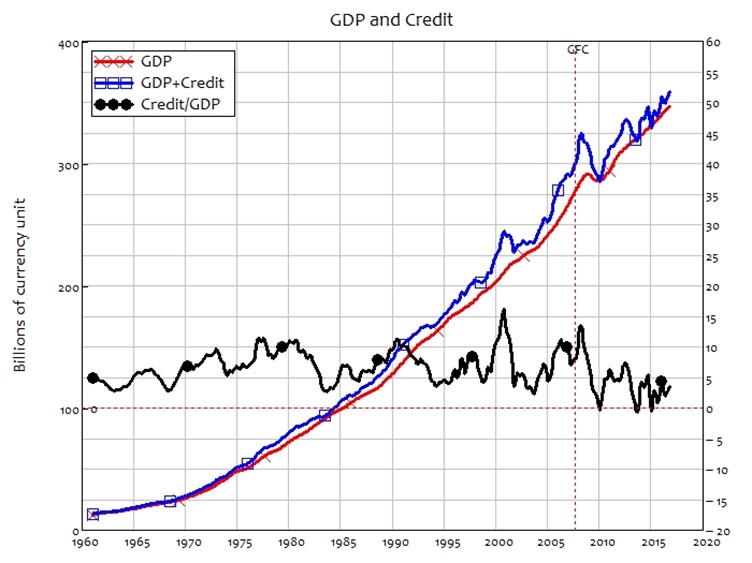

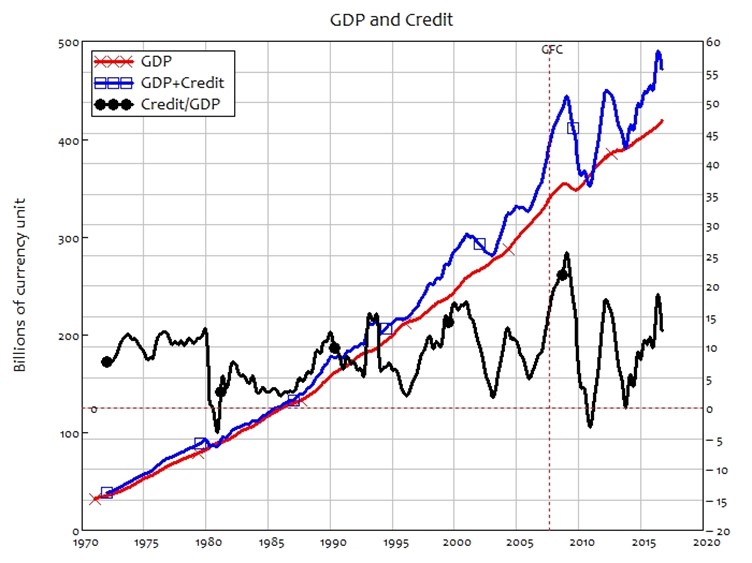

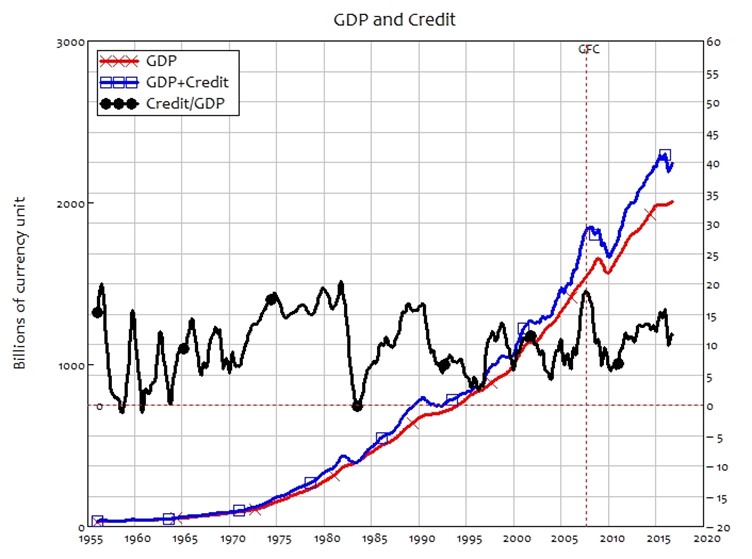

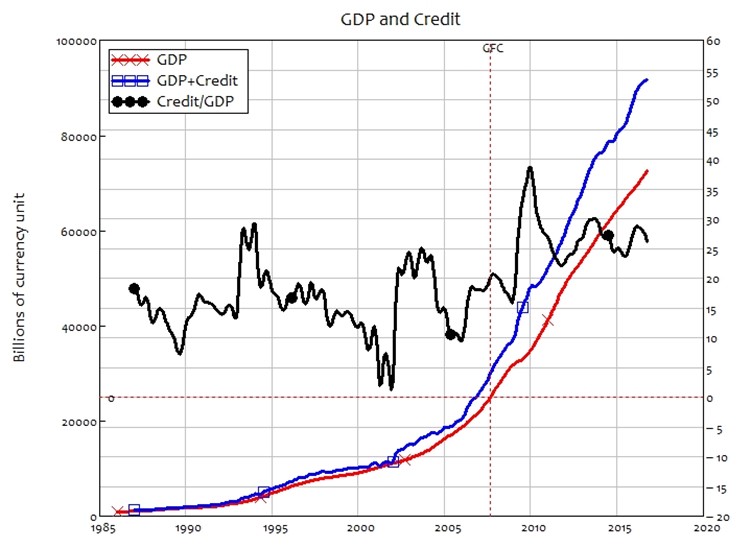

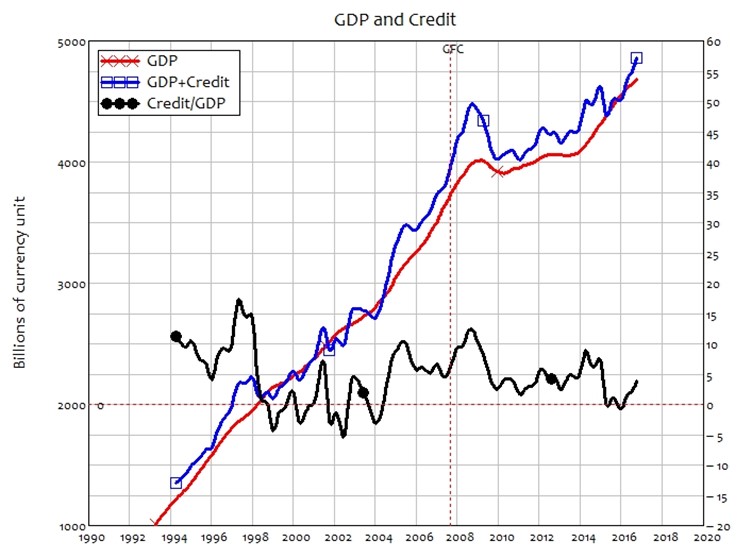

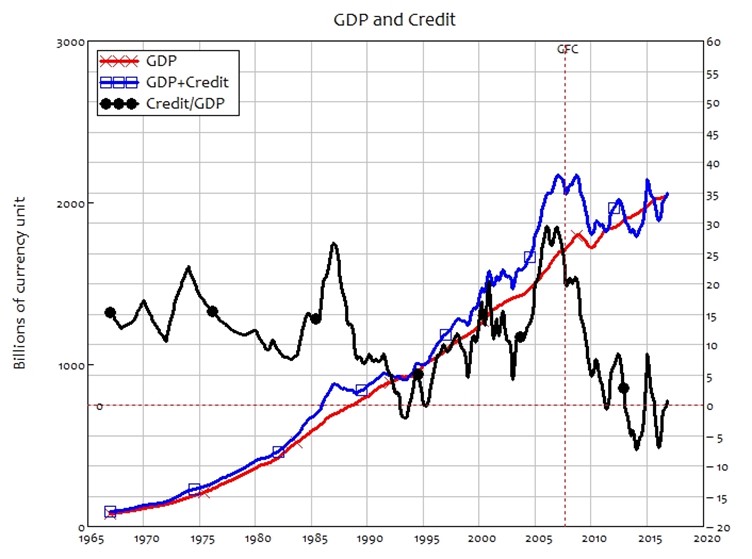

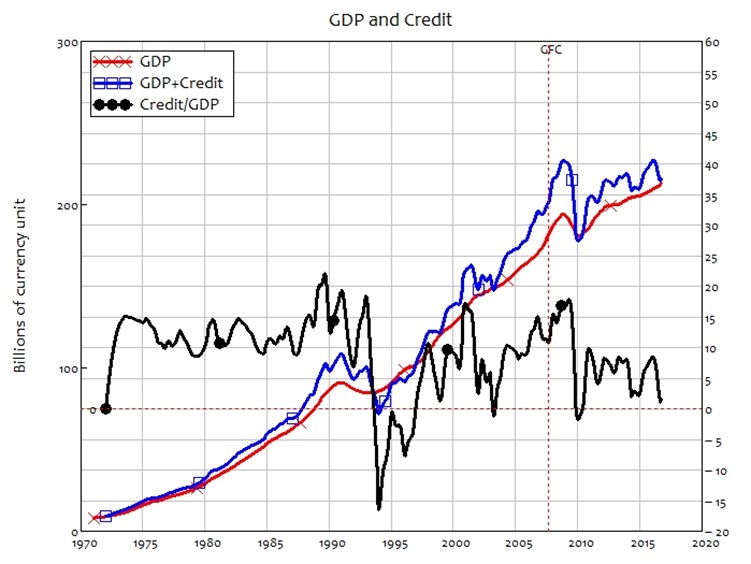

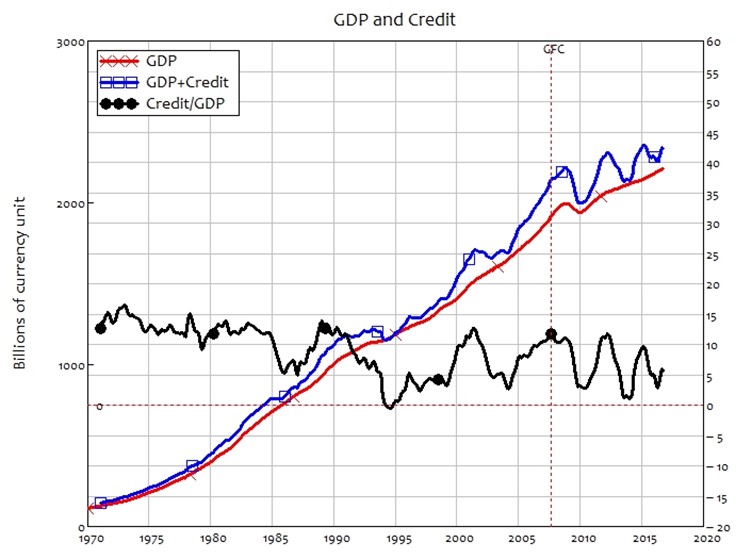

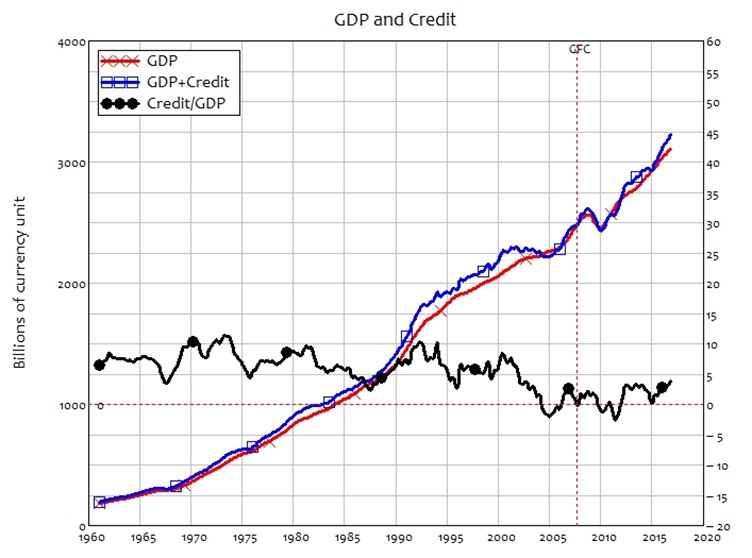

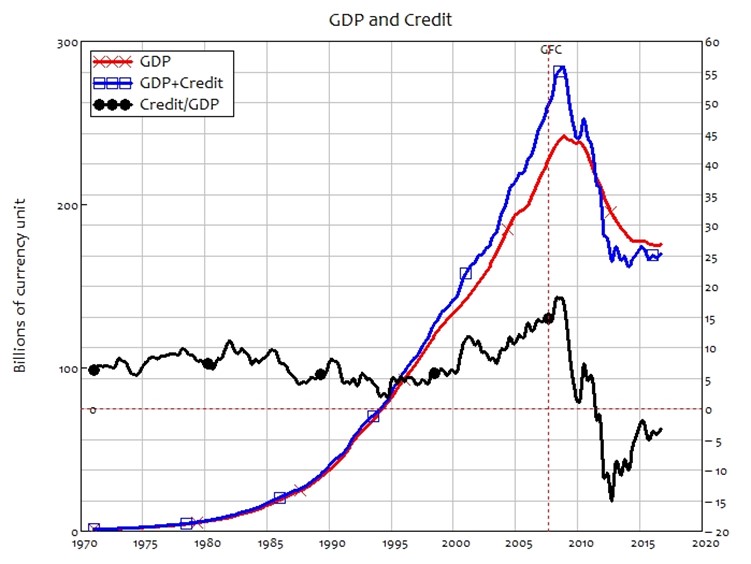

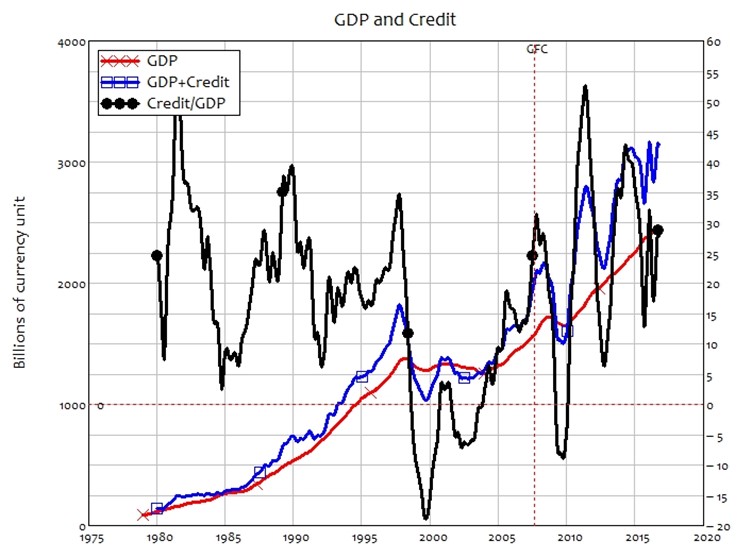

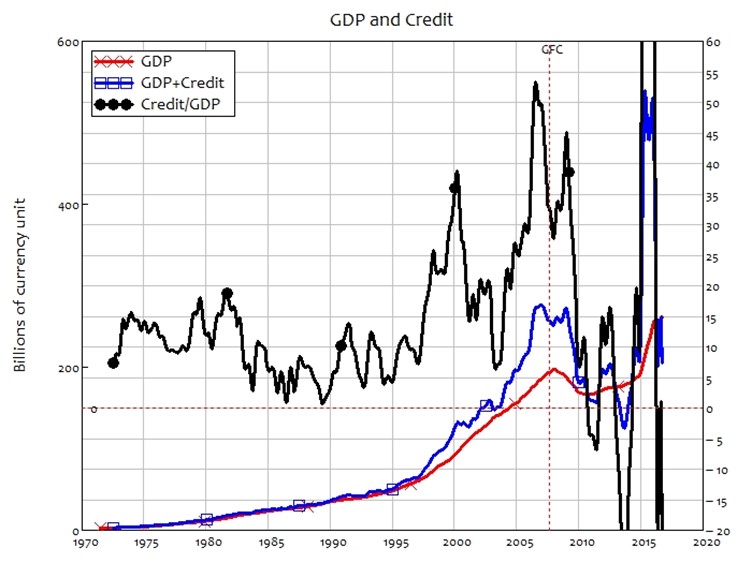

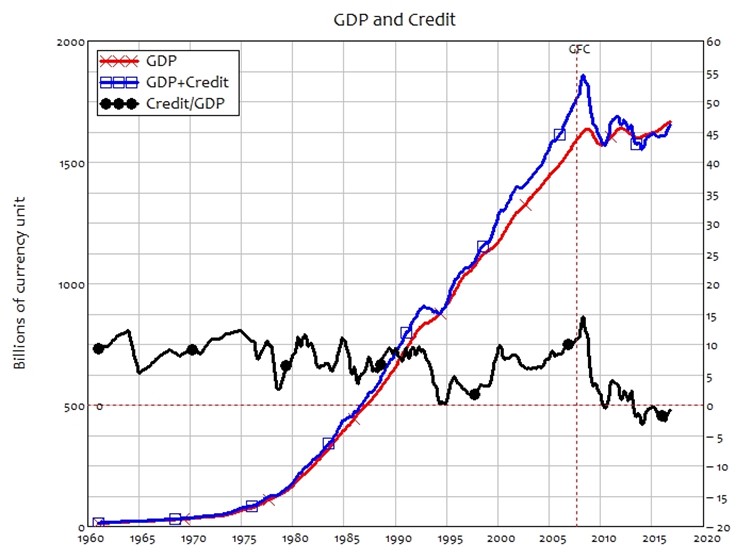

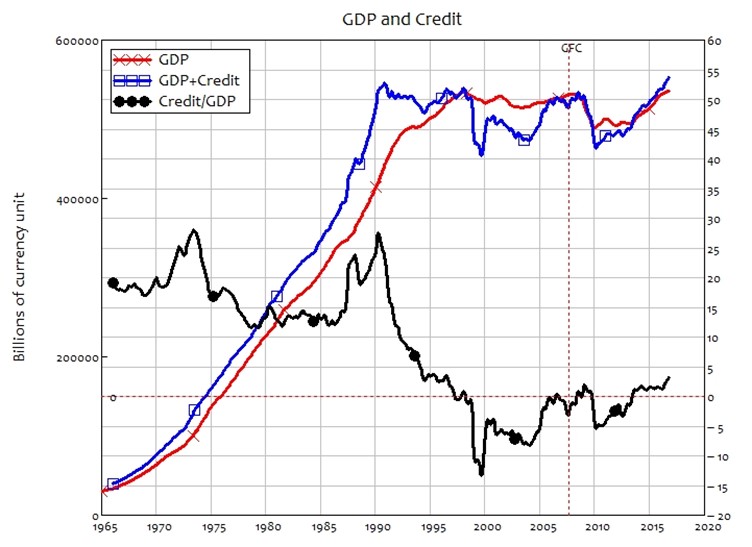

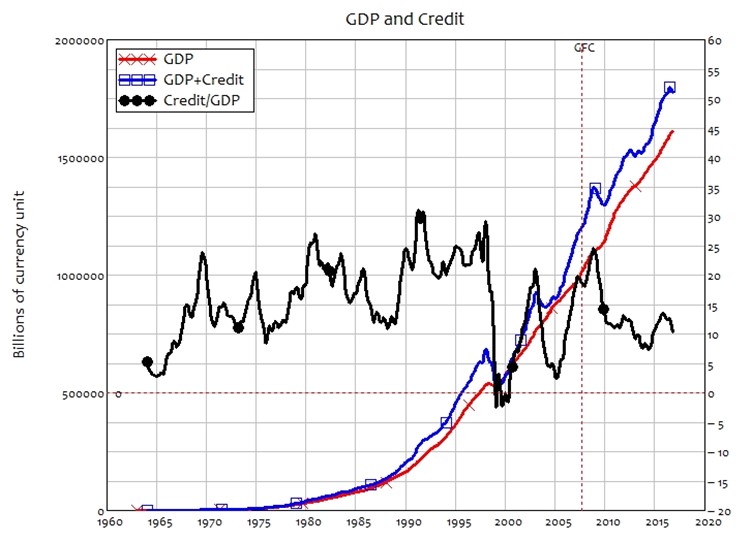

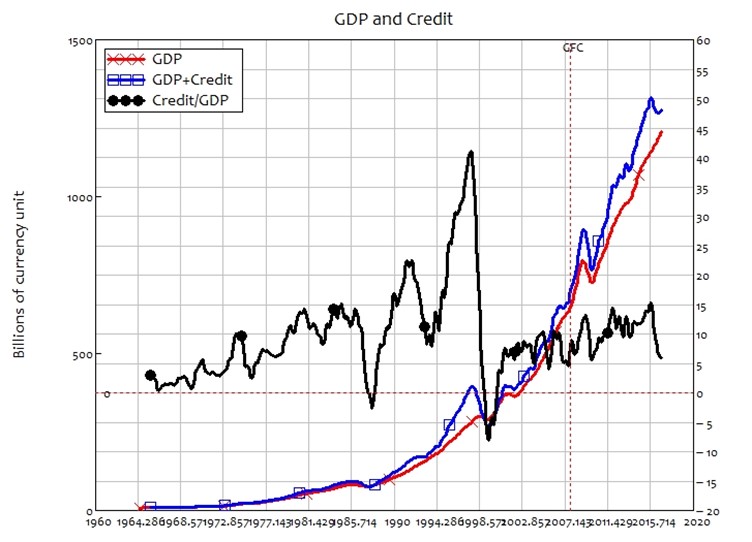

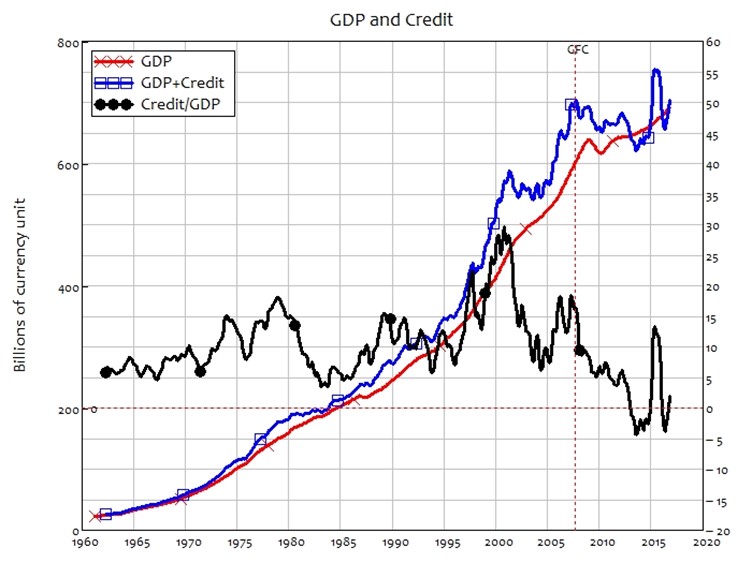

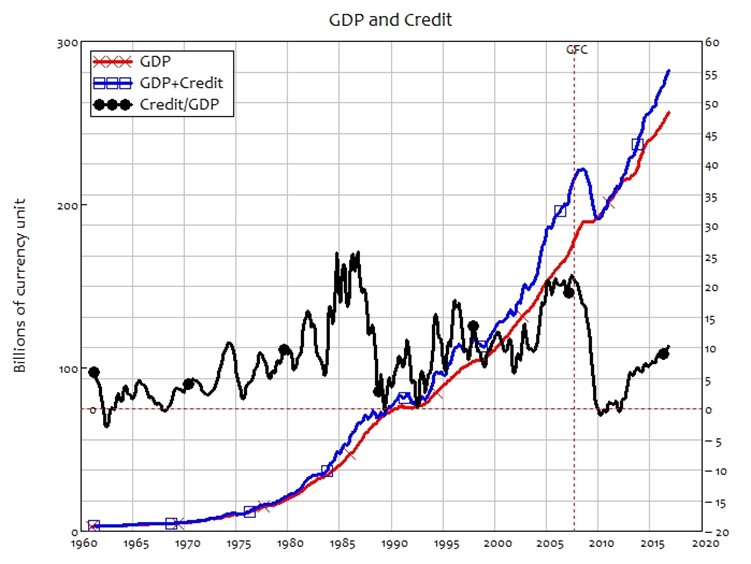

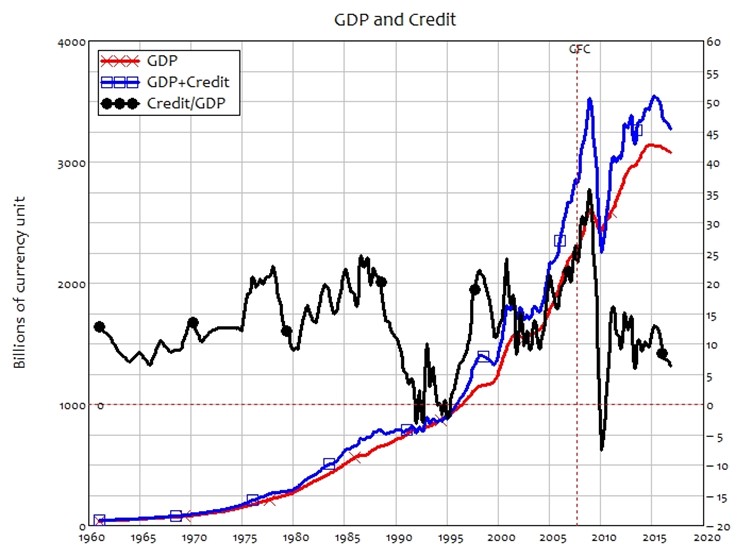

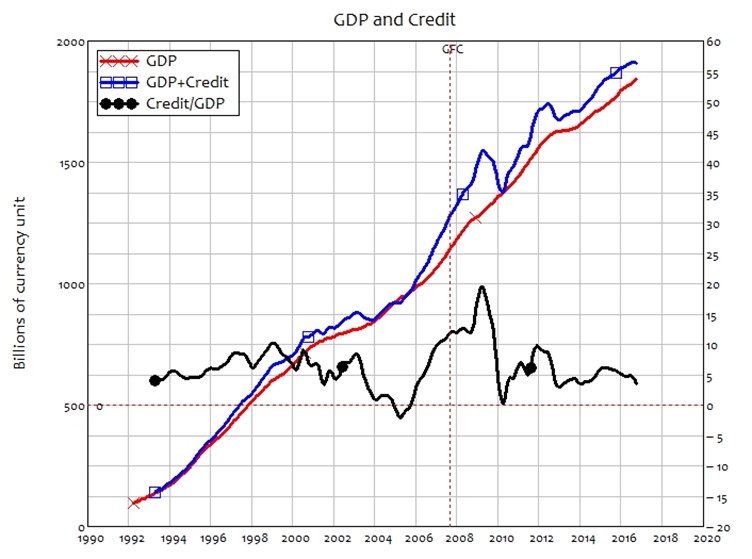

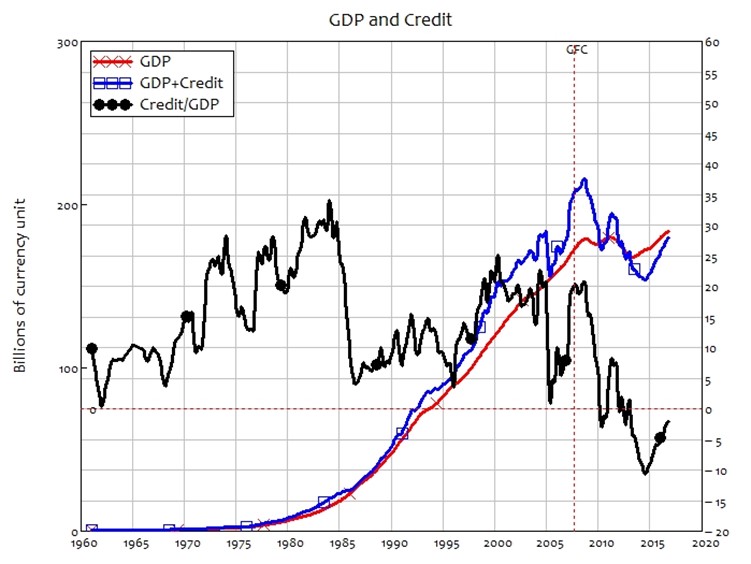

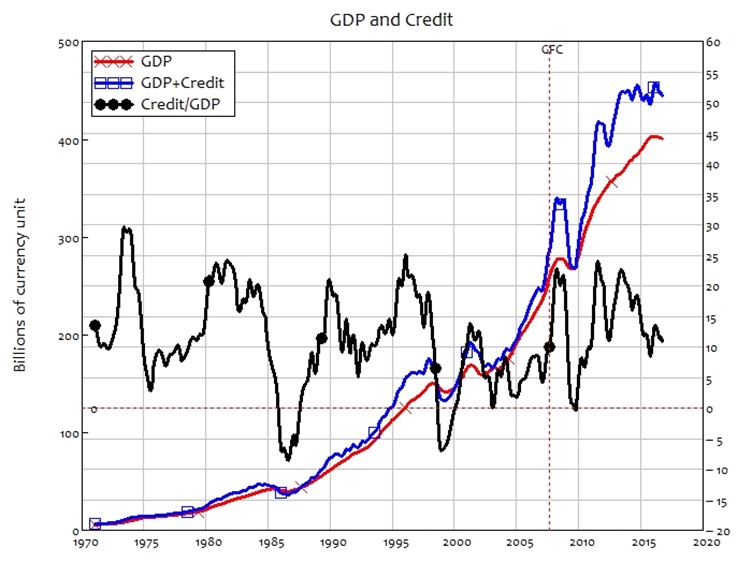

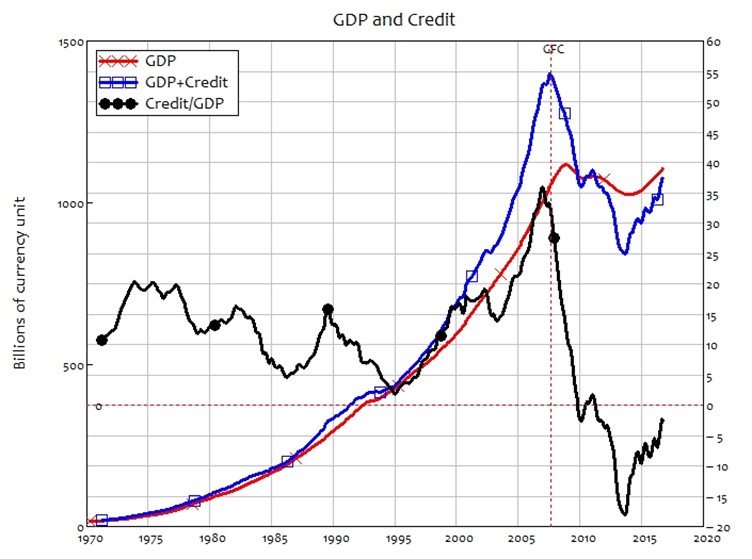

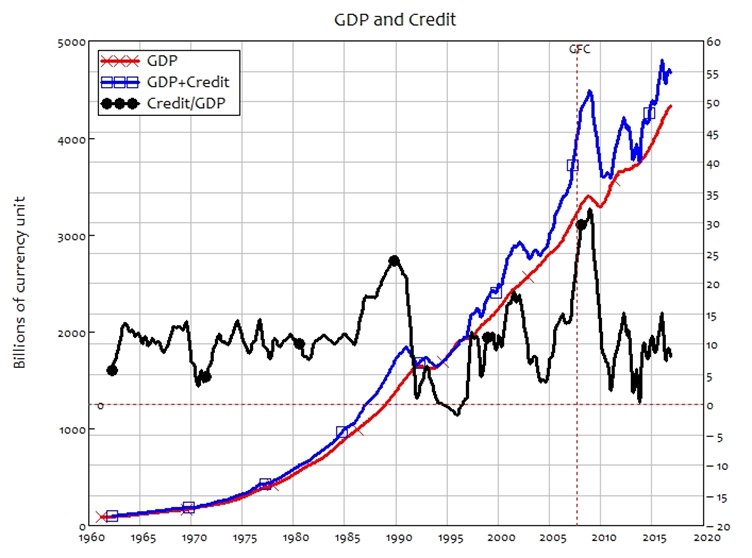

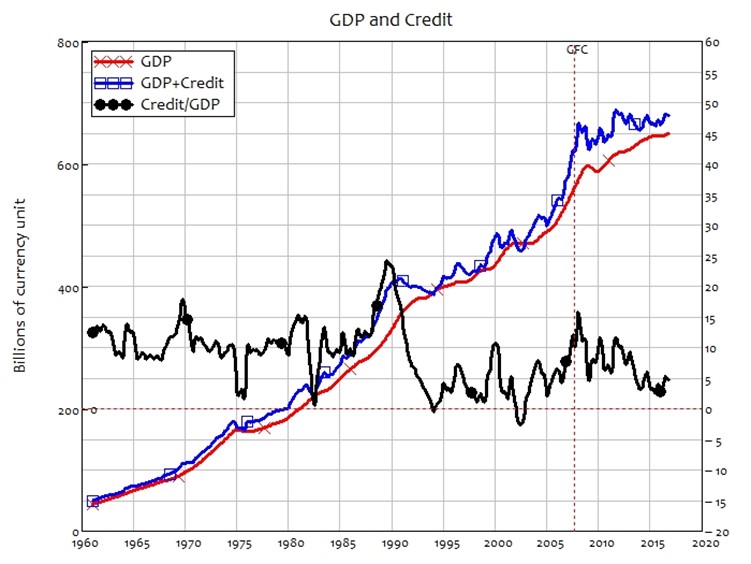

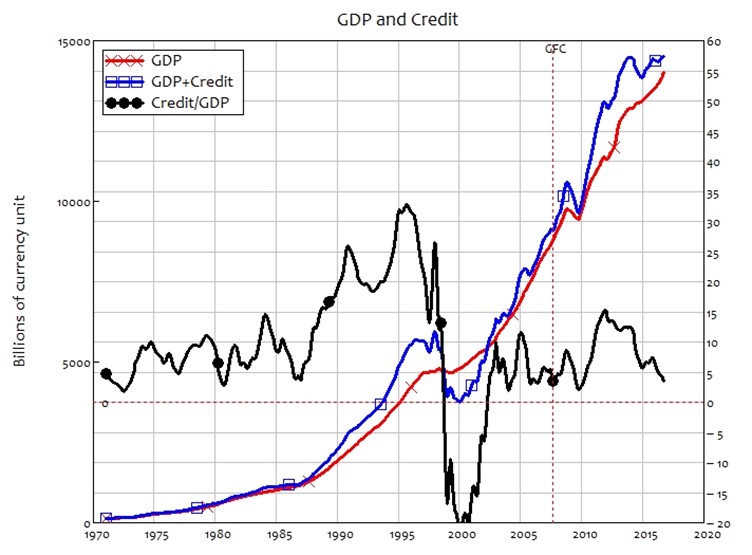

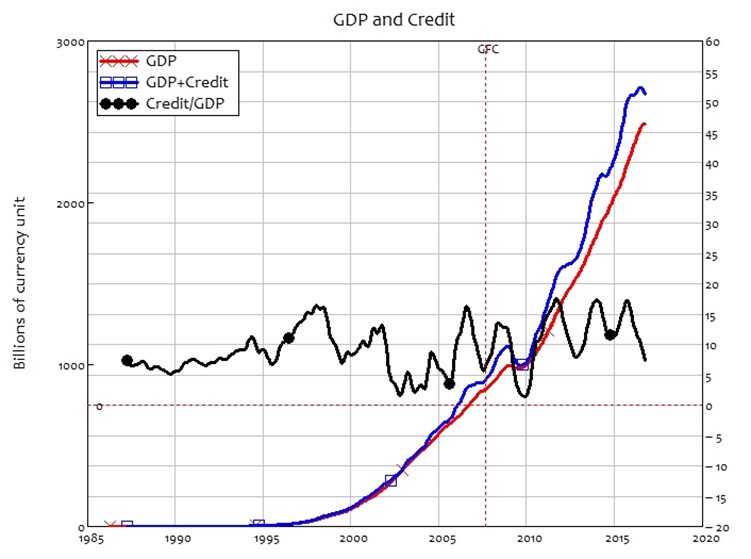

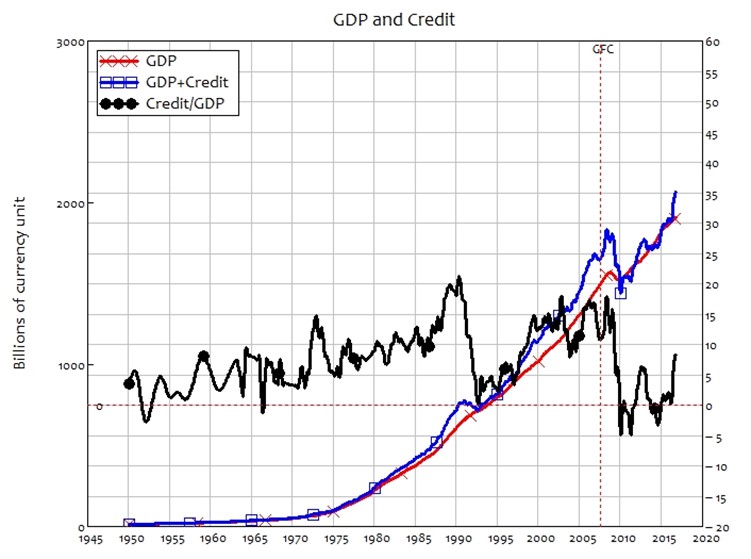

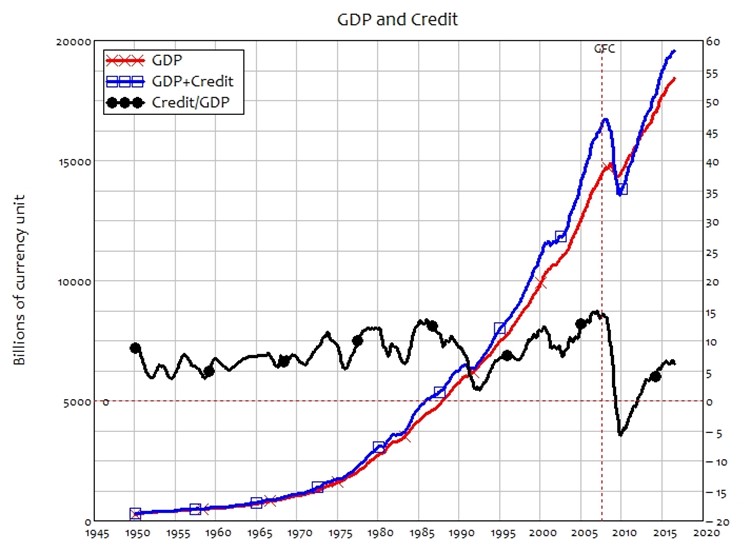

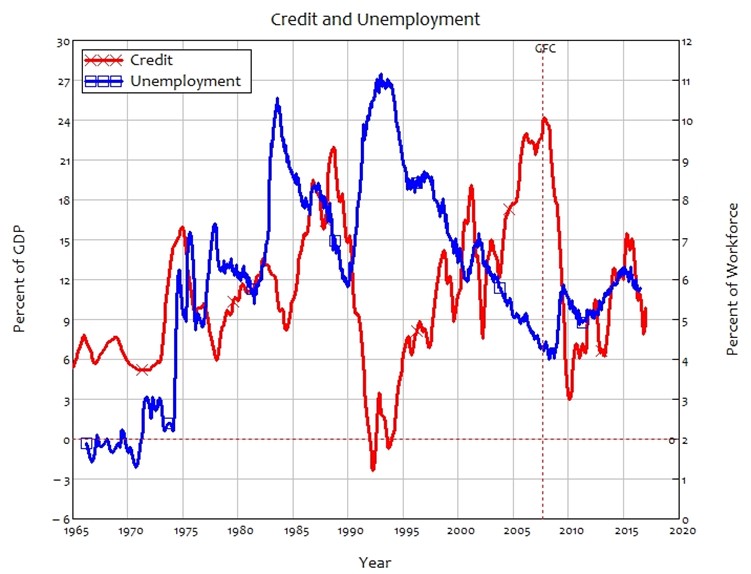

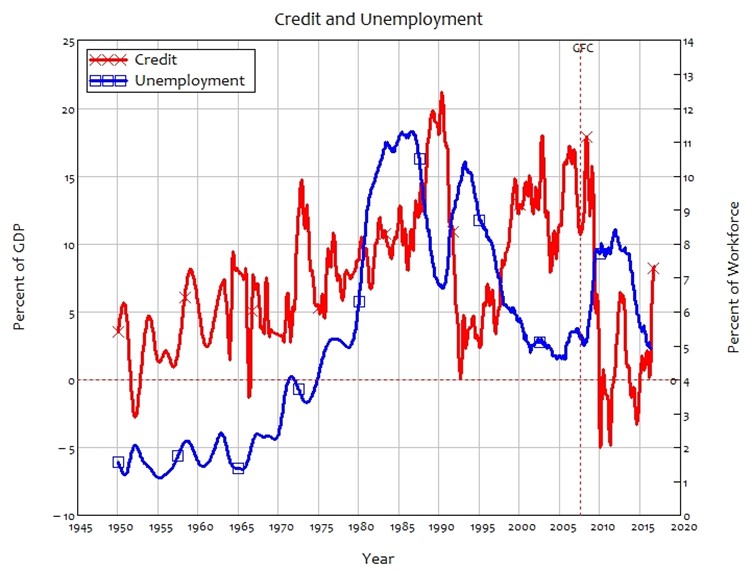

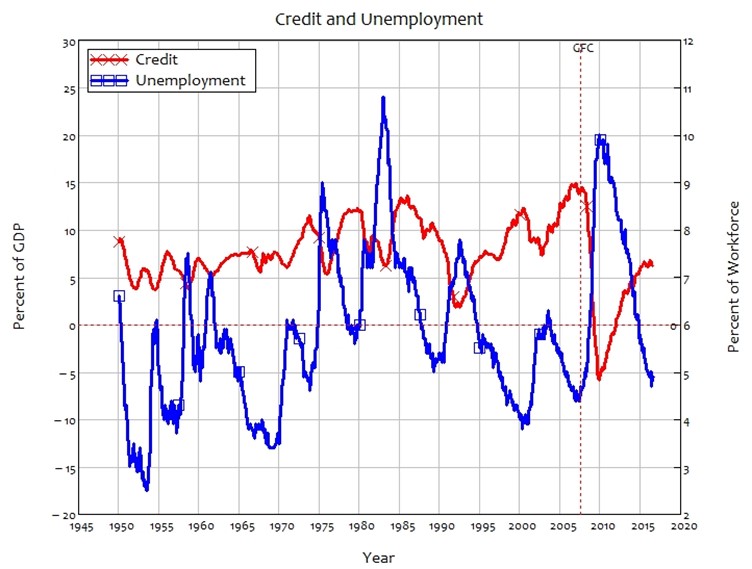

Credit and Aggregate Demand

Australia

Austria

Belgium

Canada

China

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Ireland

Italy

Japan

Korea

Malaysia

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Spain

Sweden

Switzerland

Thailand

Turkey

UK

USA

Breakdown of Private Sector Debt

Australia

Austria

Belgium

Canada

China

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Ireland

Italy

Japan

Korea

Malaysia

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Spain

Sweden

Switzerland

Thailand

Turkey

UK

USA

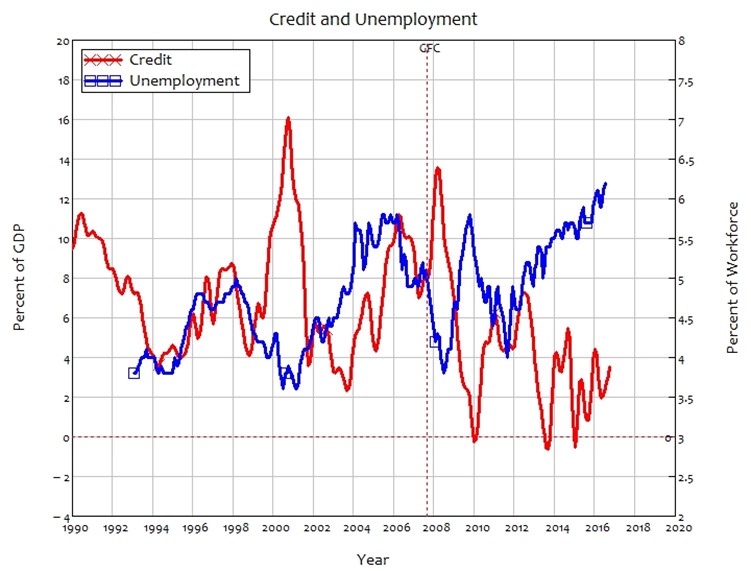

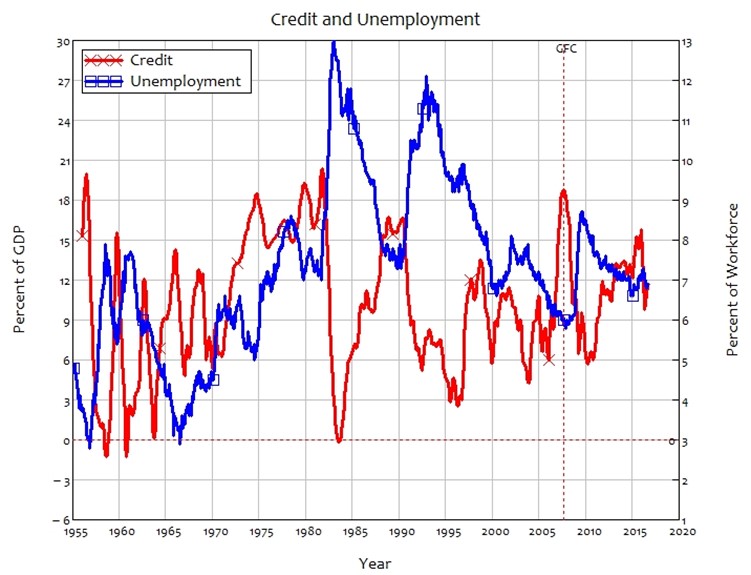

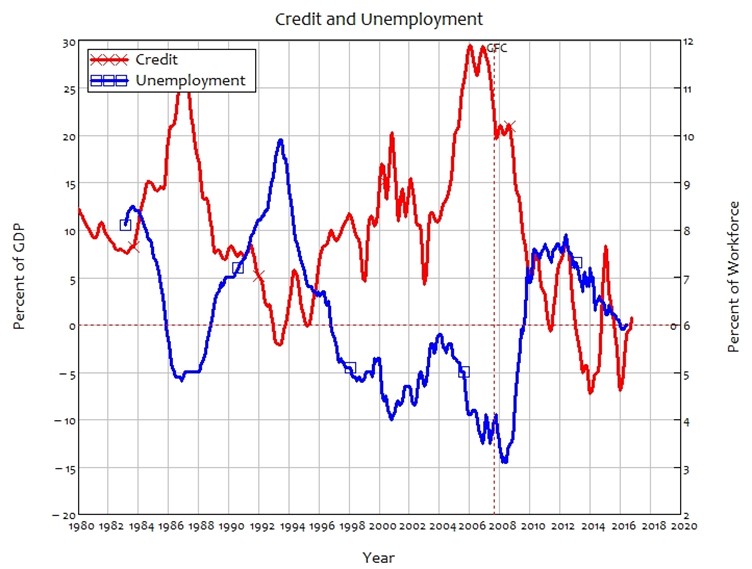

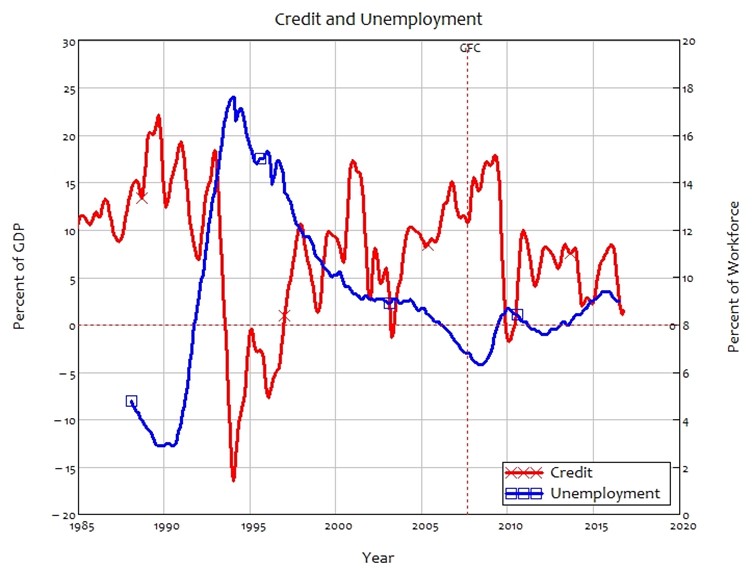

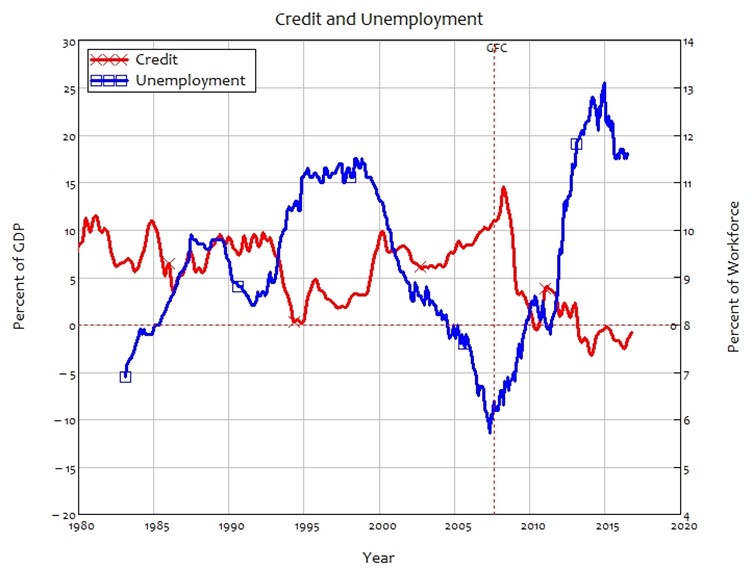

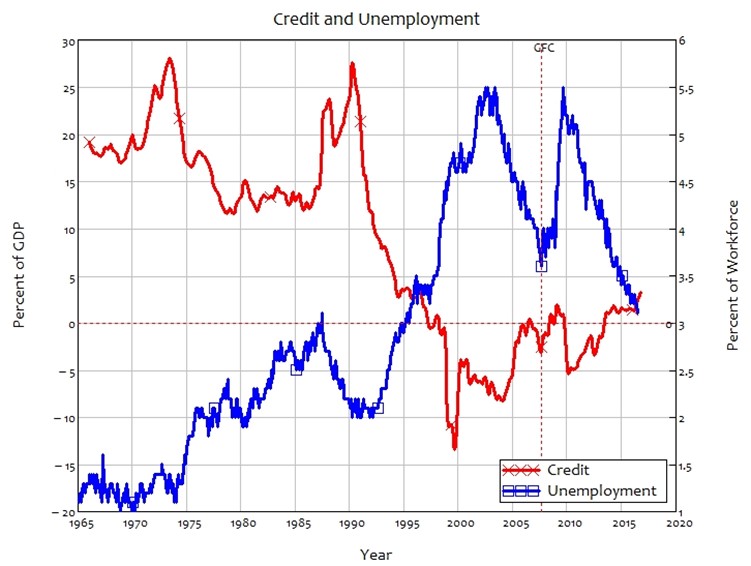

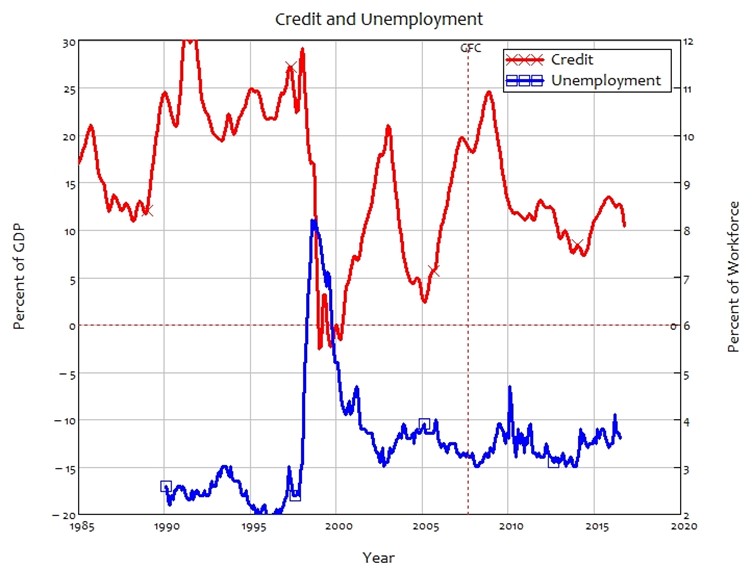

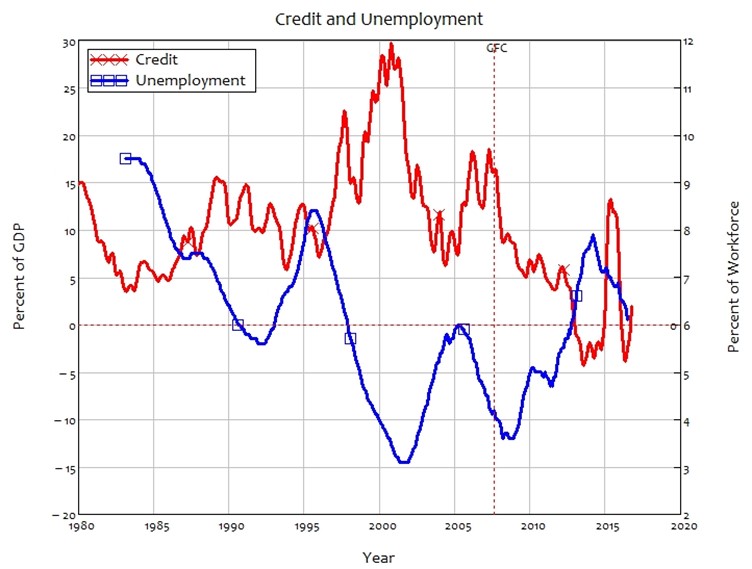

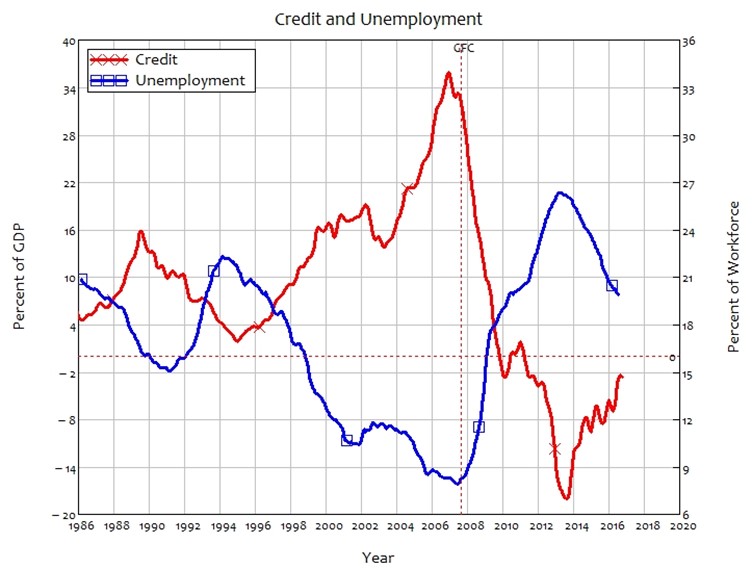

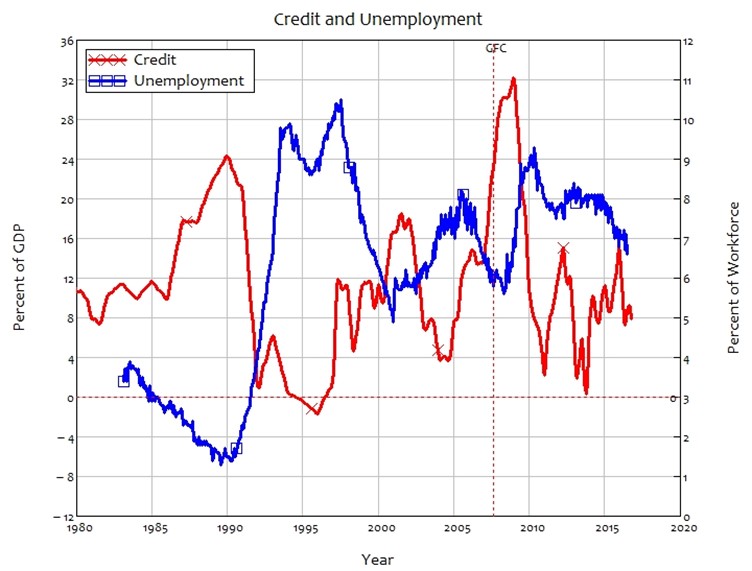

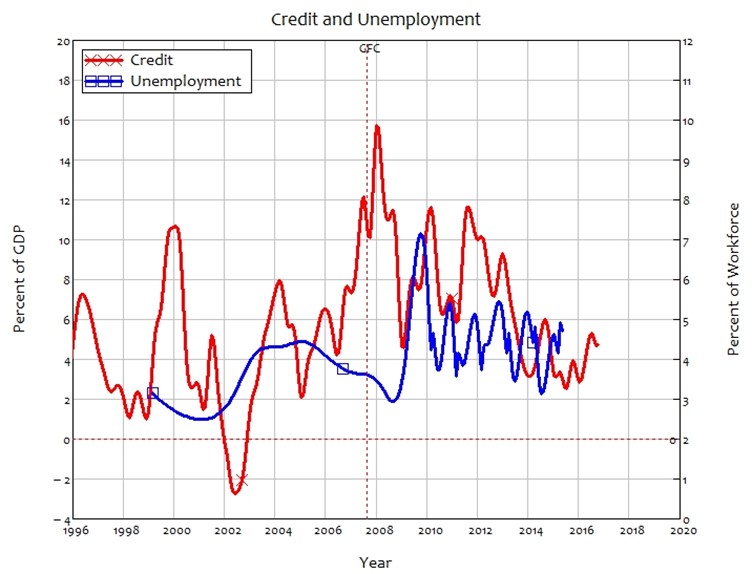

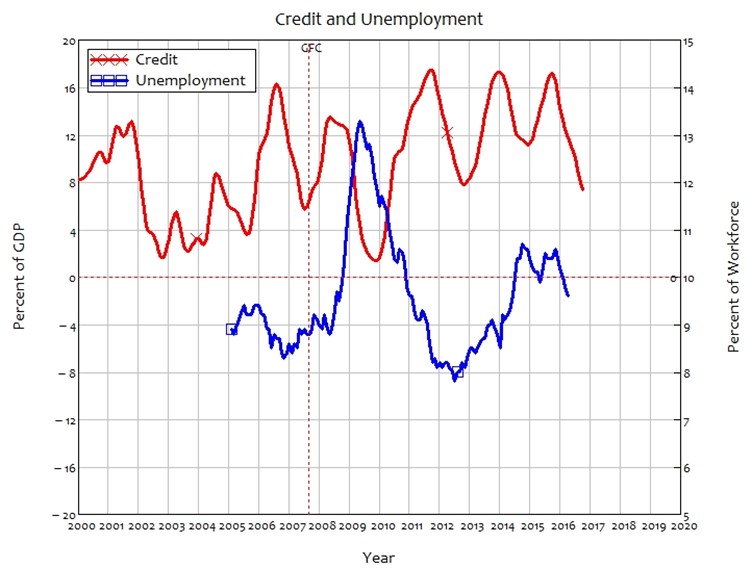

Credit and Unemployment

Australia

Austria

Belgium

Canada

China

Not Available

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Not Available

Ireland

Italy

Japan

Korea

Malaysia

Not Available

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Not Available

Spain

Sweden

Switzerland

Thailand

Not Available

Turkey

UK

USA

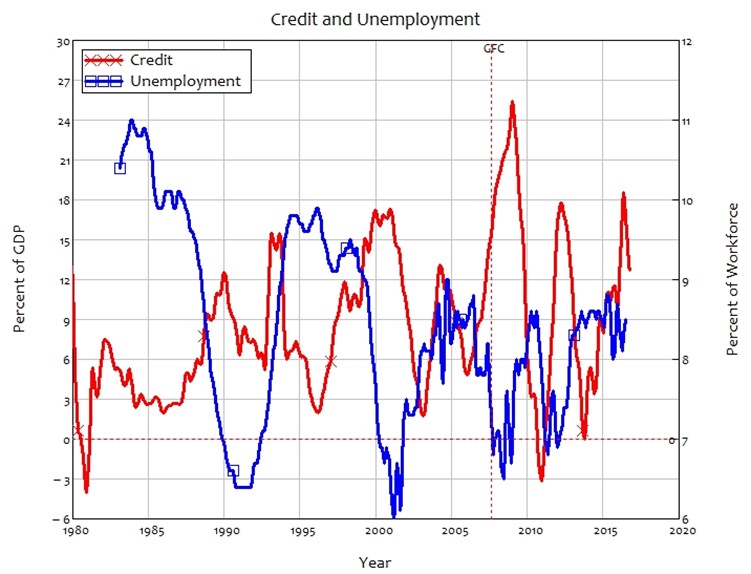

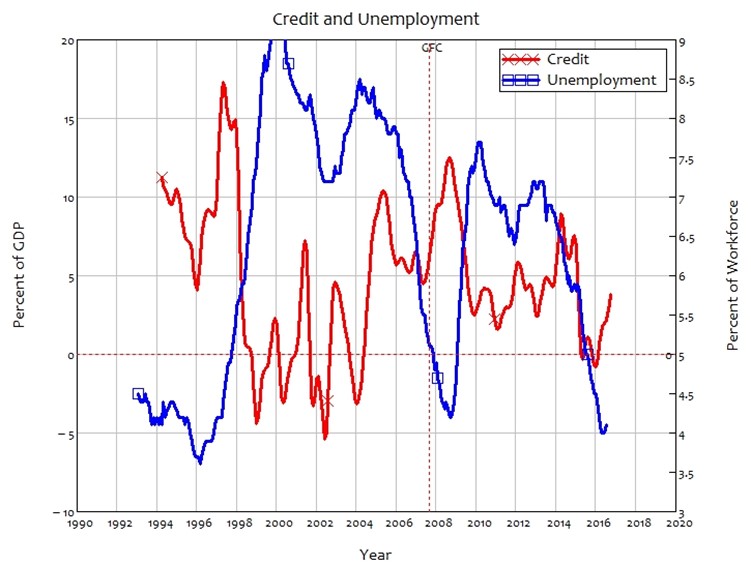

Change in Credit and Change in Unemployment

Australia

Austria

Belgium

Canada

China

Not Available

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Not Available

Ireland

Italy

Japan

Korea

Malaysia

Not Available

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Not Available

Spain

Sweden

Switzerland

Thailand

Not Available

Turkey

UK

USA

Household Debt and House Prices

Australia

Austria

Belgium

Canada

China

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Ireland

Italy

Japan

Korea

Malaysia

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Spain

Sweden

Switzerland

Thailand

Turkey

UK

USA

Change in Household Credit and Change in House Prices

Australia

Austria

Belgium

Canada

China

Czech Republic

Denmark

Finland

France

Germany

Greece

Hong Kong

Ireland

Italy

Japan

Korea

Malaysia

Netherlands

New Zealand

Norway

Poland

Portugal

Singapore

Spain

Sweden

Switzerland

Thailand

Turkey

UK

USA

Barro, R. J. (1973). “The Control of Politicians: An Economic Model.” Public Choice

14: 19-42.

Barro, R. J. (1978). “Comment from an Unreconstructed Ricardian.” Journal of Monetary Economics

4(3): 569-581.

Barro, R. J. (1989). “The Ricardian Approach to Budget Deficits.” Journal of Economic Perspectives

3(2): 37-54.

Barro, R. J. (1991). The Ricardian Model of Budget Deficits. Debt and the twin deficits debate. J. M. Rock, Mountain View, Calif.; London and Toronto:

Mayfield, Bristlecone Books: 133-148.

Bernanke, B. S. (2000). Essays on the Great Depression. Princeton, Princeton University Press.

Minsky, H. P. (1963). Can “It” Happen Again? Banking and Monetary Studies. D. Carson. Homewood, Illinois, Richard D. Irwin: 101-111.

Minsky, H. P. (1977). “The Financial Instability Hypothesis: An Interpretation of Keynes and an Alternative to ‘Standard’ Theory.” Nebraska Journal of Economics and Business

16(1): 5-16.

Minsky, H. P. (1978). “The Financial Instability Hypothesis: A Restatement.” Thames Papers in Political Economy

Autumn 1978.

Minsky, H. P. (1982). “Can ‘It’ Happen Again? A Reprise.” Challenge

25(3): 5-13.

Minsky, H. P. (1982). Can “it” happen again? : essays on instability and finance. Armonk, N.Y., M.E. Sharpe.