On October 10, 2022, I realised that there was no hope of ever reforming mainstream economics, since on that date, Ben Bernanke and two other Neoclassicals were awarded the “Nobel” Prize in economics for their work on banking. They assumed the validity of the “loanable funds” model of how banks operate—as Bernanke said in his biographical note on the Nobel website, “banks and other lenders are themselves borrowers, since they must raise funds from deposits or in capital markets in order to lend”. And yet that model had been flatly contradicted years earlier by the Bank of England (McLeay, Radia, and Thomas 2014) and the Bundesbank (Deutsche Bundesbank 2017).

The Bank of England declared that:

banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits… This article explains how, rather than banks lending out deposits that are placed with them, the act of lending creates deposits — the reverse of the sequence typically described in textbooks. (McLeay, Radia, and Thomas 2014, p. 14. Emphasis added)

The Bundesbank stated, in rather more technical language, that:

It suffices to look at the creation of (book) money as a set of straightforward accounting entries to grasp that money and credit are created as the result of complex interactions between banks, non- banks and the central bank. And a bank’s ability to grant loans and create money has nothing to do with whether it already has excess reserves or deposits at its disposal. (Deutsche Bundesbank 2017, p. 13. Emphasis added)

I was almost euphoric when those papers were published. Mainstream economists had ignored contrary research by non-mainstream authors for decades, but surely, they could not ignore such prestigious institutions when they also contradicted mainstream beliefs?

As usual, I underestimated them: mainstream economists could quite easily ignore, not only rebels like Basil Moore (Moore 1979, 1983, 1997) and Hyman Minsky (Minsky, Nell, and Semmler 1991; Minsky 1993), but even Central Banks. The award of the “Nobel” to Bernanke made that obvious. The so-called “Scientific Background” paper published by the Nobel Foundation did not even cite these well-known Central Bank papers (Committee for the Prize in Economic Sciences in Memory of Alfred Nobel 2022, pp. 61-72), while the published reactions by Neoclassical economists to the Bank of England’s paper have been limited to explaining why it didn’t matter (Faure and Gersbach 2022).

This determined indifference to the process by which money is created is a defining feature of mainstream economics. Schumpeter put very well both the accurate contrarian and the mythical conventional attitudes towards money in his short but magisterial book The Theory of Capitalist Development. He opened the Chapter entitled “Credit and Capital: the Nature and Function of Credit” with the observation that his evolutionary analysis of capitalism led to:

the heresy that money … perform[s] an essential function, hence

that processes in terms of means of payment are not merely reflexes of processes in terms of goods. In every possible strain, with rare unanimity, even with impatience and moral and intellectual indignation, a very long line of theorists have assured us of the opposite. (Schumpeter 1934, p. 95)

That “very long line of theorists” to which Schumpeter referred has over a century of additional theorists today. At the very beginning of an indoctrination into Neoclassical thought, students are taught “money neutrality”: the argument that if you double all prices and incomes, nothing changes. Therefore, only relative prices matter, not money prices.

The belief that money doesn’t matter percolates from micro to macro, with the result that almost all Neoclassical macroeconomic models entirely omit the existence of banks, and private debt, and money.

Even when they do consider private debt, they assert that only the distribution of debt matters, and not its absolute magnitude. Bernanke, in the subsequent essay to the one for which his “Nobel” was awarded, dismissed Irving Fisher’s “Debt-Deflation Theory of Great Depressions” (Fisher 1933):

because of the counterargument that debt-deflation represented no more than a redistribution from one group (debtors) to another (creditors). Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macroeconomic effects. (Bernanke 2000, p. 24. Emphasis added)

Similarly, Eggertsson and Krugman’s attempt to explain the role of debt began by noting that mainstream analysis ignored debt:

Given the prominence of debt in popular discussion of our current economic difficulties and the long tradition of invoking debt as a key factor in major economic contractions, one might have expected debt to be at the heart of most mainstream macroeconomic models—especially the analysis of monetary and fiscal policy. Perhaps somewhat surprisingly, however, it is quite common to abstract altogether from this feature of the economy. (Eggertsson and Krugman 2012, pp. 1470-71)

While admitting that this might be an error, they still asserted that only the distribution of debt—and not its level, nor its rate of change—was of significance for macroeconomics:

Ignoring the foreign component, or looking at the world as a whole, the overall level of debt makes no difference to aggregate net worth—one person’s liability is another person’s asset.

It follows that the level of debt matters only if the distribution of that debt matters, if highly indebted players face different constraints from players with low debt. (Eggertsson and Krugman 2012, p. 1471. Emphasis added)

Shortly, I’ll prove logically that these assertions are false, and that Schumpeter was correct to assert that “money … perform[s] an essential function”. But initially, I’ll demonstrate this case using a device that is unique to my Minsky software, the Godley Table. Before I do, I need to discuss something else that economists rarely think about, since economists are by training and disposition ignorant of it: accounting.

-

Of Assets, Liabilities, and Equity

Accounting is the means by which we keep track of who owes whom, and who owns what. Things that you own are your Assets; obligations you owe to others are your Liabilities. The difference between the two is your net worth, which is often called your Equity.

There are two types of Assets—Financial and Nonfinancial. Minsky can handle both types of Assets, but in this discussion of money I’ll focus on Financial Assets only.

A Financial Asset is a claim on some other person or entity, and, as Eggertsson and Krugman note above, “one person’s liability is another person’s asset”. Also, as they imply, the sum of all Financial Assets and Liabilities is zero: if you add together what someone else owes you (your Asset) and what that person owed you (their Liability), you get zero. But this does not mean, as Eggertsson and Krugman explicitly state, that this means that the level and rate of change of debt is unimportant—far from it. To understand why, you need far more than the superficial understanding of accounting possessed by Neoclassical economists.

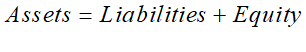

Accounting was invented when the 14th century Franciscan monk Luca Pacioli realised that by dividing accounts into Assets, Liabilities and Equity, enforcing the rule that Assets minus Liabilities equals Equity, and making two entries for every transaction, you could guarantee an accurate record of commerce. This was the origin of what is called the “fundamental accounting equation”:

Minsky uses this concept to enable monetary flows to be modelled very easily, and checked for errors as they are built. Other system dynamics programs like Vensim, Stella, etc., can model monetary flows too, but they don’t include the automatic check that the right entries have been made for the right accounts.

Figure 24 shows a Godley Table with three common transactions—buying goods, taking out a loan, and paying taxes—where the first two operations are filled in correctly and the third is in error. Paying for goods involves taking Payment dollars out of the Buyer’s account and transferring to the Seller’s; taking out a loan involves increasing the Buyer’s account (its Asset) and increasing the Bank’s Loans (its Asset); taxation reduces the amount in the Buyer’s account and does not increase Reserves—in fact it reduces them. Minsky catches this error because the operation shown on the final line of Figure 24 violates the rule that Assets minus Liabilities minus Equity equals zero.

Figure 24: A Godley Table with 3 sample transactions and one error

This simple system has many advantages over the modelling of monetary flows using the flowchart system that is common to all system dynamics programs—including Minsky. The “A-L-E=0” check makes sure that each transaction is recorded properly. The tabular layout is also much easier to read than a tangle of “wires” on a standard system dynamics program. You can also check a model line by line: if each line is correct, then the overall model can be trusted.

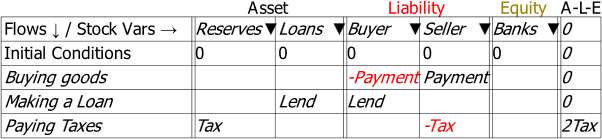

A simple model built using this system illustrates the fallacy behind the argument that, because “one person’s liability is another person’s asset”, therefore, the level and rate of change of private debt is of no macroeconomic significance. The basic model—shown in Figure 25—treats banks as mere intermediaries that enable Savers to lend to Borrowers. Both Savers and Borrowers spend money on each other, and Borrowers must pay interest to Savers equal to the prevailing interest rate times the amount of Loans outstanding. Loans don’t show up in the Banks’ Table because they are an Asset of the Savers. Spending by Savers and Borrowers is determined by SpendRate parameters, where the SpendRate for Borrowers is higher than that for Savers. Defining GDP as the sum of the spending by Savers and Borrowers on each other plus the Interest payments, with the values given to the parameters and the amount in their accounts, GDP starts at $240 per year.

Figure 25: A simple model of Loanable Funds

Figure 26 adds some graphs to this model, and runs it with (a) no credit for the first ten years; (b) credit equal to 25% of the deposits of savers per year until the private debt to GDP ratio hits 170% of GDP, which is the peak level of private debt that the USA experienced during the Global Financial Crisis; and then (c) running it with negative credit—meaning that borrowers are repaying savers, rather than taking out new loans—until the debt level falls back to zero once more.

The increase in debt increases GDP, and the reduction in debt reduces it, because Borrowers have a higher propensity to spend than Savers. But the change in GDP is slight: it rises from $240 per year to $260 per year, which is a trivial change, given that it took almost 30 years to go from zero debt to 170% of GDP. If this was all that including banking in a macroeconomic model would add, then it would make sense to ignore it, as Neoclassicals like Bernanke and Krugman do.

Figure 26: Running the Loanable Funds model with positive and then negative credit

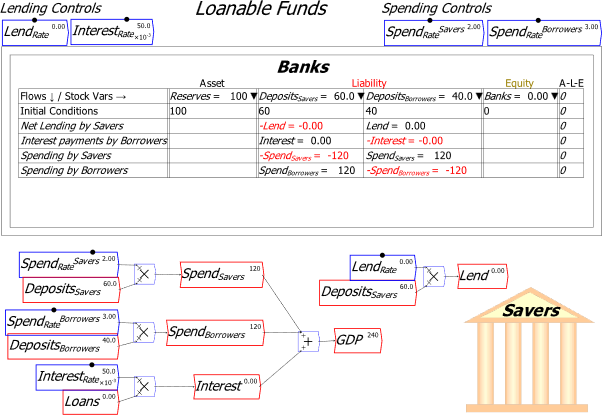

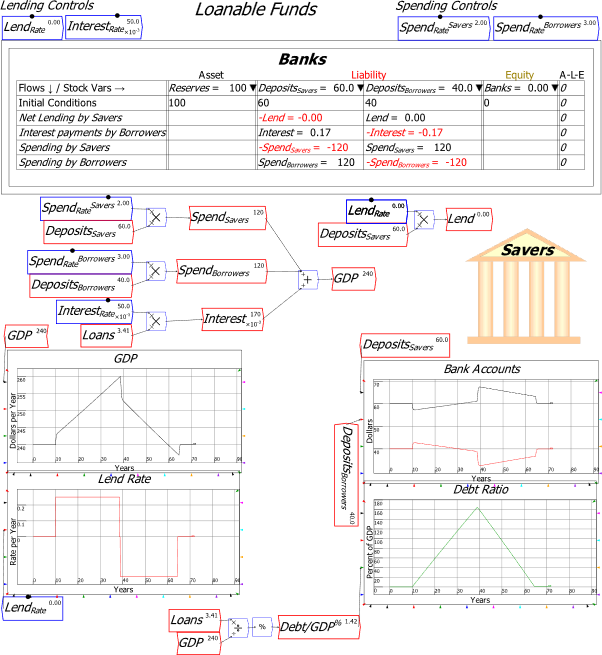

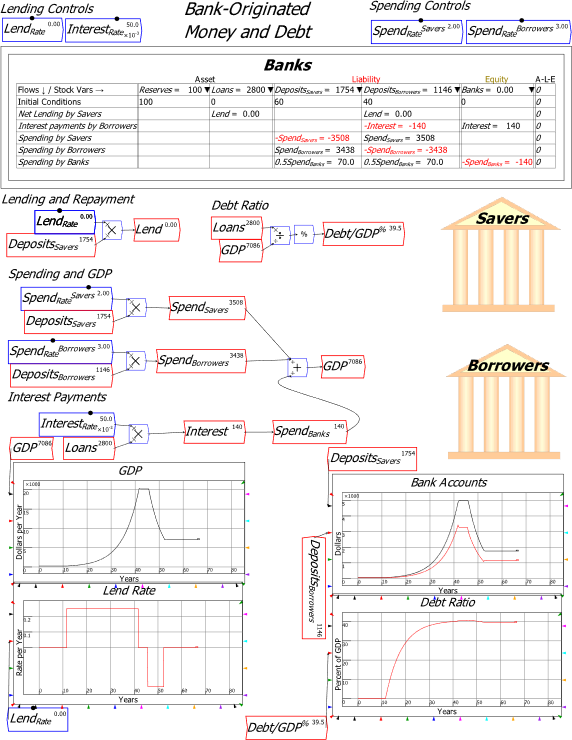

To illustrate that this is an extremely bad inference from the correct observation that “one person’s liability is another person’s asset”—I hesitate to say stupid, but what the heck, it’s stupid—the next model, shown in Figure 27, makes only two very simple changes: it treats Loans, not as an asset of Savers, but as an asset of Banks; and for simplicity, it assumes that banks spend all the interest income they earn, so that bank spending replaces Interest payments as an input to GDP. Therefore, the only substantive difference between these two models is that Figure 26 is the fictional Neoclassical model in which banks are “mere intermediaries” between Savers and Borrowers, while Figure 27 models the real-world situation outlined by the Bank of England back in 2014, that banks don’t need Savers’ funds in order to lend, and in fact that bank lending creates money.

And what a difference the real-world makes! Rather than lending making only a minor difference to GDP, it increases it dramatically. This is why banks, and private debt, and money, are essential if one is to model the real-world capitalist economy, and not a Neoclassical fantasy.

Figure 27: Treating Loans as an Asset of the Banking Sector—which they are in the real-world

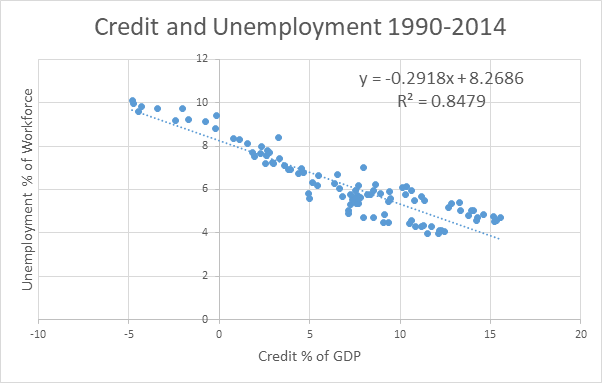

However, there is still one possible way for Neoclassical dogma to hang on: perhaps this is all just a “nominal” phenomenon, adding to monetary demand, but not changing real demand? We can dispense with that escape route by working from first principles to show that credit—the change in private debt—is an essential and highly volatile component of both aggregate expenditure and aggregate income.

-

Proving that money matters macroeconomically

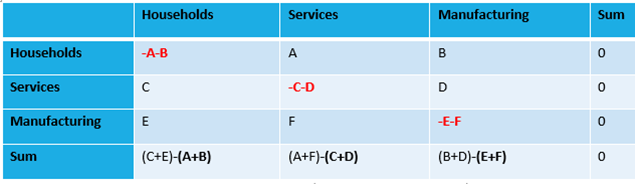

Schumpeter’s assertion that money matters is easily proven using a device I call a Moore Table, in honour of the great pioneer of endogenous money research in economics, Basil Moore (Moore 1979, 1988; Moore 2006). A Moore Table lays out monetary expenditure and income in an economy in terms of expenditure flows between sectors or agents in the economy. Each row shows the expenditure by a given sector, and the sectors that are the recipients of that expenditure, with expenditure having a negative sign and income having a positive sign. Each column shows the net income of each sector. All entries in a Moore Table are flows of dollars per year.

By construction, the negative of the sum of the diagonal elements of the table is aggregate expenditure, and it is identically equal to the sum of the off-diagonal elements, which is aggregate income. In the limit, if every agent in a country were included in the table, then it would measure that country’s GDP.

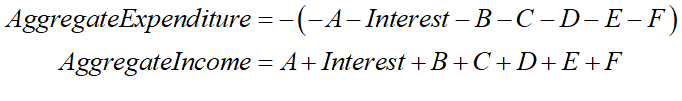

Table 6 shows the simplest example, of an economy with money but no credit or debt of any kind. Instead, there is a fixed stock of money, with each sector spending on the other two sectors. With flows labelled A to F, both aggregate expenditure and aggregate income are the sum of the flows A to F.

Table 6: A Moore Table showing expenditure IS income for a 3-sector economy

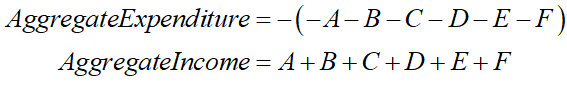

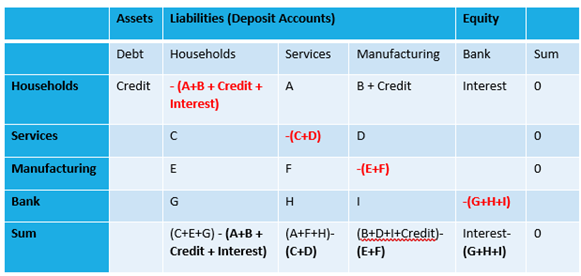

Table 7 shows Loanable Funds, with the Services sector lending Credit dollars per year to the Household sector, and the Household sector then spending this borrowed money on the Manufacturing sector. The Household sector also has to pay Interest dollars per year to the Services sector, based on the level of outstanding debt. The transfer of money in the loan is shown across the diagonal, because only income-generating transactions are shown across the rows.

This model has Credit reducing the expenditure that the Services sector can do (you can’t spend money that you have lent to someone else), while increasing the spending that the borrower—the Househol sector—can do. This spending boosts the income of the Manufacturing sector, but it is precisely offset by the lower level of spending by the Services sector on Manufacturing (the flows A to F in this table do not have to be the same as in Table 6).

This means that the entry for Credit cancels out on both the diagonal (aggregate expenditure) and the off-diagonal (aggregate income), so that Credit is not part of aggregate expenditure or aggregate income in Loanable Funds. Therefore, if Loanable Funds was an accurate description of what banks actually do, Neoclassicals would be correct to ignore credit in their macroeconomics.

Table 7: The Moore Table for Loanable Funds

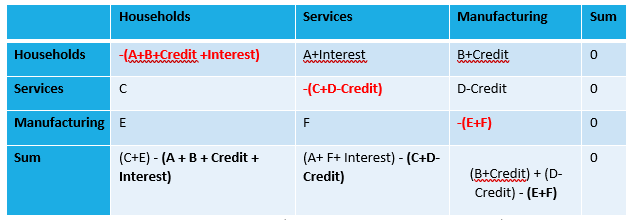

With the real-world situation of bank lending, Credit adds to both the Assets of the banking sector, and its Liabilities—the deposit accounts of the Household sector. In this simple example, Household then spend this additional money on the Manufacturing sector. The practical import of this situation is that Credit appears only once in both aggregate expenditure—the spending by the Household sector—and aggregate income—the income of the Manufacturing sector. Consequently, Credit does not cancel out, as it did for Loanable Funds, and Credit is therefore part of Aggregate Expenditure and Aggregate Income.

Table 8: The Moore Table for Bank Originated Money and Debt

Therefore, banks, debt, credit and money must be included in macroeconomics: To leave them out is to omit the most volatile component of aggregate demand from your analysis. This is the root of the complete failure of mainstream economists to see the Global Financial Crisis coming, and in fact to understand the business cycle itself.

-

The Empirical Record

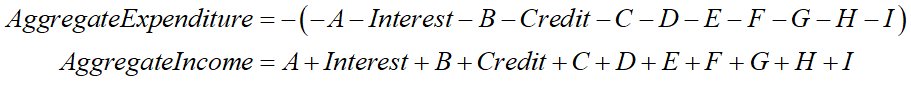

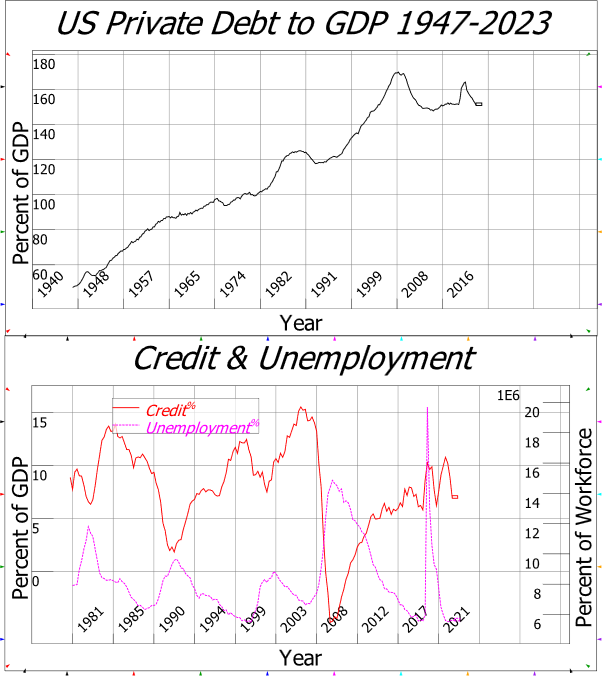

Bernanke’s assertion that credit—which, as a believer in the Neoclassical myth of Loanable Funds, he falsely describes as “pure redistributions”—”should have no significant macroeconomic effects” (Bernanke 2000, p. 24 ) implies that a regression between credit and a significant macroeconomic indicator would return a very weak result. Instead, the R2 for a linear regression of credit and unemployment between 1990 and 2014 is 0.85—see Figure 28. This implies that credit, which is omitted from Neoclassical macroeconomic models, is by far the most important determinant of economic performance.

Figure 28: The huge negative relationship between credit and unemployment when private debt levels are very high

The relationship is less powerful at times of lower private debt—see Figure 29—but it is still highly significant: by omitting credit from their macroeconomics, Neoclassical economists are omitting the major determinant of macroeconomic performance.

Figure 29

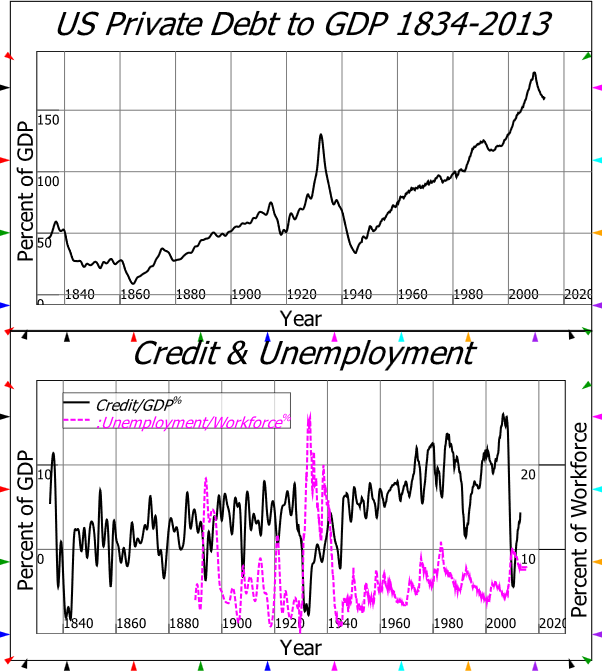

In fact, the relationship is so significant that, when I constructed a data set on debt back to 1834 using both modern Federal Reserve data and two Census data series (Census 1949, 1975), it alerted me to an economic crisis of which I was previously unaware: the “Panic of 1837”. The event is so long back in history, and so precedes modern media—including both photographs and movies—that it has been largely forgotten, but in more contemporary accounts it was described as “an economic crisis so extreme as to erase all memories of previous financial disorders” (Roberts 2012, p. 24). Extant explanations of the crisis ascribe all manner of causes to it, but I identified it simply from the fact that it, like the “Great Recession” and the Great Depression, had an extended period of negative credit—see Figure 30.

Figure 30

Private Debt, its rate of change (credit), and banks, and money, are therefore critically important components of the macroeconomy. By ignoring them all, Neoclassical economics is as realistic a model of a monetary production economy as Ptolemy’s Heliocentric paradigm is of the solar system.

Bernanke, Ben S. 2000. Essays on the Great Depression (Princeton University Press: Princeton).

Census, Bureau of. 1949. “Historical Statistics of the United States 1789-1945.” In, edited by Bureau of the Census. Washington: United States Government.

———. 1975. “Historical Statistics of the United States Colonial Times to 1970.” In, edited by Bureau of the Census. Washington: United States Government.

Committee for the Prize in Economic Sciences in Memory of Alfred Nobel, The. 2022. “Financial Intermediation and the Economy.” In. Stockholm: The Royal Swedish Academy of Sciences.

Deutsche Bundesbank. 2017. ‘The role of banks, non- banks and the central bank in the money creation process’, Deutsche Bundesbank Monthly Report, April 2017: 13-33.

Eggertsson, Gauti B., and Paul Krugman. 2012. ‘Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo approach’, Quarterly Journal of Economics, 127: 1469–513.

Faure, Salomon, and Hans Gersbach. 2022. ‘Loanable funds versus money creation in banking: a benchmark result’, Journal of economics (Vienna, Austria), 135: 107-49.

Fiebiger, Brett. 2014. ‘Bank credit, financial intermediation and the distribution of national income all matter to macroeconomics’, Review of Keynesian Economics, 2: 292-311.

Fisher, Irving. 1933. ‘The Debt-Deflation Theory of Great Depressions’, Econometrica, 1: 337-57.

Gleeson-White, Jane. 2011. Double Entry (Allen and Unwin: Sydney).

Keen, Steve. 2014. ‘Endogenous money and effective demand’, Review of Keynesian Economics, 2: 271–91.

———. 2015. ‘The Macroeconomics of Endogenous Money: Response to Fiebiger, Palley & Lavoie’, Review of Keynesian Economics, 3: 602 – 11.

Kumhof, Michael, and Zoltan Jakab. 2015. “Banks are not intermediaries of loanable funds — and why this matters.” In Working Paper. London: Bank of England.

Kumhof, Michael, Romain Rancière, and Pablo Winant. 2015. ‘Inequality, Leverage, and Crises’, The American Economic Review, 105: 1217-45.

Lavoie, Marc. 2014. ‘A comment on ‘Endogenous money and effective demand’: a revolution or a step backwards?’, Review of Keynesian Economics, 2: 321 – 32.

McLeay, Michael, Amar Radia, and Ryland Thomas. 2014. ‘Money creation in the modern economy’, Bank of England Quarterly Bulletin, 2014 Q1: 14-27.

Minsky, Hyman P. 1993. ‘On the Non-neutrality of Money’, Federal Reserve Bank of New York Quarterly Review, 18: 77-82.

Minsky, Hyman P., Edward J. Nell, and Willi Semmler. 1991. ‘The Endogeneity of Money.’ in, Nicholas Kaldor and mainstream economics: Confrontation or convergence? (St. Martin’s Press: New York).

Moore, Basil J. 1979. ‘The Endogenous Money Supply’, Journal of Post Keynesian Economics, 2: 49-70.

———. 1983. ‘Unpacking the Post Keynesian Black Box: Bank Lending and the Money Supply’, Journal of Post Keynesian Economics, 5: 537-56.

———. 1988. Horizontalists and Verticalists: The Macroeconomics of Credit Money (Cambridge University Press: Cambridge).

———. 1997. ‘Reconciliation of the Supply and Demand for Endogenous Money’, Journal of Post Keynesian Economics, 19: 423-28.

Moore, Basil John. 2006. Shaking the Invisible Hand: Complexity, Endogenous Money and Exogenous Interest Rates (Houndmills, U.K. and New York: Palgrave Macmillan).

Palley, Thomas. 2014. ‘Aggregate demand, endogenous money, and debt: a Keynesian critique of Keen and an alternative theoretical framework’, Review of Keynesian Economics, 2: 312–20.

Roberts, Alasdair. 2012. America’s first Great Depression: economic crisis and political disorder after the Panic of 1837 (Cornell University Press: Ithaca).

Schumpeter, Joseph Alois. 1934. The theory of economic development : an inquiry into profits, capital, credit, interest and the business cycle (Harvard University Press: Cambridge, Massachusetts).