Abstract

Though Minsky developed a compelling verbal model of the “Financial Instability Hypothesis” (FIH), he abandoned his early attempts to build a mathematical model of financial instability (Minsky 1957). While many mathematical models of the FIH have been developed since, the criticism that these models are “ad hoc” lingers.

In this paper I show that the essential characteristics of Minsky’s hypothesis are emergent properties of a complex systems macroeconomic model which is derived directly from macroeconomic definitions, augmented by the simplest possible assumptions for relations between system states, and the simplest possible behavioural postulates.

I also show that credit, which I define as the time derivative of private debt, is an essential component of aggregate demand and aggregate income, given that bank lending creates money (Holmes 1969; Moore 1979; McLeay, Radia et al. 2014).

Minsky’s Financial Instability Hypothesis is thus derived from sound macrofoundations. This stylized complex-systems model reproduces not only the core predictions of Minsky’s verbal hypothesis, but also empirical properties of the real world which have defied Neoclassical understanding, and which were also not predictions of Minsky’s verbal model: the occurrence of a “Great Moderation”—a period of diminishing cycles in employment, inflation, and economic growth—prior to a “Minsky Moment” crisis; and a tendency for inequality to rise over time.

The simulations in this paper use the Open Source system dynamics program Minsky, which was named in Minsky’s honour.

Keywords

Minsky, Financial Instability Hypothesis, Complexity, System Dynamics, Credit, Debt, Macroeconomics

JEL Codes

C60, C61, C62, E11, E12, E31, E40, E44, F47, G01, G12, G51, N11, N12, Y1,

Introduction

Though Minsky developed a compelling verbal model of the “Financial Instability Hypothesis” (FIH), he abandoned his early attempts to build a mathematical model of financial instability (Minsky 1957). Many mathematical models of the FIH have been developed since (Taylor and O’Connell 1985; Jarsulic 1989; Keen 1995; Charles 2005; Cruz 2005; Tymoigne 2006; Charles 2008; Fazzari, Ferri et al. 2008; Santos and Macedo e Silva 2009), and Minsky collaborated in some of them (Gatti, Delli Gatti et al. 1994), but the criticism that these models are “ad hoc” lingers (Rosser 1999, p. 83).

In this paper I show that the essential characteristics of Minsky’s hypothesis are emergent properties of a complex systems macroeconomic model which is derived directly from macroeconomic definitions, augmented by the simplest possible assumptions for relations between system states, and the simplest possible behavioural postulates.

I also show that credit—which I define as the time derivative of private debt (see Appendix A)—is an essential component of aggregate demand and aggregate income, given that bank lending creates money (Holmes 1969; Moore 1979; McLeay, Radia et al. 2014).

Minsky’s Financial Instability Hypothesis is thus derived from sound macrofoundations. This stylized complex-systems model reproduces not only the core predictions of Minsky’s verbal hypothesis, but also empirical properties of the real world which have defied Neoclassical understanding, and which were also not predictions of Minsky’s verbal model: the occurrence of a “Great Moderation”—a period of diminishing cycles in employment, inflation, and economic growth—prior to a “Minsky Moment” crisis; and a tendency for inequality to rise over time (Piketty 2014).

Deriving Minsky directly from macroeconomic definitions

Minsky’s Financial Instability Hypothesis is one of the rarest things in the history of economics: a powerful and accurate intuition. Neoclassical economists from Jevons onward have portrayed capitalism as a system that tends to equilibrium—while ignoring both history, and mathematical results like the Perron-Frobenius theorem (Jorgenson 1960; Jorgenson 1961; Jorgenson 1963; McManus 1963; Blatt 1983, , pp. 111-146), that establish otherwise. Marxists predict a perpetual tendency towards stagnation, via simplistic applications of Marx’s “tendency for the rate of profit to fall” (Marx 1894, Chapter 13), or its obverse that “that surplus must have a strong and persistent tendency to rise” (Baran 1968, p. 67). Starting from the still-disputed proposition—not just in Neoclassical economics (Bernanke 2000, p. 24), but in Post Keynesian economics as well (Fiebiger 2014; Keen 2014; Lavoie 2014; Palley 2014; Keen 2015)—that there was a “relation between debt and income” (Minsky 1982, p, 66), Minsky instead deduced that “the fundamental instability of a capitalist economy is upward”. Given the proclivity of economists to model an economist’s theory without having understood it (Hicks 1937; Hicks 1981), this pivotal passage is worth quoting at length:

The natural starting place for analyzing the relation between debt and income is to take an economy with a cyclical past that is now doing well. The inherited debt reflects the history of the economy, which includes a period in the not too distant past in which the economy did not do well… As the period over which the economy does well lengthens, two things become evident in board rooms. Existing debts are easily validated and units that were heavily in debt prospered; it paid to lever. After the event it becomes apparent that the margins of safety built into debt structures were too great. As a result, over a period in which the economy does well, views about acceptable debt structure change. In the deal-making that goes on between banks, investment bankers, and businessmen, the acceptable amount of debt to use in financing various types of activity and positions increases. This increase in the weight of debt financing raises the market price of capital assets and increases investment. As this continues the economy is transformed into a boom economy.

Stable growth is inconsistent with the manner in which investment is determined in an economy in which debt-financed ownership of capital assets exists, and the extent to which such debt financing can be carried is market determined. It follows that the fundamental instability of a capitalist economy is upward. The tendency to transform doing well into a speculative investment boom is the basic instability in a capitalist economy. (Minsky 1982, p, 66. Emphasis added)

Minsky explained the source of his “preanalytic cognitive act … called Vision” (Schumpeter 1954, p. 41) that led to the Financial Instability Hypothesis as his desire to explain what causes Great Depressions:

Can “It”—a Great Depression—happen again? And if “It” can happen, why didn’t “It” occur in the years since World War II? These are questions that naturally follow from both the historical record and the comparative success of the past thirty-five years. To answer these questions it is necessary to have an economic theory which makes great depressions one of the possible states in which our type of capitalist economy can find itself. (Minsky 1982, p. xix. Emphasis added)

Though this was a compelling and ultimately successful Vision, the dominant Vision in macroeconomics remains the need to derive it from “good” foundations, where Neoclassical economists have defined “good” as the capacity to derive macroeconomics from microeconomics. As Robert Lucas, the father of “rational expectations macroeconomics”, put it in an address subtitled “My Keynesian Education”:

I also held on to Patinkin’s ambition somehow, that the theory ought to be microeconomically founded, unified with price theory. I think this was a very common view… Nobody was satisfied with IS-LM as the end of macroeconomic theorizing. The idea was we were going to tie it together with microeconomics and that was the job of our generation. Or to continue doing that. That wasn’t an anti-Keynesian view. (Lucas 2004, p. 20)

Despite the failure of the models derived from this Vision to anticipate the Great Recession, this remains the core Vision in economics. Even the relatively progressive mainstream economist Olivier Blanchard could see no alternative to deriving macroeconomics from microeconomics:

Starting from explicit microfoundations is clearly essential; where else to start from? (Blanchard 2018, p. 47)

The answer to Blanchard’s question is surprisingly simple: you can start directly from macroeconomics itself. The fundamentals of Minsky’s successful hypothesis can be derived directly from incontestable macroeconomic definitions, allied to the simplest possible definitions for both key economic relationships and essential behavioural functions.

The essential macroeconomic definitions needed are the employment rate , the wages share of GDP , the private debt to GDP ratio , the output to employment ratio , and the capital to output ratio :

When the first three of these are differentiated with respect to time, three true-by-definition dynamic statements result:

- The employment rate will rise if economic growth exceeds the sum of change in the output to labour ratio and population growth;

- The wages share of output will rise if the total wages grow faster than GDP; and

- The private debt to GDP ratio will rise if private debt growth exceeds the rate of economic growth

These statements are shown in Equation , where is used to signify :

The following simplifying assumptions are used to turn these definitions into an economic model:

Table 1: Simplifying Assumptions

|

Assumption |

Equation |

Parameters & Initial Conditions |

|

1. Exogenous growth in the output to labour ratio |

||

|

2. Exogenous population growth |

||

|

3. A constant capital (K) to output (Y) ratio |

||

|

4. The rate of change of capital is net investment, which is gross investment minus depreciation |

||

|

5. A uniform real wage |

||

|

6. A linear wage change function driven by the employment rate . is the slope of the wage-change function and is the employment rate at which wage change equals zero. |

||

|

7. A linear gross investment function driven by the profit rate . is the slope of the investment function and is the profit rate at which gross investment equals profit . |

||

|

8. Credit, which I define as the annual change in debt (see Appendix D), finances gross investment in excess of profits |

||

|

9. Profit is output net of wages and interest payments |

||

|

10. Initial conditions for |

Applying these assumptions, and signifying the real growth rate as , leads to the model shown in Equation

As shown in Appendix B, this inherently nonlinear model has two meaningful equilibria: one with a positive employment rate, positive wages share, and debt to GDP ratio, which Grasselli & Costa Lima dubbed the “good equilibrium”; another with zero employment, zero wages share, and an infinite debt to GDP ratio, which they dubbed the “bad equilibrium” (Grasselli and Costa Lima 2012).

The key parameter that determines the stability of these two equilibria is the slope of the investment function. With a low desire to invest ()—which, on the surface, would appear to imply a poorer level of economic performance—the “good equilibrium” is stable with equilibrium values of (see Figure 1), with the system converging over a large number of cycles.

Figure 1: Simulation with : convergence to the “good equilibrium”

However, with a high desire to invest ()—which, on the surface, would appear to imply a higher level of economic performance—the “good equilibrium” is unstable, with equilibrium values of (see Figure 2).

Figure 2: Simulation with : a “Great Moderation” followed by rising cycles and breakdown

The approach to, and then repulsion from, the good equilibrium follows what is known as the “intermittent route to chaos” (Pomeau and Manneville 1980), in which systemic turbulence appears to decline, only to subsequently rise once more. This reproduces several of the stylized facts of recent macroeconomic data:

- A rising level of private debt compared to GDP;

- An initial apparent decline in the volatility of employment, growth and wage demands—a “Great Moderation”—followed by increasing volatility and (ultimately) an economic collapse—a “Great Recession”; and

- Rising inequality, as the increased share going to bankers (in this three-class system) comes at the expense not of capitalists—who are the only ones borrowing in this simple model—but at the expense of the workers’ share of income.

A simple model derived directly from macroeconomic definitions thus reproduces the essence of Minsky’s FIH: the faster cyclical growth of debt relative to income over a series of credit-driven boom and bust cycles, leading to a period of increasing volatility and, in this model without bankruptcy or government, ultimate a terminal economic breakdown.

One essential aspect of this model is the proposition that the change in debt finances part of investment, and thus part of aggregate demand—loans are not “pure redistributions” (Bernanke 2000, p. 24) as portrayed in Neoclassical literature, but increases in bank assets which simultaneously create both money and additional aggregate demand and income. This can be proven using the key macroeconomic identity that expenditure is income.

The role of credit in aggregate demand and aggregate income

Central Banks have recently relieved Post Keynesian economists of the necessity of insisting that their “Endogenous Money” model of banking behaviour is structurally correct (Holmes 1969; Moore 1979; Moore 1988; Moore 1988; Dow 1997; Rochon 1999; Fullwiler 2013), while the Neoclassical models of “Loanable Funds” and the “Money Multiplier” are incorrect (McLeay, Radia et al. 2014; Deutsche Bundesbank 2017).

However, though the endogeneity of money is fully accepted in Post Keynesian and MMT circles, the macroeconomic significance of Endogenous Money is not. For instance, in a recent blog post, Wray argued that “in retrospect the endogenous money literature is trivial for several reasons”, with its implications largely being confined to how central banks set interest rates (Wray 2019). Similarly, in the debate in the Review of Keynesian Economics over an earlier, initially flawed, and more complicated expression of the arguments in this section (Fiebiger 2014; Keen 2014; Lavoie 2014; Palley 2014; Keen 2015), Fiebiger treated passages in which Minsky attempted to establish a role in aggregate demand for a change in the money supply (caused by a change in debt) as simply expressing a tautology:

Given the parameters specified, Minsky‘s (Minsky 1975, p. 133) deduction that ΔMt must be the source of growth allows Yt ex ante > Yt–1 ex post to be viewed as a tautology. (Fiebiger 2014, p. 295)

In the following tables (which I term “Moore Tables” in honour of Basil Moore), I use the key macroeconomic identity that expenditure is income to show that endogenous money is far from macroeconomically trivial, and that Minsky’s comments in (Minsky 1975, p. 133) and (Minsky 1982, pp. 3-6 in a section entitled “A sketch of a model”) were not tautological, but critical insights whose expression was hampered by the use of period analysis (Fontana 2003; Fontana 2004), as were Fiebiger’s attempts to interpret them. These tables show flows in continuous time, including credit, which I define as the time derivative of debt:

As in any differential equation, these flows are measured instantaneously, and dimensioned in the relevant time unit, which is dollars per year. I know that this is a foreign concept to a discipline accustomed to thinking in terms of periods, normally of a year: doesn’t one have to measure for a year to speak of, for example, credit per year? In fact, one does not. A monetary flow can be measured at an instant in time in terms of dollars per year, just as a car’s speedometer measures velocity at an instant in time in terms of kilometres per hour: since velocity is the time derivative of distance, if an instantaneous velocity of 100km/hr were maintained for an hour, then the vehicle would cover 100 kilometres in that hour. The same principle applies to the near instantaneous measurement of financial flows, even though they are the sum of a large number of discrete but asynchronous transactions sampled across a very small instant of time.

Each row in a Moore Table shows expenditure by one sector on the others in an economy. Expenditure is shown as a negative entry on the diagonal of the table, and a positive entry on the off-diagonal, with the two necessarily summing to zero on each row and the overall table. The negative sum of the diagonal of the table is aggregate demand , while the sum of the off-diagonal elements is aggregate income . The two are necessarily equal: expenditure is income.

Figure 3 shows a monetary economy in which neither lending nor borrowing can occur. The flows A to F represent the turnover of an existing and constant money stock, and in this sense are comparable to Friedman’s mythical “Optimum Quantity of Money” economy (Friedman 1969), though minus the helicopters dispensing money. The sum of these monetary flows can thus be substituted by the velocity of money V times the stock of money M, as in Equation .

Figure 3: Moore Table for a monetary economy with no lending

|

|

Sector 1 |

Sector 2 |

Sector 3 |

Sum |

|

Sector 1 |

-(A+B) |

A |

B |

0 |

|

Sector 2 |

C |

-(C+D) |

D |

0 |

|

Sector 3 |

E |

F |

-(E+F) |

0 |

|

Sum |

(C+E)-(A+B) |

(A+F)-(C+D) |

(B+D)-(E+F) |

0 |

Figure 4: Moore Table for Loanable Funds

|

|

Sector 1 |

Sector 2 |

Sector 3 |

Sum |

|

Sector 1 |

-(A+B+Credit +Interest) |

A+Interest |

B+Credit |

0 |

|

Sector 2 |

C |

-(C+D-Credit) |

D-Credit |

0 |

|

Sector 3 |

E |

F |

-(E+F) |

0 |

|

Sum |

(C+E)-(A + B + Credit + Interest) |

(A+ F+ Interest) – (C+D-Credit) |

(B+D)-(E+F) |

0 |

The sum of either the off-diagonal elements of Figure 4 (or the negative of the sum of the diagonal) confirms the belief of Neoclassical economists, that if banks were just intermediaries, then credit would be a pure redistribution, and it would play no role in aggregate demand and income. However, one interesting result is that (gross) interest payments are part of aggregate demand and aggregate income—see Equation .

Figure 5 shows the real-world situation that Credit money is created by bank lending. The Table is now expanded to show the Assets, Liabilities and Equity of the Banking Sector, and monetary flows now include the matching increase of Assets and Liabilities when a new loan (Credit, denominated in $/Year) is made, as well as transfers between Liabilities (predominantly deposit accounts), and also Bank Equity. The Credit money created by the loan is used by Sector 1 to buy goods from Sector 3, and Sector 1 is obliged to service the stock of outstanding loans by paying the flow of Interest $/Year to the Bank (which is recorded in its Equity account).

Figure 5: Moore Table for Endogenous Money (“Bank Originated Money and Debt”)

|

|

Assets |

Liabilities (Deposit Accounts) |

Equity |

|

||

|

|

Debt |

Sector 1 |

Sector 2 |

Sector 3 |

Bank |

Sum |

|

Sector 1 |

Credit |

-(A+B + Credit + Interest) |

A |

B + Credit |

Interest |

0 |

|

Sector 2 |

|

C |

-(C+D) |

D |

|

0 |

|

Sector 3 |

|

E |

F |

-(E+F) |

|

0 |

|

Bank |

|

G |

H |

I |

-(G+H+I) |

|

|

Sum |

|

(C+E+G) – (A+B + Credit + Interest) |

(A+F+H)-(C+D) |

(B+D+I+Credit)-(E+F) |

Interest-(G+H+I) |

0 |

The crucial result here is that Credit is part of both aggregate demand and aggregate income, in the real world of Endogenous Money in which bank lending creates money:

This realisation strengthens the underlying Post Keynesian and MMT methodologies. Not only is “Endogenous Money/BOMD” a more realistic description of banking than “Loanable Funds”, it has an enormous impact on macroeconomics as well. Macroeconomic models that omit banks, debt, money—and therefore the role of credit in aggregate demand and income—omit the “causa causans that factor which is most prone to sudden and wide fluctuation” (Keynes 1936, p. 221), and are utterly misleading models of the macroeconomy. This judgment applies to the entire corpus of Neoclassical economics, bar the work of Michael Kumhof (Kumhof and Jakab 2015; Kumhof, Rancière et al. 2015).

Simulating Loanable Funds and BOMD

The macroeconomic significance of BOMD can be easily illustrated by converting a simple model of Loanable Funds in Minsky to a model of BOMD. The Loanable Funds model is fashioned on the model in (Eggertsson and Krugman 2012), where the consumer sector lends to the investment sector via a bank which operates as an intermediary, and which charges an introduction fee to the consumer sector. The model is completed by the employment of workers by both sectors, intermediate goods purchases by each sector from the other, and purchases of goods by workers and bankers.

The five accounts in the banking sector’s Godley Table are Reserves on its Assets side, three deposit accounts on its Liabilities—one each for the Consumer Sector , Investment Sector and workers —and the Bank’s Equity account . The transaction of lending, repayment, interest payments and the bank fee all operate through the Liability side of the Banking sector’s ledger: its Assets are unaffected (see Figure 6).

Figure 6: Banking sector view of Loanable Funds

Conversely, the financial operations all occur on the Asset side of the Consumer (lending) sector’s Godley Table (see Figure 7). Lending reduces the amount of money in the consumer sector’s deposit account, and increases the debt that the investment sector owes to it (see Figure 7).

Figure 7:Consumer (lender) sector view of Loanable Funds

For the borrower, the financial operations alter its Assets and its Liabilities equally. Credit increases its Asset the deposit account it has with the Banking Sector, and identically increases its liability of , its debt to the consumer sector (see Figure 8).

Figure 8: The Investment Sector’s (borrower’s) view of the economy

The core differential equations of this model, shown in Equation , can be derived directly by summing the columns of Figure 6 and Figure 7 (the flows that will be affected by the later conversion of this model to BOMD are highlighted in red):

All flows are defined in terms of first-order time lags related to the relevant account. In particular, lending by the consumer sector is shown as being based on the amount left in its bank account , while repayment by the Investment Sector is based upon the level of outstanding debt :

The parameters and are time constants, which can be varied during a simulation: reducing increases the speed of lending while reducing increases the speed of repayment. These are varied in the simulation shown in Figure 10. Substantial variations in the speed of lending and repayment dramatically alter the private debt to GDP ratio, but only transiently affect economic activity.

This simulation confirms the Neoclassical conditional logic that, if banks were mere intermediaries as Loanable Funds portrays them to be, then banks, debt and money could be ignored in macroeconomics. Large changes in credit have negligible impact upon GDP growth—and in fact credit and GDP growth move in opposite directions in this simulation, because the borrower has been given a lower overall propensity to spend than the lender, so that an increase in lending actually reduces GDP via a fall in the velocity of money (and vice-versa: see Figure 9).

Figure 9: Loanable Funds in Minsky. Credit has no significant impact on macroeconomics

This was done to illustrate Bernanke’s assertion that, when lending is simply a “pure redistribution” (Bernanke 2000, p. 24), any macroeconomic impact of lending depends on differences in the marginal spending propensities of the lender and borrower. With the macroeconomic impact of credit depending on idiosyncratic characteristics of the borrower and lender, there is no systemic benefit for including banks, debt, and arguably, money, in macroeconomic theory for a world in which Loanable Funds is true.

Figure 10: Varying lending & repayment rates in Loanable Funds; no significant macroeconomic effects

However, in the real world, banks originate money and debt, and the impact of banks, debt and money on macroeconomics is highly significant. This can be illustrated by making the technically minor but systemically huge changes needed to convert this model of Loanable Funds into Bank Originated Money and Debt (BOMD)—by shifting debt from being an asset of the Consumer Sector to an asset of the Banking Sector (and deleting the superfluous “Fee”, since the Banking Sector now gets its income from the flow of interest). Credit thus increases the Assets of the banking sector and its Liabilities (the sum in the Investment Sector’s account ) by precisely the same amount.

Figure 11: Banking sector view of BOMD

The financial equations of this system are shown in Equation . These are simpler than the equations for Loanable Funds: the mythical intermediation is deleted, the three financial operations are removed from the equation for , and the interest payment now goes to the Banking Sector’s Equity account

These structural changes are the only differences between the two models in this paper. Strictly speaking, the flow of new debt should have been redefined, but this was left as is, to illustrate that the change in the structure of lending alone is sufficient to drastically transform macroeconomics from a discipline in which banks, debt and money can be ignored, into one in which they are critical.

Figure 12: Bank Originated Money and Debt in Minsky. Credit plays a critical role in macroeconomics

These simple structural changes lead to credit having an enormous impact on the economy. Credit and GDP growth now move in the same direction, and GDP grows when credit is positive and falls when it is negative. In keeping with the logical analysis of the previous section, credit adds to aggregate demand and income when it is positive, and subtracts from it when it is negative.

Figure 13: Varying lending & repayment parameters in BOMD: significant macroeconomic effects

Accounting for the Great Moderation & the Great Recession

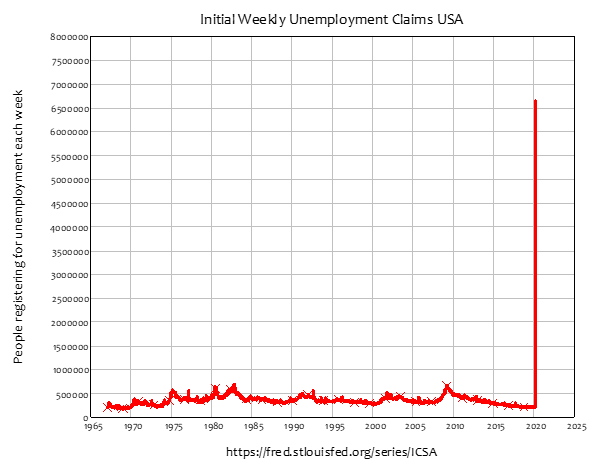

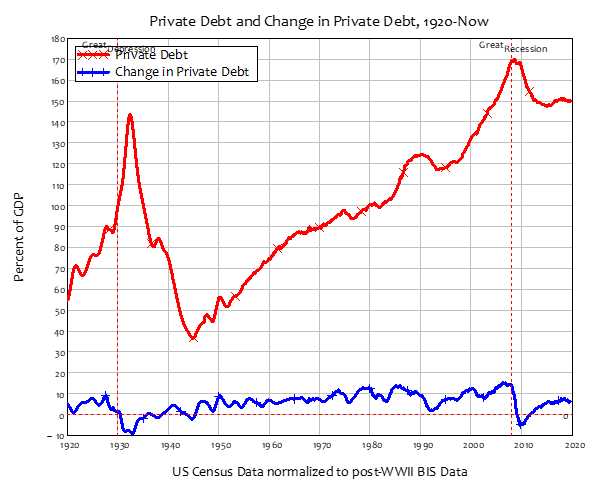

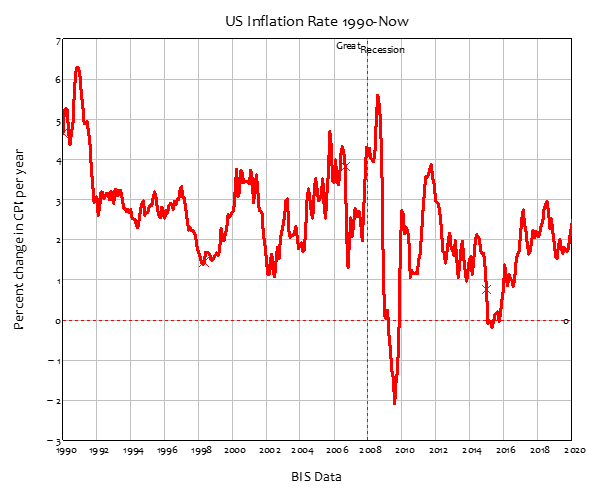

The models and logical analysis of the previous three sections provide a causal argument for a relationship between the levels of debt and credit and macroeconomics, and in particular, the experience of severe economic crises like the 2008 “Great Recession”. A rising level of debt relative to GDP, and a rising significance of credit relative to GDP, are Minskian warnings of a crisis, while the crisis is caused by a plunge in credit from strongly positive to strongly negative. The plunge in credit from a peak of 15% of GDP in late 2006 to a depth of -5% in late 2009 was the first experience of negative credit since the end of WWII, and this was the cause of the Great Recession.

Figure 14: The “Great Recession” was the first negative credit event in post-WWII economic history

The empirical relationship between credit and the level of unemployment rises as the level of private debt rises, and by the time of the recovery from the 1990s recession, it is overwhelming: in a ridiculously strong contrast to Bernanke’s Neoclassical a priori dismissal of Fisher’s Debt Deflation explanation for the Great Depression on the grounds that “Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macroeconomic effects” (Bernanke 2000, p. 24), the correlation between credit and unemployment since 1990 is a staggering -0.85 (see Figure 15).

Figure 15: Credit and Unemployment. Correlation -0.53 since 1970, -0.85 since 1990

––p

The role of negative credit in the USA’s major economic crises

Since credit has no role in mainstream economic theory, the collection of data on private debt and credit has been sporadic, depending more on the initiative of statisticians than the expressed needs of economists for data. This situation has improved dramatically in recent years thanks to the work of the Bank of International Settlements (Borio 2012; Dembiermont, Drehmann et al. 2013), the Bank of England (Hills, Thomas et al. 2010) and various non-mainstream economists (Jorda, Schularick et al. 2011; Schularick and Taylor 2012; Vague 2019), but much remains to be done to provide the comprehensive time series data that the significance of debt and credit warrants.

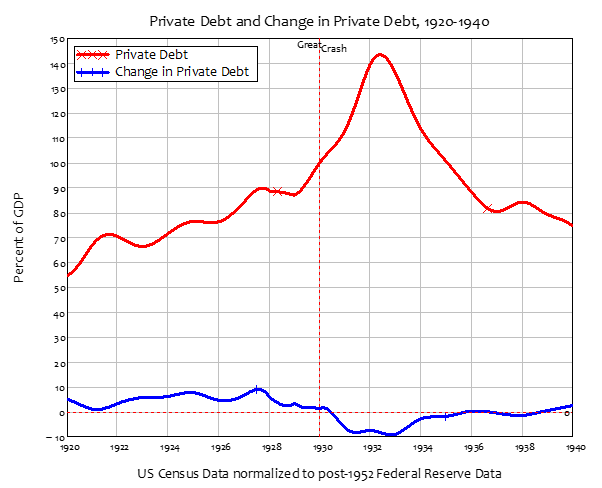

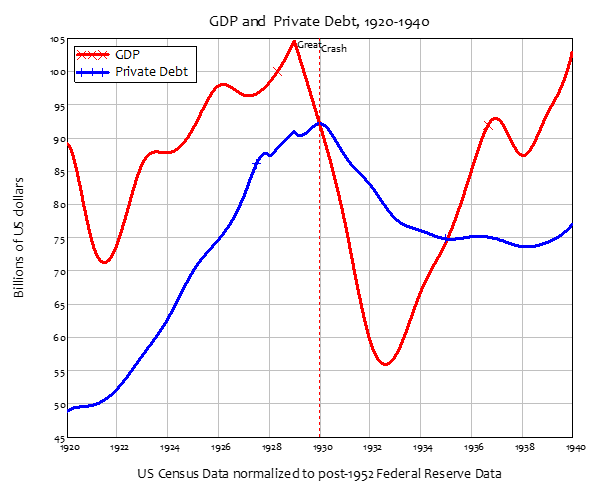

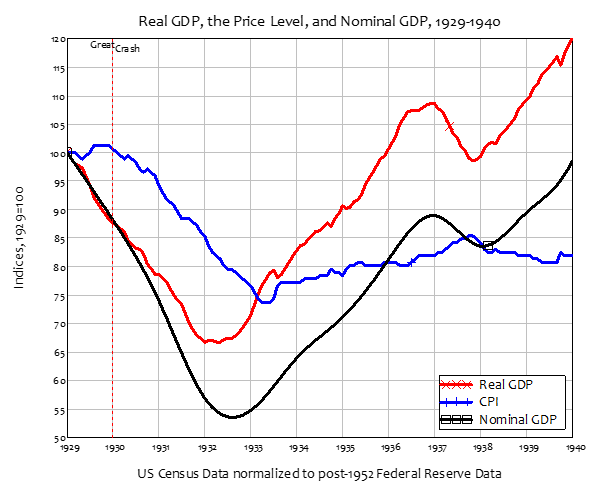

However, some data can still be retrieved that helps make sense of past economic crises (Vague 2019). In particular, a long term debt series can be derived for the USA from three very different time series: the post-1952 Federal Reserve Flow of Funds data; Census data for debt between 1916 and 1970; and a series on loans by selected banks between 1834 and 1970 (Census 1949; Census 1975).

Figure 16: Debt to GDP data from the BIS & US Census

Fortunately, the data series overlap, and the trends in the data show that, though the definitions differed, the same fundamental processes were being tracked by these three data series. This allows a composite time series to be assembled by rescaling the two Census data series to match the current BIS/Federal Reserve data set. When credit data is derived from this composite series, two phenomena stand out: firstly, America’s greatest economic crises are caused by sustained periods of negative credit; and secondly, the post-WWII regime has only one negative credit event—the “Great Recession”—while the pre-WWI regime had frequent, though smaller, negative credit experiences (see Figure 17). The two greatest were the Great Depression, and the “Panic of 1837” (Roberts 2012).

While Great Depression and the Great Recession are etched into our collective memories, I was personally unaware of the “Panic of 1837” until this credit data alerted me to the scale of negative credit at that time. Though the recorded level of private debt was low compared to post-WWII levels, the rate of decline of debt—the scale of negative credit—was both enormous and sustained. Credit was negative between mid-1837 and 1844, and hit a maximum rate of decline of 9% of GDP. It is little wonder that the “Panic of 1837” was described as “an economic crisis so extreme as to erase all memories of previous financial disorders” (Roberts 2012, p. 24).

Figure 17: Composite time series for private debt and credit derived from the data in Figure 16

Nonlinearity and Realism

The model in Equation generates symmetric cycles—booms that are as big as busts, before a final collapse—simply because of the unrealistic assumption, made for reasons of analytic tractability, of linear behavioural relations (assumptions 7 & 8 in Table 1). Realistically, workers wage demands given the level of employment are nonlinear, as Phillips insisted (Phillips 1954; Phillips 1958), as are the investment reactions of capitalists to the rate of profit, as Minsky insisted with his perceptive concept of “euphoric expectations” (Minsky 1982, p. 140).

Keen’s 1995 Minsky model (Keen 1995) used the hyperbolic nonlinear function suggested by Blatt (Blatt 1983, p. 213) to avoid unrealistic outcomes, such as the employment rate exceeding 100% in a nonlinear Goodwin model (Goodwin 1967). A generalized exponential function can be used instead (see Equation ), which could allow unrealistic values. However, these are avoided by suitable choices of input variables (the employment to population ratio rather than the unemployment rate in the “Phillips Curve” function).

The parameters shown in Table 2 (stable wages at 60% employment, a slope of 2 for the wage change function at 60% employment, and a maximum wage decline of 4% per annum; investment 3% of GDP at 3% profit rate, investment function slope at 3% of 2, and a minimum gross investment level of zero) generate an asymmetric process in which the ultimate downturns are deeper than the booms. Nonlinear behavioural assumptions thus improve the realism of the model, but do not change its fundamental properties, which emanate from the inherent structural nonlinearity of the model itself.

Table 2: Nonlinear behavioural functions for wage change and investment

|

Assumption |

Parameters |

|

11. Nonlinear wage change function parameters |

, min=-4% |

|

12. Nonlinear investment function parameters |

, min=0 |

Extending the definitions to include inflation

A simple single-price-level nominal extension can be derived from definitions in the same fashion as the model in Equation , though it takes more assumptions to turn the definitional dynamic statements into a model. The definition of the employment rate is unchanged, while the definitions of the wages share of GDP and the debt to GDP ratio are both in monetary terms:

When differentiated with respect to time, this yields three definitionally true statements as before, but this time the rate of change of prices is a component of two of them:

- The employment rate will rise if real economic growth exceeds the sum of population growth and growth in labor productivity;

- The wages share of output will rise if money wage demands exceed the sum of inflation and growth in labor productivity; and

- The private debt to GDP ratio will rise if the rate of growth of private debt exceeds the sum of inflation plus the rate of economic growth.

In equations, these statements are:

where the subscript R signifies “real” as opposed to monetary.

Conclusion: the macroeconomic foundations of macroeconomics

Minsky’s Financial Instability Hypothesis is thus not merely a particular Post Keynesian model, but a foundational model of macroeconomics, in the same sense that Lorenz’s model of turbulence in fluid dynamics is a foundational model for meteorology (Lorenz 1963). Though Minsky did not do this himself, a model of his hypothesis can be derived directly from the impeccably sound macroeconomic foundations of incontestable macroeconomic definitions. It can be extended in the same manner, by adding definitions for government spending, asset price dynamics that differ from commodity price dynamics, multi-sectoral production, etc. The structure and history of an economy are the primary drivers of its behaviour, rather than the behaviour of individual agents in it. “Agents” are, as Marx famously remarked, constrained by history:

Men make their own history, but they do not make it as they please; they do not make it under self-selected circumstances, but under circumstances existing already, given and transmitted from the past. The tradition of all dead generations weighs like a nightmare on the brains of the living. (Marx 1852, Chapter 1)

System dynamics enables the modelling of the structure, the history, and the dynamics of the economy. Minsky’s genius was that he perceived, without this technology, the essential elements of all three that make capitalism prone to crises. Minsky and system dynamics therefore provide the foundations for a paradigmatic challenge to Neoclassical economics, whose development has been driven by the obsession with finding sound microfoundations for macroeconomics, all the while ignoring results that showed this was impossible (Gorman 1953; Anderson 1972; Sonnenschein 1972; Sonnenschein 1973). Macrofoundations, far-from-equilibrium complex systems dynamics, and monetary analysis—the polar opposites of the Neoclassical obsessions with microfoundations, equilibrium and barter—are the proper bases for economic theory.

Postscript: Minsky the Software

All the models in this paper have been built in Minsky, which is an Open Source system dynamics program with the unique feature enabling financial flows to be modelled easily—and their structure modified easily—using interlocking double-entry bookkeeping tables called “Godley Tables” (in honour of Wynne Godley). Minsky can be downloaded from SourceForge, or its Patreon page. The developers would appreciate it if specialists on Minsky the economist—and Post Keynesian economists in general—would download Minsky the software, and help to extend it further by providing user feedback.

Appendix

-

Continuous versus discrete time

A referee suggested that discrete-time difference equations were more appropriate “for problems which are specified in terms of accounting relationships (which are discrete)”, and that continuous-time differential equations “gives rise to nonobvious relationships in the structure of delays. What kind of profit does finance investment? Obviously past profit; but the specification in continuous-time does not allow to make it evident.”

While each individual financial transaction is discrete, each is also asynchronous with other financial transactions. In a “top down” model, aggregate asynchronous phenomena are more realistically modelled using continuous time than discrete time: this is why aggregate population growth models use continuous time, even though each birth is a discrete event.

The time delays in discrete time economic models are also normally arbitrary. They are almost always in terms of years, which is reasonable for investment, but not for consumption, where the scale should be in terms of weeks or months rather than years. To do discrete-time modelling properly, consumption in period t should be modelled as depending on income in period t-2 (say), where the time period is measured in weeks, while investment in period t should be modelled as depending on the change in income between period t-26 and t-52 (say).

But firstly, no-one does this, because it is simply too complicated: in practice, lags of one year are commonplace in macroeconomic discrete time models. Secondly, if this were done, and empirical work later found that investment in period t actually depended on the change income between period t-40 and t-86 (say), then entire structure of the model would need to be re-written. This is not necessary for a continuous time model, where the equivalent function to a time delay is a time lag. The dependence of, for example, investment today on profits in the past, could be shown using a linear first order time lag: a new variable is defined (say, ) which is shown as converging to the actual variable with a time lag of , where the value of is measured in years:

The scalar can be altered in a continuous time model without having to alter the structure to the model itself.

Time lags were not used in the model derived from macroeconomic definitions, because the objective was to produce the simplest possible model working from those definitions, and because time lags introduce dynamics of their own, independent of the structural points made by that model. However, time lags were integral to the models of Loanable Funds and Bank Originated Money and Debt (BOMD), in which they linked the outstanding stocks to the flows. The full equation for the rate of change of private debt in the BOMD model is:

Here is the length of time that new lending would take to double D if it occurred at a linear rate, while tells how long repayment would take to reduce D to zero if it occurred at a linear rate. For more on discrete vs continuous time modelling, and time lags in economic modelling, see (Andresen 2018).

-

Stability analysis of basic Minsky model

The basic Minsky model is:

The following shorthand expressions are used in this model with linear behavioural functions:

Spelling out these shorthand expressions yields the fully specified model, which makes it easier to identify the nonlinear feedbacks in this model. Instances where the system states interact nonlinearly with each other are highlighted in red: there are two dampening nonlinear feedbacks in the equation for , one amplifying feedback for , and two amplifying feedbacks for (including one term in ).

The “good” equilibrium of this model is more easily derived by solving for the zeros of these equations via the substitution that  (with ):

(with ):

This equilibrium is in terms of the profit share, employment rate and debt ratio: the wages share is a derivative of these, since  . This residual role for the wages-share of output manifests itself in the model dynamics as well: before the crisis, the wages share falls as the debt level rises, while the profit share fluctuates around its equilibrium. This confirms Marx’s intuition in Capital I that wages are a dependent variable in capitalism: “To put it mathematically: the rate of accumulation is the independent, not the dependent, variable; the rate of wages, the dependent, not the independent, variable” (Marx 1867, Chapter 25, Section 1).

. This residual role for the wages-share of output manifests itself in the model dynamics as well: before the crisis, the wages share falls as the debt level rises, while the profit share fluctuates around its equilibrium. This confirms Marx’s intuition in Capital I that wages are a dependent variable in capitalism: “To put it mathematically: the rate of accumulation is the independent, not the dependent, variable; the rate of wages, the dependent, not the independent, variable” (Marx 1867, Chapter 25, Section 1).

The stability of the system about its equilibria are given by its Jacobian, which, given the system’s 3 dimensions and 10 parameters, is very complicated. Making the substitutions that , it is

Substituting numerical values for all but the key parameter yields the characteristic polynomial of the Jacobian in terms of :

This has one real eigenvalue which is always negative, and two complex eigenvalues which have zero or negative real parts for values of , and positive real parts for : see Figure 18. The system thus bifurcates at this point, changing from one where the “good equilibrium” is stable and a cyclical attractor, to one where it is unstable and a cyclical repeller: the system converges towards it under the influence of the negative real eigenvalue until, in proximity to this equilibrium, the real parts of the complex eigenvalues repel the system, which then explosively converges to the “bad equilibrium”.

Figure 18: Eigenvalues for π_S=6 & 6.1, as calculated symbolically in Mathcad

-

Loanable Funds & BOMD

The key differential equations for the models of Loanable Funds and BOMD as shown in Equations and respectively. The definitions they share are shown in Equation :

-

Distinguishing Debt from Credit

Kalecki once famously remarked that economics was “the science of confusing stocks with flows” (Robinson 1982, p. 295). That is apparent in the confusion caused by the use of the word “Credit” to describe both the level of debt (in $) and its rate of change (in $/year). An outstanding example of this is the paper “The Economic Crisis from a Neoclassical Perspective” (Ohanian 2010), by the prominent “New Classical” economist Lee Ohanian, in which he rules out the “financial explanation” of the 2008 crisis on the basis of the following empirical argument:

The financial explanation also argues that the 2007-2009 recession became much worse because of a significant contraction of intermediation services. But some measures of intermediation have not declined substantially. Figure 4, which is updated from Chari, Christiano, and Kehoe (Chari, Christiano et al. 2008), shows that bank credit relative to nominal GDP rose at the end of 2008 to an all-time high. And while this declined by the first quarter of 2010, bank credit was still at a higher level at this point than any time before 2008… These data suggest that aggregate quantities of intermediation volumes have not declined markedly. (Ohanian 2010, p. 59)

Ohanian’s Figure 4 is reproduced below. It is obvious from the scale that the data he used recorded the stock of outstanding debt, rather than the flow of new debt: if new debt had indeed been between 1.2 and 2 times GDP every year since 1978, then private debt would have been many hundreds to thousands of times GDP by 2010. He—and Chari, Christiano, and Kehoe before him (Chari, Christiano et al. 2008; Troshkin 2008)—interpreted that stock as a flow, in part because the word “credit” was used to describe it—and also of course because this error suits the non-monetary analysis of Neoclassical economics. On the basis of this obvious error, Ohanian (and Chari, Christiano, and Kehoe before him) reject the argument that the financial crisis of 2008 was in fact a financial crisis.

To avoid this stock-flow confusion, I use the word “Debt” to describe the level of debt, dimensioned in currency units, and “Credit” to describe the flow of new debt, dimensioned in currency units per year. I recommend this practice to other Post Keynesians.

References

Anderson, P. W. (1972). “More Is Different.” Science

177(4047): 393-396.

Andresen, T. (2018). On the Dynamics of Money Circulation, Creation and Debt – a Control Systems Approach. Engineering Cybernetics, Norwegian University of Science and Technology.

Baran, P. A. (1968). Monopoly capital an essay on the American economic and social order / Paul A. Baran and Paul M. Sweezy. New York, New York : Monthly Review Press.

Bernanke, B. S. (2000). Essays on the Great Depression. Princeton, Princeton University Press.

Blanchard, O. (2018). “On the future of macroeconomic models.” Oxford Review of Economic Policy

34(1-2): 43-54.

Blatt, J. M. (1983). Dynamic economic systems: a post-Keynesian approach. Armonk, N.Y, M.E. Sharpe.

Borio, C. (2012) “The financial cycle and macroeconomics: What have we learnt?” BIS Working Papers.

Census, B. o. (1949). Historical Statistics of the United States 1789-1945. B. o. t. Census. Washington, United States Government.

Census, B. o. (1975). Historical Statistics of the United States Colonial Times to 1970. B. o. t. Census. Washington, United States Government.

Chari, V., L. Christiano, et al. (2008). “Facts and myths about the financial crisis of 2008.” IDEAS Working Paper Series from RePEc.

Charles, S. (2005). “A Note on Some Minskyan Models of Financial Instability.” Studi Economici

60(86): 43-51.

Charles, S. (2008). “Teaching Minsky’s Financial Instability Hypothesis: A Manageable Suggestion.” Journal of Post Keynesian Economics

31(1): 125-138.

Cruz, M. (2005). “A Three-Regime Business Cycle Model for an Emerging Economy.” Applied Economics Letters

12(7): 399-402.

Dembiermont, C., M. Drehmann, et al. (2013). “How much does the private sector really borrow? A new database for total credit to the private nonfinancial sector.” BIS Quarterly Review(March): 65-81.

Deutsche Bundesbank (2017). “The role of banks, non- banks and the central bank in the money creation process.” Deutsche Bundesbank Monthly Report: 13-33.

Dow, S. C. (1997). Endogenous Money. A “second edition” of The general theory. G. C. Harcourt and P. A. Riach. London, Routledge. 2: 61-78.

Eggertsson, G. B. and P. Krugman (2012). “Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo approach.” Quarterly Journal of Economics

127: 1469–1513.

Fazzari, S., P. Ferri, et al. (2008). “Cash Flow, Investment, and Keynes-Minsky Cycles.” Journal of Economic Behavior and Organization

65(3-4): 555-572.

Fiebiger, B. (2014). “Bank credit, financial intermediation and the distribution of national income all matter to macroeconomics.” Review of Keynesian Economics

2(3): 292-311.

Fontana, G. (2003). “Post Keynesian Approaches to Endogenous Money: a time framework explanation.” Review of Political Economy

15(3).

Fontana, G. (2004). “Hicks on monetary theory and history: money as endogenous money.” Cambridge Journal of Economics

28: 73-88.

Friedman, M. (1969). The Optimum Quantity of Money. The Optimum Quantity of Money and Other Essays. Chicago, MacMillan: 1-50.

Fullwiler, S. T. (2013). “An endogenous money perspective on the post-crisis monetary policy debate.” Review of Keynesian Economics

1(2): 171–194.

Gatti, D. D., D. Delli Gatti, et al. (1994). Financial Institutions, Economic Policy, and the Dynamic Behavior of the Economy. Levy Economics Institute of Bard College Working Papers. Annandale-on-Hudson, NY, Levy Economics Institute.

Goodwin, R. M. (1967). A growth cycle. Socialism, Capitalism and Economic Growth. C. H. Feinstein. Cambridge, Cambridge University Press: 54-58.

Gorman, W. M. (1953). “Community Preference Fields.” Econometrica

21(1): 63-80.

Grasselli, M. and B. Costa Lima (2012). “An analysis of the Keen model for credit expansion, asset price bubbles and financial fragility.” Mathematics and Financial Economics

6: 191-210.

Hicks, J. (1981). “IS-LM: An Explanation.” Journal of Post Keynesian Economics

3(2): 139-154.

Hicks, J. R. (1937). “Mr. Keynes and the “Classics”; A Suggested Interpretation.” Econometrica

5(2): 147-159.

Hills, S., R. Thomas, et al. (2010). “The UK recession in context — what do three centuries of data tell us?” Bank of England Quarterly Bulletin

2010 Q4: 277-291.

Holmes, A. R. (1969). Operational Constraints on the Stabilization of Money Supply Growth. Controlling Monetary Aggregates. F. E. Morris. Nantucket Island, The Federal Reserve Bank of Boston: 65-77.

Jarsulic, M. (1989). “Endogenous credit and endogenous business cycles.” Journal of Post Keynesian Economics

12: 35-48.

Jorda, O., M. Schularick, et al. (2011). “Financial Crises, Credit Booms, and External Imbalances: 140 Years of Lessons.” IMF Economic Review

59(2): 340-378.

Jorgenson, D. W. (1960). “A Dual Stability Theorem.” Econometrica

28(4): 892-899.

Jorgenson, D. W. (1961). “Stability of a Dynamic Input-Output System.” The Review of Economic Studies

28(2): 105-116.

Jorgenson, D. W. (1963). “Stability of a Dynamic Input-Output System: A Reply.” The Review of Economic Studies

30(2): 148-149.

Keen, S. (1995). “Finance and Economic Breakdown: Modeling Minsky’s ‘Financial Instability Hypothesis.’.” Journal of Post Keynesian Economics

17(4): 607-635.

Keen, S. (2014). “Endogenous money and effective demand.” Review of Keynesian Economics

2(3): 271–291.

Keen, S. (2015). “The Macroeconomics of Endogenous Money: Response to Fiebiger, Palley & Lavoie.” Review of Keynesian Economics

3(2): 602 – 611.

Keynes, J. M. (1936). The general theory of employment, interest and money. London, Macmillan.

Kumhof, M. and Z. Jakab (2015). Banks are not intermediaries of loanable funds — and why this matters. Working Paper. London, Bank of England.

Kumhof, M., R. Rancière, et al. (2015). “Inequality, Leverage, and Crises.” The American Economic Review

105(3): 1217-1245.

Lavoie, M. (2014). “A comment on ‘Endogenous money and effective demand’: a revolution or a step backwards?” Review of Keynesian Economics

2(3): 321 – 332.

Lorenz, E. N. (1963). “Deterministic Nonperiodic Flow.” Journal of the Atmospheric Sciences

20(2): 130-141.

Lucas, R. E., Jr. (2004). “Keynote Address to the 2003 HOPE Conference: My Keynesian Education.” History of Political Economy

36: 12-24.

Marx, K. (1852). The Eighteenth Brumaire of Louis Bonaparte. Moscow, Progress Publishers.

Marx, K. (1867). Capital. Moscow, Progress Press.

Marx, K. (1894). Capital Volume III, International Publishers.

McLeay, M., A. Radia, et al. (2014). “Money creation in the modern economy.” Bank of England Quarterly Bulletin

2014 Q1: 14-27.

McManus, M. (1963). “Notes on Jorgenson’s Model.” The Review of Economic Studies

30(2): 141-147.

Minsky, H. P. (1957). “Monetary Systems and Accelerator Models.” The American Economic Review

47(6): 860-883.

Minsky, H. P. (1975). John Maynard Keynes. New York, Columbia University Press.

Minsky, H. P. (1982). Can “it” happen again? : essays on instability and finance. Armonk, N.Y., M.E. Sharpe.

Moore, B. J. (1979). “The Endogenous Money Stock.” Journal of Post Keynesian Economics

2(1): 49-70.

Moore, B. J. (1988). “The Endogenous Money Supply.” Journal of Post Keynesian Economics

10(3): 372-385.

Moore, B. J. (1988). Horizontalists and Verticalists: The Macroeconomics of Credit Money. Cambridge, Cambridge University Press.

Ohanian, L. E. (2010). “The Economic Crisis from a Neoclassical Perspective.” Journal of Economic Perspectives

24(4): 45-66.

Palley, T. (2014). “Aggregate demand, endogenous money, and debt: a Keynesian critique of Keen and an alternative theoretical framework.” Review of Keynesian Economics

2(3): 312–320.

Phillips, A. W. (1954). “Stabilisation Policy in a Closed Economy.” The Economic Journal

64(254): 290-323.

Phillips, A. W. (1958). “The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom, 1861-1957.” Economica

25(100): 283-299.

Piketty, T. (2014). Capital in the Twenty-First Century. Harvard, Harvard College.

Pomeau, Y. and P. Manneville (1980). “Intermittent transition to turbulence in dissipative dynamical systems.” Communications in Mathematical Physics

74: 189-197.

Roberts, A. (2012). America’s first Great Depression: economic crisis and political disorder after the Panic of 1837. Ithaca, Cornell University Press.

Robinson, J. (1982). “Shedding darkness.” Cambridge Journal of Economics

6(3): 295-296.

Rochon, L.-P. (1999). “The Creation and Circulation of Endogenous Money: A Circuit Dynamique Approach.” Journal of Economic Issues

33(1): 1-21.

Rosser, J. B. (1999). Chaos Theory. Encyclopedia of Political Economy. P. A. O’Hara. London, Routledge. 2: 81-83.

Santos, C. H. D. and A. C. Macedo e Silva (2009). ‘Revisiting (and Connecting) Marglin-Bhaduri and Minsky–An SFC Look at Financialization and Profit-led Growth’, Levy Economics Institute, The, Economics Working Paper Archive.

Schularick, M. and A. M. Taylor (2012). “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008.” American Economic Review

102(2): 1029-1061.

Schumpeter, J. A. (1954). History of economic analysis / Joseph A. Schumpeter / edited from manuscript by Elizabeth Boody Schumpeter. London, London : Allen & Unwin.

Sonnenschein, H. (1972). “Market Excess Demand Functions.” Econometrica

40(3): 549-563.

Sonnenschein, H. (1973). “Do Walras’ Identity and Continuity Characterize the Class of Community Excess Demand Functions?” Journal of Economic Theory

6(4): 345-354.

Taylor, L. and S. A. O’Connell (1985). “A Minsky Crisis.” Quarterly Journal of Economics

100(5): 871-885.

Troshkin, M. (2008). “Facts and myths about the financial crisis of 2008 (Technical notes).” IDEAS Working Paper Series from RePEc.

Tymoigne, E. (2006). ‘The Minskyan System, Part III: System Dynamics Modeling of a Stock Flow-Consistent Minskyan Model’, Levy Economics Institute, The, Economics Working Paper Archive.

Vague, R. (2019). A Brief History of Doom: Two Hundred Years of Financial Crises. Philadelphia, University of Pennsylvania Press.

Wray, L. R. (2019). “Response to Doug Henwood’s Trolling in Jacobin.” New Economic Perspectives

http://neweconomicperspectives.org/2019/02/response-to-doug-henwoods-trolling-in-jacobin.html.

”

”

, so that:

, so that:

(ignoring for simplicity), we get

(ignoring for simplicity), we get

and

and  in the model:

in the model: